Headlines

Biden Leads the build-out of an EV market critical minerals supply chain outside of China parade

Originally posted on Investorintel.com

By Matt Bohlsen

For the past decade it has been China that has massively supported its battery and EV industry resulting in China now being by far the leader in EV production globally; and quite frankly a threat of totally dominating the future global auto industry as it goes electric.

Now, finally, the tide is turning with the Western governments starting to make very significant moves to support the EV and energy storage sectors (including batteries & the electric grid) and its supply chain. Today’s article gives a summary of major western governments’ new policies to support the EV and energy storage supply chain so far in 2022.

USA

As announced last week the DoE awarded US$2.8 billion of grants to accelerate U.S. manufacturing of batteries for electric vehicles and the electric grid. As stated by Energy.Gov.:

“The 20 companies will receive a combined US$2.8 billion to build and expand commercial-scale facilities in 12 states to extract and process lithium, graphite and other battery materials, manufacture components, and demonstrate new approaches, including manufacturing components from recycled materials.”

A key component of the US$2.8 billion in grants is that they will be matched with US$9 billion in recipient funds. Furthermore, the 20 company’s projects are spread across the key areas of the battery supply chain with the key purpose to build a new U.S lithium-ion battery industry.

As shown below some of the winners were lithium companies Albemarle Corporation (NYSE: ALB) and Piedmont Lithium Inc. (Nasdaq: PLL | ASX: PLL), spherical graphite (soon to be a producer) company Syrah Resources Limited (ASX: SYR), nickel junior Talon Metals Corp. (TSX: TLO) and several others.

Location map showing the planned project locations of the DoE project grant recipients

Source: Energy.Gov DoE

Earlier in 2022, the U.S government announced funding in the Inflation Reduction Act of US$369 billion towards clean energy and climate change initiatives.

The Biden Administration is certainly leading the West in supporting the environment and building up a new clean energy industry with factories and jobs in the USA.

Canada

Canada has recognized that it is extremely well positioned to be a supplier of EV metals and components due to its inherent wealth of critical raw material resources. In the 2022 Canadian Budget the government allocated an additional “C$3.8 billion for critical minerals, including those that feed into clean technologies”. Clean Energy Canada stated:

“This new funding will help Canada realize its vision of building an “end-to-end” battery supply chain through which Canada can do it all, from sourcing the materials to building the parts, batteries, and clean cars.”

Specifically, the Canadian government will spend up to C$1.5 billion over seven years, starting in 2023-24, for infrastructure investments that would support the development of the critical minerals supply chain, with a focus on priority deposits. Many very promising Canadian projects, such as Frontier Lithium Inc.’s (TSXV: FL | OTCQX: LITOF) PAK Lithium Project, need roads to be built to help bring their projects to production. Canada has a plan to make this happen, albeit rather slowly.

Australia

The Australian government under Prime Minister Albanese has brought a new focus towards EVs and climate change. As announced last week the “support for critical minerals breakthroughs” policy is designed to accelerate the growth of the critical minerals sector. The announcement stated:

“The Strategy will complement other Government initiatives including the National Battery Strategy and the Electric Vehicle Strategy. The National Reconstruction Fund will include the $1 billion Value Adding in Resources Fund which will work alongside the $2 billion Critical Minerals Facility…….The Government will also allocate $50 million over three years to the Critical Minerals Development Program for competitive grants to support early and mid-stage critical minerals projects, building on the $50 million recently committed to six key projects across Australia.”

The winning “six key projects” are owned by Alpha HPA Limited (ASX: A4N), Cobalt Blue Holdings Limited (ASX: COB), EQ Resources Limited (ASX: EQR), Global Advanced Metals Pty Ltd, Lava Blue Ltd., and Mineral Commodities Ltd. (ASX: MRC).

Europe

Last month the European Commission announced a new policy proposal called the ‘European Critical Raw Materials Act’. The announcement emphasized Europe’s need to secure a safe and secure supply of critical minerals, notably lithium and rare earths. The announcement stated:

“Lithium and rare earths will soon be more important than oil and gas. Our demand for rare earths alone will increase fivefold by 2030. […] We must avoid becoming dependent again, as we did with oil and gas. […] We will identify strategic projects all along the supply chain, from extraction to refining, from processing to recycling. And we will build up strategic reserves where supply is at risk. This is why today I am announcing a European Critical Raw Materials Act.”

The European Critical Raw Materials Act is still being developed but it looks like it will follow along similar footsteps as the U.S Inflation Reduction Act, supporting and building local supply chains, but also relying on ally countries. The European Commission stated one objective as:

“To facilitate the roll-out of targeted raw materials projects in the EU, the Commission should be empowered to list Strategic Projects – which would be labelled as of European interest – based on proposals from Member States. These projects could benefit from streamlined procedures and better access to finance.”

An excerpt from the recent 2022 State of the European Union address discussing the need for Europe to source critical raw materials

Source: European Commission

Some possible winners might be rare earths processing company Neo Performance Materials Inc. (TSX: NEO) and European Metals Holdings Limited (ASX: EMH | AIM: EMH | OTCQX: EMHXY). The former owns the only commercial rare earth separations and rare metal processing plant in Europe and the later has a JV 49% ownership of the largest hard rock lithium project in Europe.

Closing remarks

The Western governments have woken up from a decade long slumber and are now finally moving to build key critical raw material, battery, and EV supply chains both locally and with ally countries. Project funding and permitting are key obstacles being addressed as they are the reason why much of USA and Europe have virtually no EV supply chain today.

As we approach COP 27 starting on November 6, the 2022 awakening of the Western governments should lead to one of the biggest investment themes this decade. That is, investing in quality companies that are likely to succeed in supplying the EV and energy storage supply chains as the Western world looks to gain independence from China.

InvestorIntel has been bringing attention to these companies for more than a decade and provides the ideal starting point to research and learn about promising critical raw materials companies. Stay tuned.

Analysis: Biden’s EV minerals cash fruitless without permitting reform

Originally Posted on Mining.com

By Ernest Scheyder; Editing by David Gregorio

US President Joe Biden. (Credit: Edward M. Kennedy Institute for the United States Senate )

Washington’s growing financial support for companies that produce metals used in electric vehicles will likely prove fruitless unless the federal government streamlines the mine permitting process, investors, executives and consultants told Reuters.

President Joe Biden last week doled out $2.8 billion to miners developing new US sources of lithium, nickel, copper and other EV minerals, as well as battery parts manufacturers and recyclers. Those grants followed August’s Inflation Reduction Act, which links EV tax credits to minerals extracted domestically or from 20 allies.

Both measures aim to spur domestic mining and push the country closer to Biden’s goal for half of all new US vehicles to be electric by 2030.

But it currently takes a decade or longer to obtain a US mining permit, an arduous process that frustrates miners who welcome the financial support but want more permitting transparency. Biden’s administration has also opposed permits for several proposed mines.

“The US government is saying ‘Go! Go! Go!,’ but the environmental review process is extremely cumbersome,” said Jerry Hicks at the Optica Rare Earths & Critical Materials ETF, which holds shares of Albemarle Corp, Freeport-McMoRan Inc and Glencore Plc.

“China has the infrastructure in place, and it’s going to take a long time for the US to get anywhere close.”

Related: US to support new mines that avoid ‘historical injustices’, Biden says

Senator Joe Manchin, a West Virginia Democrat, failed to push permitting reform through Congress last month, though he is expected to try again later this year.

“What I would like, if I could ask for something, is predictability,” said Arne Frandsen, chief executive of mining investment group Pallinghurst and a director at Talon Metals Corp, which received $114.8 million from Biden to partially fund a nickel processing plant in North Dakota that will supply Tesla Inc.

“It’s difficult to get capital to commit if you don’t know if you’ll get a permit in 12 months or five years.”

Some projects receiving government funding may have an easier path to permitting than others. Recycling plants, for example, are more akin to manufacturing operations than open-pit mines.

Privately-held Nth Cycle Inc is building a recycling plant in the US Midwest expected to be producing 5,000 tonnes of nickel annually by 2025. That is about when the only current US nickel mine prepares to close.

“People have a misconception about how quickly we can get mines up and running given the US permitting process,” said Megan O’Connor, Nth Cycle’s CEO.

Albemarle is betting that the $149.7 million grant it won last week will ease its path to obtain permits to reopen a mothballed North Carolina lithium mine.

“Hopefully, they’ll give us some help and fast track some of the permitting process,” said Kent Masters, Albemarle’s CEO.

Yet most proposed US mining projects would be new mines that face widespread pushback, several from Biden himself.

Lithium Americas Corp’s efforts to build the largest US lithium mine are mired in a court battle. Piedmont Lithium Inc, which received $141.7 million from Biden, faces opposition to its North Carolina mining project.

“What really needs to happen is not for permitting to be relaxed, but to be expedited to ensure we can build the mines that can supply the automakers,” said Jordan Roberts, a minerals analyst at consultancy Fastmarkets.

Permitting delays may paradoxically keep EV prices high by limiting the domestic supply of minerals needed to reduce battery prices, said Hicks of the Optica Rare Earths & Critical Materials ETF.

The yawning divide between America and China’s approaches to funding the EV supply chain is now a top concern for many policymakers and their advisers in the nation’s capital.

“Unless you can break ground on these sites, you’re not going to be able to take advantage of those funds,” said Abigail Wulf at SAFE, an energy-focused think tank.

Biden awards $2.8 billion to boost US minerals output for EV batteries

Originally posted on Mining.com

By : David Shepardson, Ernest Scheyder and Nandita Bose; Editing by Bernadette Baum, Matthew Lewis and Paul Simao

US president Joe Biden. Credit: Wikimedia Commons

The Biden administration said on Wednesday it is awarding $2.8 billion in grants to boost US production of electric vehicle batteries and the minerals used to build them, part of a bid to wean the country off supplies from China.

Albemarle Corp is among the 20 manufacturing and processing companies receiving US Energy Department grants to domestically mine lithium, graphite and nickel, build the first large-scale US lithium processing facility, construct facilities to build cathodes and other battery parts, and expand battery recycling.

The grants, which are going to projects across at least 12 states, mark the latest push by the Biden administration to help reduce the country’s dependence on China and other nations for the building blocks of the green energy revolution.

“As the world transitions from a fossil fuel to a clean energy powered economy, we cannot trade dependence on oil from autocrats like (Russian President Vladimir) Putin to dependence on critical minerals from China,” said a senior administration official briefing reporters on the program.

The funding recipients, first reported by Reuters, were chosen by a White House steering committee and coordinated by the Department of Energy with support from the Interior Department.

The funds are being doled out to a range of companies, some of which could self-fund projects and others that will see the grants as a financial lifeline to further expand their US plans. The funding, though, does nothing to alleviate permitting challenges faced by some in the mining industry.

Albemarle is set to receive $149.7 million to build a facility in North Carolina to lightly process rock containing lithium from a mine it is trying to reopen. That facility would then feed a separate plant somewhere in the US Southeast that the company said in June would produce as much lithium for EV batteries as the entire company produces today.

Albemarle, which also produces lithium in Australia and Chile, said the grant “increases the speed of lithium processing and reduces greenhouse gas emissions from long-distance transportation of raw minerals.”

Piedmont Lithium Inc is receiving $141.7 million to build its own lithium processing facility in Tennessee, where the company will initially process the metal sourced from Quebec and Ghana. Piedmont’s plans to build a lithium mine in North Carolina have faced strong opposition.

Shares of Piedmont rose 7.5% after Reuters broke the news of its funding award earlier on Wednesday. Piedmont did not immediately respond to a request for comment.

Talon Metals Corp will receive $114.8 million to build a processing plant in North Dakota in a strategy shift for the company, which has a nickel supply deal with Tesla Inc. Talon now aims to extract rock from its planned underground mine in Minnesota and ship it to a North Dakota processing facility that will be funded in part by the grant.

Talon said the grants are “a clear recognition that production of domestic nickel and other battery minerals is a national priority.”

Other grants include $316.2 million to privately-held Ascend Elements to build a battery parts plant, $50 million to privately-held Lilac Solutions Inc for a demonstration plant for so-called direct lithium extraction technologies, $75 million to privately-held Cirba Solutions to expand an Ohio battery recycling plant, and $219.8 million to Syrah Technologies LLC, a subsidiary of Syrah Resources Ltd, to expand a graphite processing plant in Louisiana.

Biden’s goal

By 2030, President Joe Biden wants 50% of all new vehicles sold in the United States to be electric or plug-in hybrid electric models along with 500,000 new EV charging stations. He has not endorsed the phasing-out of new gasoline-powered vehicle sales by 2030.

Legislation Biden signed in August sets new strict battery component and sourcing requirements for $7,500 consumer EV tax credits. A separate $1 trillion infrastructure law signed in November 2021 allocates $7 billion to ensure US manufacturers can access critical minerals and other necessary components to manufacture the batteries. The announcement on Wednesday was linked to that 2021 legislation.

The White House said in a fact sheet that the United States and allies do not produce enough of the critical minerals and materials used in EV batteries.

“China currently controls much of the critical mineral supply chain and the lack of mining, processing, and recycling capacity in the US could hinder electric vehicle development and adoption, leaving the US dependent on unreliable foreign supply chains,” the White House said.

In March, Biden invoked the Defense Production Act to support the production and processing of minerals and materials used for EV batteries.

The White House is also launching an effort, dubbed the American Battery Material Initiative, to strengthen critical mineral supply chains as automakers race to expand US electric vehicle and battery production.

Digging for green minerals a priority for the North, says federal minister

Originally posted on Cbc.ca

By : Liny Lamberink

Heavy machinery clears brush from where the Nechalacho mining project's pit will be, back in 2021. One of the federal government's priorities as it moves to a net-zero economy is to make it easier to step up critical mineral mines like this one, which extracts rare earths. (Liny Lamberink/CBC)

Speeding up the regulatory process for critical mineral mines in the North is a goal of the federal government, according to Canada's natural resources minister.

"Critical minerals are essential for us to be able to successfully execute an energy transition," said Jonathan Wilkinson. If Canada doesn't mine more critical minerals, he said, it can't make batteries for electric vehicles needed to reduce emissions from transportation.

Rare earths, for example, are a critical mineral said to be crucial in technology like computers, LED displays, wind turbines and electric vehicles. Canada's first rare earth operation is the Nechalacho mining project in the N.W.T.

Of the 31 minerals deemed critical by the federal government, 23 can be found in the N.W.T. and 25 are in the Yukon.

"We have to find ways to expedite [these projects] in a manner that's consistent with environmental sustainability," said Wilkinson. He also said getting such projects down to zero emissions or close to zero emissions is important, and suggested biomass, biofuels or synthetic fuels as an option for mines that can't connect to hydroelectric power.

But Kevin O'Reilly, the MLA for Frame Lake in the N.W.T., believes the federal government is suggesting to deregulate critical mineral mines. He said it's not environmental regulations that keep mines from opening.

"The evidence shows most of the delays, if there are any with projects, are because of proponents. It's not because the process takes too long. It's because proponents don't supply the right kinds of information, they don't answer questions in a timely fashion," he said.

O'Reilly said if the federal and territorial governments want to speed up the review process, it should settle outstanding Indigenous land claims of the Dehcho and Akaitcho regions.

Agreeing on priorities

Natural Resources Canada announced Thursday that the N.W.T. and Yukon had signed up to participate in its Regional Energy and Resource Tables, along with three more provinces.

The tables are meant to be conversations, set up by the federal government, to help figure out what common goals it has with territories and provinces for reducing emissions and building a net-zero economy. A spokesperson said Nunavut would be invited to participate in the next phase.

"This is not the federal government telling the territories what their priorities should be within this process. It's about sitting down and agreeing on what the priorities are and then advancing some of these particular projects," said Wilkinson.

He said discussions with the two territories will likely revolve around renewable energy projects, infrastructure adaptation and the mining industry.

In a statement to CBC News, Caroline Wawzonek, the N.W.T.'s minister of industry, tourism and investment, said a net-zero economy "may be a challenge for the N.W.T." and that because of its location, it's not ready for net-zero mining either.

"We are trucking, barging and flying energy-intensive diesel into our territory to live — let alone mine," she said. "Federal investments in roads and especially our hydro potential are needed to get us to the point where we can talk about [economic] opportunities."

Critical mineral Vanadium finds new interest in grid energy storage battery applications

Originally posted on Investorintel.com

By : Alastair Neill

Vanadium (V) is a critical mineral element named after the Scandinavian goddess of beauty and fertility Vanadis. It is the 20th most abundant element in the earth’s crust. Global production in 2020, according to Statista, was about 105,000 tonnes. China accounted for 70,000 tonnes or two-thirds of global production. Russia was next at just over 19,500 tonnes, followed by South Africa at 8,584, and Brazil at 7,582. India produced 100 tonnes and the USA 17 tonnes. Vanadium occurs in magnetite and in China and Russia it is produced from steel smelter slag. Other sources are bauxite, crude oil, coal and tar sands, or as a byproduct of uranium mining.

About 85% of all vanadium is used as an alloy for steel to improve its strength and wear resistance, particularly in tool steel where the amount of vanadium used ranges from 1% to 5%. A few years ago China passed requirements for rebar to use vanadium but the advent of COVID and the current malaise of the Chinese construction/real estate business has not seen the potential increase in demand that the industry widely expected. Vanadium is also used in titanium/aluminum alloys in jet engines and dental implants. Recently there has been renewed interest in the large potential capacity of the vanadium redox battery, also known as the vanadium flow battery (VFB), for grid energy storage. An advantage of vanadium flow batteries is they have no limit on energy capacity and long charge/discharge cycle lives of between 15,000-20,000 cycles making them useful for power plants and electrical grids. Also, Lithium vanadium oxide has been explored for a high-density anode.

Earlier this year the Ferrovanadium price in Europe was $62.8/kg but recently has fallen to about half at $31/kg. In late 2018 and early 2005 Ferrovanadium prices spiked over $120/kg but these were short lived peaks. It has short periods where producers can make significant profits.

There are two producers of vanadium outside China and Russia that are of particular interest. The first is Largo Inc. (TSX: LGO | NASDAQ: LGO), which listed on the Nasdaq last year. Largo is a Toronto based company with operations in Brazil from one of the world’s highest grade vanadium deposits. Largo reported revenues in Q2 of this year at $84.8 million, which was due to the spike in vanadium prices. Volume sold was 3,291 of V2O5 equivalents while production of V2O5 was 3,084 tonnes. Expected production for the full year is estimated at 11-12,000 tonnes of V2O5. Their cash operating cost is reported at $4.10-4.50/lb. V2O5 ($9.03-9.92/kg). Recent pricing inside China is shown to be $16.80/kg, so Largo is in a good position relative to the market. In addition, Largo is investigating diversification in 2022-23 in an ilmenite concentration plant with a nameplate of 150,000 TPY. This will feed a titanium oxide (TiO2) pigment at a rate of 30,000 TPY beginning in 2024. This is a very small operation compared to the size of the TiO2 industry, but this will diversify their product line and possibly soften the impact of the swings in vanadium pricing.

Another part of Largo’s business is Clean Energy Storage. They boast a “unique, vertically integrated business model” to “supply some of the world’s most advanced vanadium redox flow battery solutions for the integration of renewable energy.” By supplying their own vanadium Largo can lower the upfront cost to its customers. To that end Largo signed a non-binding MOU with Ansaldo Green Tech to negotiate the formation of a Joint Venture for making and deployment of Vanadium Redox Flow Batteries in the European, African and Middle East markets. In their latest press release Largo announced it had completed its qualifying transaction for Largo Physical Vanadium Corp. (TSXV: LPV). According to Largo’s President and CEO Paulo Misk, “this listing will allow investors direct exposure to vanadium.”

Another vanadium company is Bushveld Minerals Limited (LSE: BMN), a South African company, which owns 2 of the 4 world’s operating primary vanadium processing facilities. Last year they produced just under 3,600 metric tonnes of vanadium. Bushveld has announced they plan to grow production by 40-50% this year, and subject to funding and market conditions they would increase their output to 8,000 TPY.

It is also worth mentioning that Glencore International AG, one of the world’s largest global diversified natural resource companies, is also in the V2O5 market with production around 6,900 tonnes in 2021.

Vanadium is an interesting element, though the pricing swings make it challenging to plan budgets and investments, but the use in vanadium redox flow batteries has given a new growth market for the industry.

Canada will fast-track energy and mining projects important to allies: Freeland

Originally posted on Financialpost.com

By : Meghan Potkins

Deputy Prime Minister Chrystia Freeland speaking during a press conference at Bison Transport in Calgary. PHOTO BY GAVIN YOUNG/POSTMEDIA FILES

Canada will have to fast-track energy and mining projects if it is to help its democratic allies and achieve its own net-zero ambitions, Deputy Prime Minister Chrystia Freeland said in a speech this week in Washington — the most tangible signal to date that the federal Liberal government is prepared to address regulatory hurdles that have hampered economic development in this country for years.

In a swing through the U.S. capital to attend meetings of the IMF and World Bank, Freeland told a gathering at the Brookings Institution that a deepening of trade ties between allied democracies will be necessary to combat powerful autocratic regimes such as Russia and China. Democracies, Freeland said, must make a conscious effort to build supply chains through each other’s economies — a phenomenon U.S. Treasury Secretary Janet Yellen has described as “friendshoring.”

Freeland went on to say the Canadian government must be prepared to expend some “domestic political capital” in the name of economic security for its democratic partners — as Europe did during the COVID pandemic when European vaccine makers honoured their contracts with non-European allies.

“Canada must — and will — show similar generosity in fast-tracking, for example, the energy and mining projects our allies need to heat their homes and to manufacture electric vehicles,” Freeland said. “I cite these examples because, critically, friendshoring must be green. The curse of oil is real, and so is the dependence of many of the world’s democracies on the world’s petro-tyrants.”

Freeland’s pronouncement set off a shockwave in Canada, surprising some trade experts and drawing praise from energy and mining groups who have been pushing for more regulatory certainty to encourage investment in Canada’s natural resource sector.

History is shifting

CARLO DADE

“This could be really important,” said Carlo Dade, director of the trade and investment centre at the Canada West Foundation, noting that it would amount to a “sea change” if the shift is sustained and serious.

“This certainly seems to be an astute response to the moment — a realization that the moment has shifted, history is shifting,” Dade said. “The question is, though, will it be long term?”

Critics of the Canada’s current regulatory process have argued it has hampered investment in oil and gas, renewables, hydrogen, mining and emissions-reduction projects, stalling growth in production and preventing Canadian resources from reaching global markets. While improvements have been made to strengthen consultations with Indigenous people under the federal Impact Assessment Act — the changes have not yet translated to more regulatory certainty for investors.

“How many boards of directors are going to approve their CEO to go and spend billions of dollars on a project and a process and an application that is highly uncertain at the end of that?” said Adam Legge, president of the Business Council of Alberta, at a recent Alberta Securities Commission conference. “At the very end of it, after all the due diligence is done and checks have been done and studies have been done, it’s still a highly uncertain politicized decision.”

It’s not yet clear what steps the federal government is prepared to take to improve the process, though Freeland’s remarks have some precedent.

Natural Resources Minister Jonathan Wilkinson speaking to the Calgary Chamber of Commerce. PHOTO BY JIM WELLS/POSTMEDIA FILES

Natural Resources Minister Jonathan Wilkinson has said that the federal government hopes to align regulatory and permitting processes to “speed up” the rate at which projects are built through so-called Regional Energy and Resource Tables. The tables would bring together federal, provincial and Indigenous partners to identify and accelerate resource projects — though, critically, Alberta, Ontario and Quebec have not yet signed on to the process. So far, British Columbia, Manitoba, Newfoundland and Labrador, New Brunswick, Nova Scotia, Price Edward Island, the Northwest Territories and the Yukon have all agreed to join the regional tables initiative.

“It is certainly my hope that Alberta will be part of this process as soon as possible,” Wilkinson told a recent gathering of business leaders at the Calgary Chamber of Commerce.

Still, Canadian industry groups have welcomed the deputy prime minister’s recent comments, urging the government to use the tools at its disposal to move critical minerals and energy projects forward more quickly.

“There are definitely ways to improve the timeliness and efficiency of federal project reviews and we’re keen to see the government use the tools they have more effectively,” said Pierre Gratton, president of the Mining Association of Canada, citing the Ring of Fire project in northern Ontario, as well as nickel projects near Sudbury and copper projects in B.C. such as the joint Teck Resources-Newmont Corporation Galore Creek Mine as examples.

It is certainly my hope that Alberta will be part of this process as soon as possible

JONATHAN WILKINSON

However, the recent visit to Canada by German Chancellor Olaf Scholz and his departure from the country without an agreement on liquified natural gas (LNG) has exacerbated pessimism in the resource sector that the Liberal government will ultimately be willing to facilitate further fossil fuel production.

Freeland appeared to open the door to additional investment in LNG on Friday, calling it “an important transition fuel” that could keep the world from burning coal amid the current energy crunch.

“We will always be looking at economically viable LNG projects,” Freeland told reporters as the IMF meeting concluded on Friday.

Freeland also addressed calls for the federal government to create incentives to decarbonize on par with those in the U.S. Inflation Reduction Act — legislation that could prompt a surge in investment in emissions reduction and renewables south of the border over the next decade.

“It is something we are very, very focused on,” Freeland said Friday. “We need to act even more energetically and aggressively than we have hitherto…. We need to find ways to attract even more private capital.”

Those comments came after Canada’s largest oilsands companies announced earlier in the day that their ambitious plan to cut emissions by 22 million tonnes by 2030 will require a $24-billion investment in carbon capture and storage and other emission-reducing technologies — a sum that proponents say will require assurances from governments on the long-term price of carbon.

Canada’s ability to deploy renewables and low-emission fuels and technologies also face the prospect of being bogged down in the same regulatory processes that are hampering conventional energy production.

“It’s just too slow,” Legge said. “We have countries that we’re competing with in some of these more transition-oriented fuels like hydrogen, like rare earth minerals, in countries like Australia, who are doing a far better job, far faster job of approving these projects that are going to be essential to enabling these countries to compete in the low-to-zero emitting future.

“We’re going to miss that boat if we don’t begin to think more competitively, more nimbly.”

Autonomous driving boosts copper use in cars – report finds “minimal” substitution

Originally posted on Mining.com

New research commissioned by the International Copper Association (ICA) reveals demand for copper in the wire harness in the light-duty automotive industry is expected to grow to more than 1.7 million annual tonnes of copper by 2025, a 14% increase from today’s levels.

New technologies in battery electric and hybrid vehicles and autonomous driving systems are expected to add an annual 344,000 tonnes of demand over the next decade.

The shift to autonomous driving is expected to increase a vehicle’s copper content by around 2kg (4.5lb) as copper’s conductivity (second only to that of silver) makes it the ideal material for the high-speed data wires needed for cameras, short-range and long-range radar, lidar and sensors for advanced driver assistance systems.

The research, conducted by Martec Group, found that while some original equipment manufacturers and suppliers are testing aluminum in place of copper in the wire harness, the overall level of substitution will remain minimal.

Trends toward fuel economy regulation, weight reduction and miniaturisation are expected to drive demand for copper in favour of aluminum, which has roughly 60% of the conductivity of copper. Martec points out that aluminum bus bars are a threat to copper wire harnesses within the battery pack, “but still have plenty of downfalls compared to the reliability of copper.”

The contribution of EVs to overall demand will rise to 36% through 2032 while SUVs share of demand will average 1.1 million tonnes per year between 2022 and 2032, based on copper weight per unit and production forecast volumes.

Martec: Automotive Wire Harness Market Assessment 2022

Three reasons why vanadium redox flow battery technology has NOT hit the mainstream… yet

Originally posted on Stockhead.com

Pic: Getty Images

Vanadium redox flow batteries have shown plenty of promise over the past few years and delivered very little, however, big developments in China plus a perceived shortage of battery metals may be the spark this battery technology needs to lift off.

Stockhead took that question to vanadium expert David Gillam, the principal and CEO of financial consultancy Mastermines, who reckons while a lithium or Elon-Musk-style moment will come for vanadium redox flow batteries (VRFB) in the next two years, there are several reasons why this battery technology hasn’t taken off yet.

For a quick summary, vanadium redox flow batteries (VRFB) are used in large scale, battery storage systems that store excess power from the grid for use during peak demand periods.

Whether in combination with solar PV, biogas generators, wind power, or in parallel operation, the bulk storage capacity of these batteries allows consumption to be shifted completely to off-peak hours with cheaper electricity.

As the name suggests, VRFBs use vanadium-ions in the electrolyte solutions and are considered safer, more scalable, and longer lasting than their lithium counterparts with a lifespan of more than 20 years.

Other battery types like lithium-ion or leach-acid are subject to a charging cycle but VRFBs come with vanadium electrolyte storage tanks, which can be replenished even when the system is supplying power.

According to Gillam, investors are sitting back watching vanadium stocks wondering why market penetration has taken so long, but the situation is “very complex,” he says.

“Vanadium is quite unique as far as a battery metal goes and investors don’t really understand the basis of the problem.”

Vanadium cost drives up the cost of VRFBs

The initial investment for vanadium batteries is considerably more expensive compared to lithium, Gillam says, and while the price of lithium is increasing, VRFBs face a bigger issue.

Vanadium is an expensive metal and significantly drives up the cost of a VRFB system compared with other battery types.

If the uptake of VRFBs increases dramatically, so does the price of vanadium pentoxide (V205) – the material used in the electrolyte solutions.

“We believe anything under $10/lb is viable but let’s say there is a huge uptake in vanadium batteries – what happens when the price goes to $20?” Gillam asks.

“It has happened before, and it happens very quickly.

“You’ve got this very volatile price of the major component, so you can imagine battery companies would be worried about the cost because it could add 30% overnight to the batteries.

“At the same time, the financiers and miners would also be worried about the volatility of V205 – it’s great when it’s going up but what happens when a major starts up and there’s 10% additional capacity?” he explains.

The International Renewable Energy Agency (IRENA) reports installation costs for both vanadium redox flow and zinc bromine flow in 2016 ranged between US$315 and US$1680 per kWh as compared with lithium iron phosphate at US$200 to US$840 per kWh.

By 2030, IRENA says the installation cost for VRFBs is expected drop to between US$108 and US$576/kWh.

“Although they presently indicate high upfront investment costs compared to other technologies, these batteries often exceed 10,000 full cycles, enabling them to make up for the high initial cost through very high lifetime energy throughputs,” IRENA points out.

“Their long-term electrolyte stability, however, is key to this longevity and is the focus of an important avenue of research effort.”

Mine development

In 2019, China was the world’s top vanadium producing country with output totalling 40,000Mt followed by Russia at 18,000Mt and South Africa at 8,000Mt where major players include LSE listed Bushveld Minerals and Glencore.

China is also a large spot market, which makes everything more difficult for ASX vanadium stocks, Gillam says.

“While off-take agreements will not be difficult, getting the funding from China to move towards mining is another matter that would take considerable effort.

“All investors want to see is new mine development outside China, but the problems are many.”

Around 90% of vanadium production is used to strengthen steel, making it economically vulnerable owing to its sensitivity to market demand by developing countries.

As Geoscience Australia notes, the vanadium price surged from US$5.70 in 2004 to US$16.89 in 2005 due to the growth of global steel production that caused an increase in vanadium consumption and a commensurate depletion of stockpiles.

Over the years, Australia’s reserves and resources of vanadium have also fluctuated in response to the volatile nature of the vanadium market but of the few main contenders in the space, Gillam believes we are beginning to see real effort from management.

“Investors will need to be patient and hope for a massive uptake that forces a market development outside China that can attract finance,” he says.

Competition and market outlook

The question of whether flow batteries based on vanadium electrolyte are the main event is even more complex.

As it stands, China is leading the charge in the vanadium redox flow battery space where a hot bed of activity is taking place.

Last month, Shanghai Electric – a Chinese multinational power general and electrical equipment company – held the ‘Energy Integration, Smart Future’ Enterprise Summit where Yang Linlin, vice chairman of Shanghai Electric Energy Storage Technology Co revealed up to now, the company had 3GWh of orders for vanadium batteries.

In a LinkedIn post, Bushveld Energy CEO Mikhail Nikomarov said Shanghai Electric also announced the delivery of more than 50 vanadium battery energy storage projects and a cumulative installed capacity exceeding 50MWh.

But Gillam says we need to be cautious of wild claims by Chinese entities as there can be confusion between what they wish for and reality.

“That being said, there is no doubt we are seeing a substantial increase in real projects utilising vanadium in 2022 along with many new entrants.

“There is also competition emerging from iron flow batteries and we are watching how that plays out carefully,” he says.

“From conversations we know the Chinese are also watching but probably lack the technology so will continue to favour vanadium flow batteries within China in the short to medium term.

“We can see this competition emerging rapidly and just last month the start of construction for a $70M factory to produce ESS IFBs in Queensland – how serious that competition is, remains to be seen.”

There is also a distinct possibility that no single winner will emerge due to a dramatic uptake in demand.

“We may just need everything we can produce on a number of fronts – I don’t se this a mere market shift, rather as a new energy revolution that will drive markets for years to come,” Gillam adds.

“A combination of better scale and lower manufacturing costs for flow batteries as well as higher prices for lithium will push the market towards flow batteries and iron flow batteries, if they are successful, will be a real threat if they don’t have that high electrolyte cost and we all know how cheap iron ore is.”

ASX vanadium stocks to watch

AUSTRALIAN VANADIUM (ASX:AVL)

One of the biggest players on the ASX is AVL whose subsidiary, VSUN Energy, develops renewable energy storage solutions using VRFB technology.

At the end of 2021, AVL signed an an agreement with VSUN Energy for a project utilising a stand-alone power system (SPS) based on VRFB energy storage tech at its Nova Nickel Operation.

The VRFB will be initially free issued, with ownership or rental options after a period of 12 months.

AVL marketing manager Sam McGahan says this will be the first standalone power system in Australia using the vanadium flow battery.

“Over east there are a few vanadium flow batteries installed at different universities, all up I’d say there is around eight vanadium flow batteries in Australia,” she says.

“It is important to have the right solution for the right setting but with the huge demand for lithium in electric vehicles, the market is beginning to look at other materials for stationary storage.

“The world is going to need a lot of energy storage – pumped hydro, iron flow batteries, vanadium, lithium ion – the way we see it, there isn’t a winner and a loser.”

AVL is also developing the Australian Vanadium Project in WA’s Murchison project, where a bankable feasibility study (BFS) released in April confirmed the project as a potentially globally significant primary producer.

TECHNOLOGY METALS (ASX:TMT)

TMT’s subsidiary, vLYTE, was formed to add value to the high-quality feedstock from the Murchison Technology Metals Project (MTMP) in Western Australia – right next door to AVL – on downstream processing opportunities such as vanadium electrolyte production.

vLYTE is working with global battery manufacturers and renewable energy suppliers as it progresses its downstream processing strategy.

Recently, TMT revealed it will collaborate with the Government backed Future Battery Industries Cooperative Research Centre (FBICRC) to enhance the performance of vanadium redox flow batteries, with product from the Murchison project to be utilised as feedstock for vanadium electrolyte research.

Molybdenum – securing a domestic supply of the vital but underappreciated mineral

Originally posted on Investorintel.com

By : Alastair Neill

Element 42 on the periodic table is Molybdenum (Mo), commonly referred to in the industry as the easier to pronounce moly. Most of the world’s moly production comes as a byproduct from copper or tungsten mining. Most people know it as a lubricant. The main use of moly is in steel production as it gives weather and acid resistance in certain steel alloys, particularly stainless steel. This is an element largely overlooked as current production is in the range of 290,000-300,000 metric tonnes per year, which makes it a $10 billion annual business at its current pricing of $16/lb. Pricing earlier this year reached $20 per pound. Those are prices that have not been seen since 2008. Two years ago, the price was under $8 per pound.

According to the CPM Group, there are 76 mines globally that produce moly and 36 are inside China, with China producing over 40% of the world’s output. Between 70-80% of that output is from copper mines. In 2021 the world’s top 10 moly producing countries were:

Outside China, there are only two pure moly plays, and both of these are in Colorado and operated by Freeport-McMoRan (NYSE: FCX) subsidiary Climax Molybdenum. 90% of western-sourced moly comes from copper production. This means that the main driver for moly production is copper production, so output and pricing can be counterintuitive. An example of this was in 2020 when prices dropped 30% but production went up, while in 2021 prices climbed 96% but production went down.

According to a World Bank report on the impact of low carbon technologies (LCT) in 2018, 21 million tonnes of copper were produced compared to 0.3 million tonnes of moly, or about 1 tonne of moly per 7,000 tonnes of copper. Moly is used in wind turbines, with one megawatt of output requiring 130 kilograms of moly. A typical offshore turbine is 12MW, which requires 1.56 tonnes of molybdenum.

One of the issues facing the industry is Chile’s production. According to CPM, moly production in 2021 dropped 7.5% from 2020. The main drop was from Codelco, a state owned Chilean company, whose production declined 24%. A presentation by Codelco in 2019 indicated they needed new investment, otherwise production would fall by 74% by 2029. The Chilean government has asked Codelco to find $1 billion in annual savings and make a $8 billion cut in planned investments. This may delay investments. The Chilean government is talking about privatizing the mining industry and taking a royalty of up to 12%. These steps will likely give companies pause for thought on new investments. Based on this, the CPM Group is looking at a deficit position for moly over the next five years.

There is one potential new moly mine opportunity that is intriguing – Stuhini Exploration Ltd. (TSXV: STU) based in British Columbia. The CEO, David O’Brien, pulls a monthly salary of $2,000 which is different than a lot of junior mining companies. The share structure is very tight with 26.1 million shares issued and fully diluted at 28.3 million shares. Insiders hold 43% and Eric Sprott is a strategic investor.

Stuhini’s project is in Northwestern British Columbia and is called Ruby Creek. It has an option to earn 100% interest with a 1% NSR. There is a $22 million road built by a previous operator so there is access to the site. The mine was under construction by Adanac Molybdenum Corp. when it went bankrupt because of the 2008 financial crisis. This is a pure moly play, like the two mines in Colorado. A resource was released earlier this year with a measured and indicated resource of 433 million pounds. This gives an in situ value of $6 billion at current prices. Additionally, there are gold and silver indications on the property. Interestingly the market cap is $14 million while the previous operator had a market cap of $300 million.

It bears keeping an eye on this moly as low carbon technologies expand and what decisions Chile makes over the next few years. At present pricing, it can support new mines but there are few stand-alone opportunities. It is well worth keeping an eye on this market.

More than half of US car sales will be electric by 2030

Originally posted on Mining.com

By : Ira Boudway, with assistance from Kyle Stock

GM Ultium battery. Credit: General Motors

Just over half of passenger cars sold in the US will be electric vehicles by 2030, according to a report from BloombergNEF, thanks in part to consumer incentives included in the $374 billion in new climate spending enacted by President Joe Biden.

Those incentives, among them a point-of-sale tax credit of up to $7,500 for a new EV purchase, are likely to boost the pace of adoption, BloombergNEF analysts found in the report. Prior to passage of the Inflation Reduction Act (IRA) in August, projections for EV sales by 2030 2030 came in at 43% of the US market. With the climate-spending measure in place, that estimate was revised upwards to 52%.

The latest projection from BloombergNEF puts the US on track to hit a key target set by Biden last year, for half of all cars sold in the US to be battery-electric, plug-in hybrid or fuel cell-powered by the end of the decade.

In 2021, electric vehicles accounted for less than 5% of sales in the US, below the global rate of nearly 9% and well below the adoption rate in countries like China, where plug-ins currently account for roughly 24% of new car sales. Norway became the first country to see electric overtake combustion engine vehicle sales last year. Under the revised forecast from BloombergNEF, the US will surpass the global average in 2026 instead of 2028.

The three automakers with the most domestic battery production coming online in the near term—Tesla, GM, and Ford—are set to benefit most from the new law, according to the report. At the insistence of West Virginia Senator Joe Manchin, the IRA restricts the full $7,500 credit to vehicles assembled in North America, with additional phased-in thresholds for manufacturing batteries in North America.

In the new report, analysts noted that these requirements “will take time to adjust to,” particularly as automakers contend with critical minerals and battery rules. But those challenges are expected to lessen over time, a shift that could also bring more electric cars into an affordable price range.

“In the next year or so, there shouldn’t be too much of a difference [in sales],” said BloombergNEF electric car analyst Corey Cantor. “Later in the decade, we expect not only the EV tax credit but the battery production tax credit to drive a steeper decline in EV costs.”

A Great Copper Squeeze Is Coming for the Global Economy

Originally posted on bbnbloomberg.ca

An open pit copper mine near Calama, Chile. Photographer: Cristobal Olivares/Bloomberg , Bloomberg

The price of copper — used in everything from computer chips and toasters to power systems and air conditioners — has fallen by nearly a third since March. Investors are selling on fears that a global recession will stunt demand for a metal that's synonymous with growth and expansion.

You wouldn't know it from looking at the market today, but some of the largest miners and metals traders are warning that in just a couple of years' time, a massive shortfall will emerge for the world's most critical metal — one that could itself hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course. The recent downturn and the under-investment that ensues only threatens to make it worse.

“We'll look back at 2022 and think, ‘Oops,’” said John LaForge, head of real asset strategy at Wells Fargo. “The market is just reflecting the immediate concerns. But if you really thought about the future, you can see the world is clearly changing. It's going to be electrified, and it's going to need a lot of copper.”

Inventories tracked by trading exchanges are near historical lows. And the latest price volatility means that new mine output — already projected to start petering out in 2024 — could become even tighter in the near future. Just days ago, mining giant Newmont Corp. shelved plans for a $2 billion gold and copper project in Peru. Freeport-McMoRan Inc., the world's biggest publicly traded copper supplier, has warned that prices are now “insufficient” to support new investments.

Commodities experts have been warning of a potential copper crunch for months, if not years. And the latest market downturn stands to exacerbate future supply problems — by offering a false sense of security, choking off cash flow and chilling investments. It takes at least 10 years to develop a new mine and get it running, which means that the decisions producers are making today will help determine supplies for at least a decade.

“Significant investment in copper does require a good price, or at least a good perceived longer-term copper price,” Rio Tinto Group Chief Executive Officer Jakob Stausholm said in an interview this week in New York.

Why Is Copper Important?

Copper is essential to modern life. There’s about 65 pounds (30 kilograms) in the average car, and more than 400 pounds go into a single-family home.

The metal, considered the benchmark for conducting electricity, is also key to a greener world. While much of the attention has been focused on lithium — a key component in today’s batteries — the energy transition will be powered by a variety of raw materials, including nickel, cobalt and steel. When it comes to copper, millions of feet of copper wiring will be crucial to strengthening the world’s power grids, and tons upon tons will be needed to build wind and solar farms. Electric vehicles use more than twice as much copper as gasoline-powered cars, according to the Copper Alliance.

How Big Will the Shortage Get?

As the world goes electric, net-zero emission goals will double demand for the metal to 50 million metric tons annually by 2035, according to an industry-funded study from S&P Global. While that forecast is largely hypothetical given all that copper can't be consumed if it isn't available, other analyses also point to the potential for a surge. BloombergNEF estimates that demand will increase by more than 50% from 2022 to 2040.

Meanwhile, mine supply growth will peak by around 2024, with a dearth of new projects in the works and as existing sources dry up. That’s setting up a scenario where the world could see a historic deficit of as much as 10 million tons in 2035, according to the S&P Global research. Goldman Sachs Group Inc. estimates that miners need to spend about $150 billion in the next decade to solve an 8 million-ton deficit, according to a report published this month. BloombergNEF predicts that by 2040 the mined-output gap could reach 14 million tons, which would have to be filled by recycling metal.

To put in perspective just how massive that shortage would be, consider that in 2021 the global deficit came in at 441,000 tons, equivalent to less than 2% of demand for the refined metal, according to the International Copper Study Group. That was enough to send prices jumping about 25% that year. Current worst-case projections from S&P Global show that 2035’s shortfall will be equivalent to about 20% of consumption.

As for what that means for prices?

“It’s going to get extreme,” said Mike Jones, who has spent more than three decades in the metal industry and is now the CEO of Los Andes Copper, a mining exploration and development company.

Where Are Prices Heading?

Goldman Sachs forecasts that the benchmark London Metal Exchange price will almost double to an annual average of $15,000 a ton in 2025. On Wednesday, copper settled at $7,690 a ton on the LME.

“All the signs on supply are pointing to a fairly rocky road if producers don’t start building mines,” said Piotr Kulas, a senior base metals analysts at CRU Group, a research firm.

Of course, all those mega-demand forecasts are predicated on the idea that governments will keep pushing forward with the net-zero targets desperately needed to combat climate change. But the political landscape could change, and that would mean a very different scenario for metals use (and the planet).

And there’s also a common adage in commodity markets that could come into play: high prices are the cure for high prices. While copper has dropped from the March record, it’s still trading about 15% above its 10-year average. If prices keep climbing, that will eventually push clean-energy industries to engineer ways to reduce metals consumption or even seek alternatives, according to Ken Hoffman, the co-head of the EV battery materials research group at McKinsey & Co.

Scrap supply can help fill mine-production gaps, especially as prices rise, which will “drive more recycled metals to appear in the market,” said Sung Choi, an analyst at BloombergNEF. S&P Global points to the fact that as more copper is used in the energy transition, that will also open more “opportunities for recycling,” such as when EVs are scrapped. Recycled production will come to represent about 22% of the total refined copper market by 2035, up from about 16% in 2021, S&P Global estimates.

The current global economic malaise also underscores why the chief economist for BHP Group, the world’s biggest miner, just this month said copper has a “bumpy” path ahead because of demand concerns. Citigroup Inc. sees copper falling in the coming months on a recession, particularly driven by Europe. The bank has a forecast for $6,600 in the first quarter of 2023.

And the outlook for demand from China, the world’s biggest metals consumer, will also be a key driver.

If China’s property sector shrinks significantly, “that's structurally less copper demand,” said Timna Tanners, an analyst at Wolfe Research. “To me, that's just an important offset” to the consumption forecasts based on net-zero goals, she said.

But even a recession will only mean a “delay” for demand, and it won’t “significantly dent” the consumption projections going into 2040, according to a presentation from BloombergNEF dated Aug. 31. That’s because so much of future demand is being “legislated in,” through governments’ focus on green goals, which makes copper less dependent on the broader global economy than it used to be, said LaForge of Wells Fargo.

Plus, there’s little wiggle room on the supply side of the equation. The physical copper market is already so tight that despite the slump in futures prices, the premiums paid for immediately delivery of the metal have been moving higher.

What’s Holding Back Supplies?

Just take a look at what’s happening in Chile, the legendary mining nation that’s long been the world’s largest supplier of the metal. Revenue from copper exports is falling because of production struggles.

At mature mines, the quality of ore is deteriorating, meaning output either slips or more rock has to be processed to produce the same amount. And meanwhile the industry’s pipeline of committed projects is running dry. New deposits are getting trickier and pricier to both find and develop. In Peru and Chile, which together account for more than a third of global output, some mining investments have stalled, partly amid regulatory uncertainty as politicians seek a greater portion of profits to resolve economic inequalities.

Soaring inflation is also driving up the cost of production. That means the average incentive price, or the value needed to make mining attractive, is now roughly 30% higher than it was 2018 at about $9,000 a ton, according to Goldman Sachs.

Globally, supplies are already so tight that producers are trying to squeeze tiny nuggets out of junky waste rocks. In the US, companies are running into permitting roadblocks. While in the Congo, weak infrastructure is limiting growth potential for major deposits.

Read More: Biggest US Copper Mine Stalled Over Sacred Ground Dispute

And then there’s this great contradiction when it comes to copper: The metal is essential to a greener world, but digging it out of the earth can be a pretty dirty process. At a time when everyone from local communities to global supply chain managers are heightening their scrutiny of environmental and social issues, getting approvals for new projects is getting much harder.

The cyclical nature of commodity industries also means producers are facing pressure to keep their balance sheet strong and reward investors rather than aggressively embark on growth.

“The incentive to use cash flows for capital returns rather than for investment in new mines is a key factor leading to a shortage of the raw materials that the world needs to decarbonize,” analysts at Jefferies Group LLC said in a report this month.

Even if producers switch gears and suddenly start pouring money into new projects, the long lead time for mines means that the supply outlook is pretty much locked in for the next decade.

“The short-term situation is contributing to the stronger outlook longer term because it's having an impact on supply development,” Richard Adkerson, CEO of Freeport-McMoRan, said in an interview. And in the meantime, “the world is becoming more electrified everywhere you look,” he said, which inevitably brings “a new era of demand.”

©2022 Bloomberg L.P.

Investing abroad could be the solution to America’s clean energy future

Originally posted on Mining.com

By Bruno Venditti and Frik Els

Benchmark Mineral Intelligence Executive Editor Henry Sanderson (Image: Benchmark Minerals Intelligence)

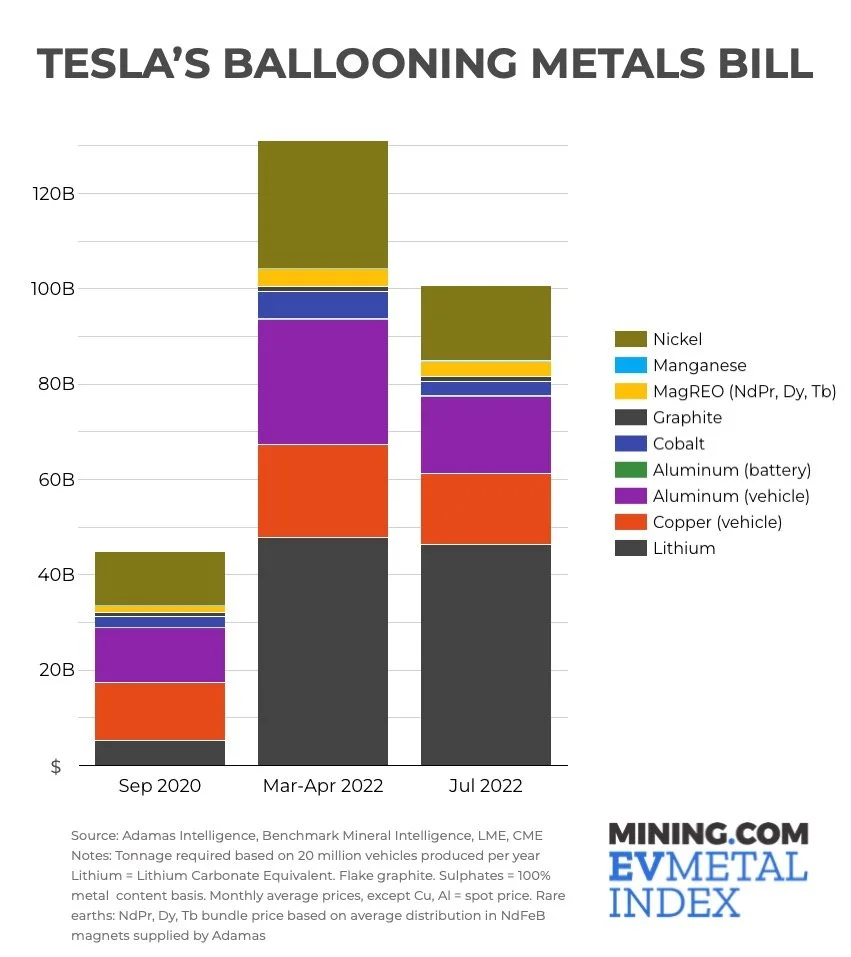

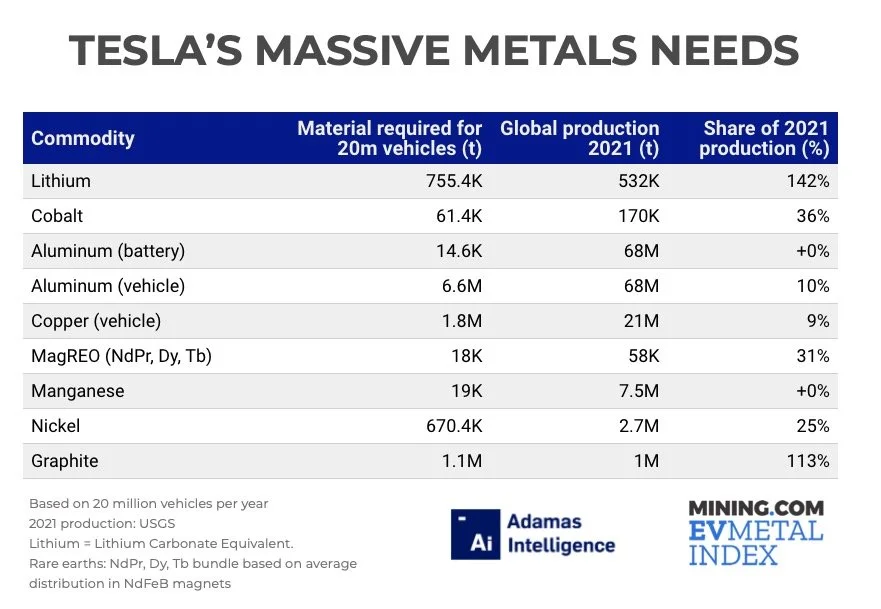

Asked about how many cars Tesla will have made by August 2032—10 years from now—the company founder Elon Musk said: “I’d say 100 million is pretty doable.”

Reaching the 100 million mark by the end of the decade is also considered essential to reduce carbon emissions and achieve the Paris Agreement.

In total, 22 US states have set the goal to have 100% carbon-free electricity before 2050. A massive and rapid deployment of renewable energy is also central to Europe’s drive to end its dependency on Russian fossil fuels.

However, even as president Biden declared this week ‘Detroit is back’ and announced $900 million to build EV charging stations across America, the question remains how quickly the transition to renewable energy can be made.

In his latest book “Volt Rush: The Winners and Losers in the Race to Go Green,” Benchmark Mineral Intelligence Executive Editor Henry Sanderson discusses the global supply chain of materials and mining needed for the electric push.

Sanderson elaborates in an interview with MINING.COM:

MINING.COM: Is it feasible for us to transition to clean energy over the next decades?

We have to. You look at the extreme weather, this year was the hottest in Europe. China is dealing with record heat waves. So we have to move to clean energy. Countries like China are victims of climate change that also produce many of the solutions. So I think there’s a huge incentive to scale up clean energy and the costs.

The Russian invasion of Ukraine highlights how our reliance on fossil fuels is so problematic.

It may be difficult if we don’t want to rely on China at all. Does the US and Europe want to do it on their own without China? That’s going to be more difficult in the timeframe, by 2030, but with China, I think it’s possible.

MINING.COM: Is there enough metal to replace oil?

I think few people are aware that to solve climate change, we need speed and scale. Scale is critical. So when you’re talking about the scale of batteries for EVs, for energy storage, there are enough raw materials on the earth. The problem we have is that this energy transition is quite a policy-driven one.

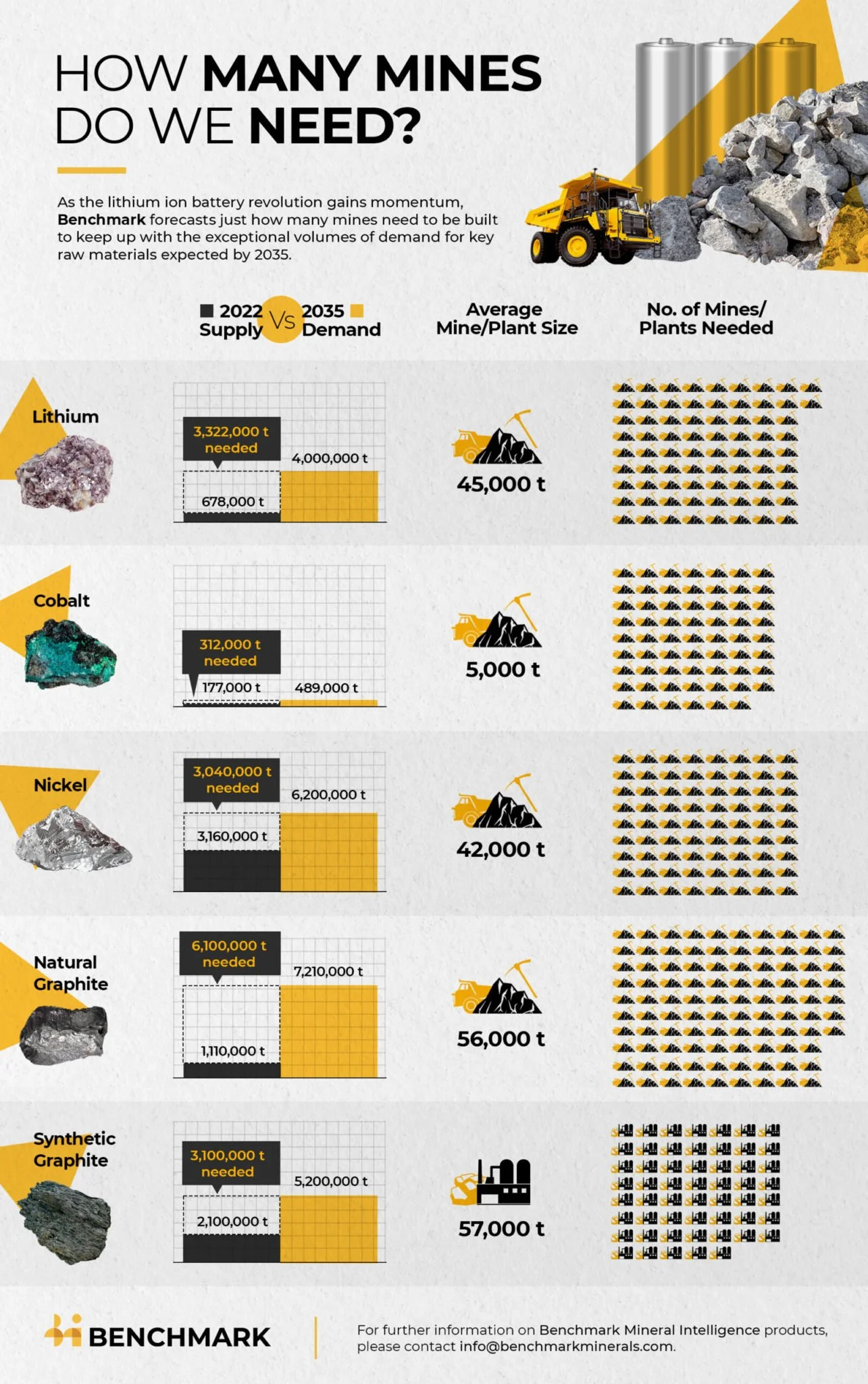

More than 300 new mines could need to be built over the next decade to meet the demand for electric vehicle and energy storage batteries, according to a Benchmark forecast.

More than 300 new mines could need to be built over the next decade to meet the demand for electric vehicle and energy storage batteries, according to a Benchmark forecast.

It has to be fast to meet the climate goals. We’ve left it so late. So when you have this exponential demand increase this decade and the next, it’s gonna be hard for mines to keep up. And also what sort of social environmental cost are we willing to bear to get all these mines into production? Where are we willing to mine?

MINING.COM: Mining in America is not a really popular topic. How do you see Biden’s Administration’s push to clean energy so far?

The Inflation Reduction Act is important because it’s a signal and action. The critical mineral requirements are very strict and difficult to meet. If mines can get approved in the US, then I think there’ll be policy support for it but it is difficult.

So what I see happening is probably more Canada. There’ll be more mine development in Australia, in these free trade agreement countries. What you need to do is build up the processing in the US or North America and Canada. So you know that you can divert the raw materials from Australia to North America, not to China. It’s just an industrial facility, it’s not rocket science.

If the US and Europe want to completely develop their own supply chains by scratch, that’s going to be very challenging

I think probably the best thing is to help these mineral-rich countries with mining backgrounds to develop their mines. That’s probably easier than building in the US. Why aren’t we helping the DRC? There’s graphite in Mozambique, for example, and these are all places that will suffer from climate change but can benefit from these minerals.

MINING.COM: What do you say to those worried about the CO2 emissions in the green metals supply chain?

When it comes to metals, we have this perception that maybe is going to be colossal, a gigantic effort to put that supply chain to work.

The fossil fuel infrastructure is just so colossal. Just take a look at Europe and the energy crisis. The fossil fuel infrastructure is so key to our economies, and so massive. The battery minerals pale in comparison to fossil fuels.

The point in my book is saying, if you are building this battery supply chain from scratch, let’s try to avoid some of the old problems. Every additional tonne of CO2 emitted is an environmental cost. So let’s try and keep it as low CO2, as least environmentally destructive as possible.

MINING.COM: What are the biggest challenges right now for the energy transition?

The biggest challenge is geopolitical. If the US and Europe want to completely develop their own supply chains by scratch, that’s going to be very challenging. Given the urgency of this energy transition, we probably all need to work together a bit more.

The second challenge is the poorer countries. What are we going to do to help them? What we can do to help them mine sustainably and responsibly?

There are a couple of risks. First is that tensions escalate to a point where China considers using its leverage. We’ve seen China boycott foreign companies and foreign goods. The second risk is that a lot of these Chinese companies are very innovative, especially battery companies. If there is a shortage of batteries or raw materials, how much will they get priority over Western companies?

MINING.COM: When it comes to EVs, how do we move from premium models like Teslas to a more mass market?

China’s quite a lesson in this space because the best-selling EV there is this tiny Hongguan Mini, which uses a tiny battery. Consumer choice will play a big part in determining raw material demand. If we are gonna just replace big SUVs with electric SUVs or pickup trucks with electric pickup trucks, then we need lots of metals. Are we willing to use this transition as an opportunity to change some of our motor transport? Can we accept smaller cars in the city? If you look at average driving distances, they’ve been coming down in the Western world.

MINING.COM: Stanford professor Mark Jacobson estimated that in a clean energy world, the total mining burden would drop 80% but yet there’s this great fear about expanding mining for green metals. Why?

I think probably the answer is just for a Tesla or other big automaker to really invest in mining, given its sort of stamp of approval, to say we need this mine. But I think some companies may be afraid of certain projects in the US, where there are still issues with indigenous peoples or communities.

MINING.COM: So when you see a hundred percent EV? Let’s keep it to cars.

Well, let’s take China, it’s already over 25% of total vehicle sales. I’d say maybe by 2050 we could get there, but definitely earlier in China.

Vale sees 44% increase in global nickel demand by 2030

Originally posted on Mining.com

By Roberto Samora; Editing by Alistair Bell)

Vale’s Voisey’s Bay nickel-cobalt-copper mine in Labrador. Credit: Vale

Brazilian mining company Vale said on Wednesday that global demand for nickel should increase 44% by 2030 compared to that expected for this year, due to high demand for use in batteries that power electric vehicles.

“Demand for nickel is forecast to increase rapidly this decade with the energy transition,” the company said in a statement, adding that the new forecast would be of 6.2 million tonnes in demand.

The company also estimated the company’s own production volumes for the medium term should reach between 230,000 and 245,000 tonnes of nickel per year, compared to a 2022 projection of up to 190,000 tonnes.

Growth in nickel supplies should be driven mainly by Indonesia and Canada, where the company has operations, as well as Australia, it added.

Global demand for copper – also used in vehicle batteries and renewable energy systems – is also expected to rise by about 20% by 2030 to 37 million tonnes, Vale added.

The medium-term forecast for copper is seen at between 390,000 and 420,000 tonnes per year, versus up to 285,000 tonnes forecast for 2022.

The company did not predict that supply would catch up with demand, projecting in the medium and long-term a “structural deficit” of copper.

“Increased demand, coupled with a lack of supply, will attract significant interest across the sector,” it said.

MORE THAN 300 NEW MINES REQUIRED TO MEET BATTERY DEMAND BY 2035

Originally posted on Cbc.ca

More than 300 mines around the world will be needed to meeting growing demand for electric vehicles, according to a new forecast. (Steve Lawrence/CBC)

More than 300 new mines will be needed globally to meet growing demand for electric vehicle (EV) batteries, according to a new forecast from a mining analyst.

Benchmark Mineral Intelligence estimates at least 384 new mines for graphite, lithium, nickel and cobalt will be required to meet electric vehicle demand by 2035. If battery materials can be recycled in large enough quantities, the firm says about 336 new mines would be needed.

Andrew Miller, Benchmark's chief operating officer, said he wasn't surprised when they arrived at the numbers.

"You know this has been something that has been building," he told CBC News.

"The targets, if you talk about EV demand, are increasing. We publish our forecast every quarter and that number has only ticked up."

Miller said the rest of the world is catching up to China with regard to demand for electric vehicles.

Traditional automakers like General Motors, Volkswagen and Hyundai have also started to offer more electric vehicles.

Except for cobalt, Miller said there are enough minerals in the ground to meet growing demand for batteries, but mines can take years to develop. There are types of batteries called lithium iron phosphate batteries that no longer need cobalt, however.

"Canada has some massive potential," Miller said.

"It already has some of these mines that are under development today. A huge number of lithium prospects are being developed across Canada."

U.S tax credits a benefit for Canada

He said new tax credits under the Inflation Reduction Act in the U.S. will benefit Canada, because they apply to vehicles built in North America, that use minerals mined from the U.S. or its free trade partners.

Miller said recycling batteries to recover their metals will become more important as demand grows and the mining industry struggles to keep up.

It will also be important for mining companies to expand their operations in a responsible fashion, he added.

"I think a huge opportunity for the new generation of miners and suppliers into the EV market is to make sure things are done sustainably," Miller said.

"To deploy new methods, new practices, to build out the clean energy credentials on site as well for the energy that's being used to really make sure that the the materials going into feeding this EV revolution are sustainable and are being extracted responsibly."

Battery-mineral shortage likely to impede Canada's goals for electric vehicles, industry expert says

Steve LeVine, the editor of The Electric, a publication that focuses on electric vehicles and the lithium ion batteries that power them, previously told CBC News it's unlikely automakers will be able to meet their projections for electric vehicles as demand continues to rise.

He said current mines can't meet future demand.

"At the end of the decade, the desire is to make between 25 million and 40 million EVs, if you count the Chinese [industry] and Tesla," LeVine said.

"There's enough nickel to make 13 million."

Why BYD Will Surpass Tesla as the New King of Electric Vehicles

Originally posted on Makeuseof.com

By Charles Early

BYD is one of the largest electric car brands in the world. How is it that so few people have heard of it?

This is an exciting time for the electric vehicle market. It’s one of the most rapidly growing industries in technology and design. Tesla has risen to the top of electric vehicle manufacturers in recent years because of its good looks and moderate price, with companies like Mercedes, Toyota, and Lucid trailing behind.

Since changing from a company that only made batteries to manufacturing full-scale electric vehicles, BYD has made a tremendous impact on the EV market. While discussing EV innovations, here’s why BYD is a name you’ll want to remember.

From Battery Expert to Electric Vehicle Maker

Image Credit: そらみみ/Wikimedia Commons

BYD (Build Your Dreams) is a Chinese company based in Shenzhen founded in 1995 by chemist, billionaire, and entrepreneur Wang Chuanfu. Chuanfu's goal was to compete with Japan’s rechargeable battery export market by creating his own company. This led to China taking much of the rechargeable battery market share away from Japan.

As a maker of rechargeable batteries, BYD became the largest supplier of batteries for mobile phones, which accounts for much of its revenue to this day.

Wang Chuanfu saw opportunities in electric vehicles, so he bought out Chinese automaker Tsinchuan Automobile Co Ltd, in 2002. He later bought more struggling automakers using already established factories making BYD the international company it is today.

Since starting out as a trailblazer in battery technology, BYD has created innovations that span multiple industries. According to its website, BYD has designed technologies for battery-electric cars, buses, trucks, forklifts, the SkyRail monorail system, solar power generation, energy storage, and consumer electronics.

Now considered among the largest electric vehicle manufacturer on the market and the fourth-largest battery manufacturer, BYD’s ambitious dreams are being realized. The company is currently valued at 950.77 billion Hong Kong dollars or 121.16 billion U.S. dollars. Internationally, its dominance has expanded beyond the Chinese market.

Billionaire Warren Buffett has been one of its largest investors since 2008, owning 7.73% of the company. Despite being relatively new to selling cars, it plans to sell vehicles in numerous countries in the coming years, notably in Australia, Europe, and North America.

BYD’s Innovations

Image Credit: AdityaPrasetyo/Wikimedia Commons

Besides Tesla, there are many electric vehicle companies breaking new ground. BYD is one of China's top car manufacturers. It sold over 640,000 new energy passenger cars in the first half of the year, an increase of 300% from last year. This surpasses Tesla’s first-half sales by 76,000. A key factor in BYD's success is its patent portfolio. With 9,426 patents, it ranks first among the top 20 Chinese companies in the field of new energy.

With over 21,000 granted patents across four battery business sectors in electronics, automobiles, and rail transportation, BYD is a world leader in battery innovation. For the advancement of battery technology, it is ranked first in the number of R&D personnel compared to other Chinese companies.

Strong scientific research is vital to brand development and the new energy market. BYD has opened the industry doors and become a major contributor with its advanced technology.

A key move for BYD in the supply chain is the separation of its battery business and distribution to more Original Equipment Manufacturers (OEMs), joining forces with the likes of Mercedes, and Toyota. This will allow its technology to reach a global market.

BYD's Big Three Offerings

Image Credit: Jengtingchen/Wikimedia Commons

When BYD introduced the big three in 2021, the EV market took a major leap forward. These are the DM-I super hybrid, its E- platform, and the blade battery.

The DM-I Super hybrid gets 3.8 KPG per 100 kilometers. This is an excellent starting point for the future development of hybrid vehicles. As the DM-I super-hybrid technology is improved, fuel consumption will be reduced and cost performance will be increased.

Its E-platform 3.0 has played an important role in the transition from pure electrification to more intelligence. On its website, BYD states that it will promote intelligence, efficiency, and safety in future electric vehicles.