Headlines

Why miners are racing to produce one of the world’s most in-demand metals

Australian nickel is in high demand. (Rachel Pupazzoni, ABC News.)

Mining companies in Australia are racing to find the next big reserve of one of the world's most in-demand metals.

Nickel is a critical metal in batteries, and as the world keeps moving toward renewables, more batteries are needed to store energy.

In fact, there's a strong case that much more of it is needed than lithium — a commodity many people know of, because it is in the name of lithium batteries.

But there are a variety of batteries made with different metal compositions and, as Elon Musk puts it, batteries need a sprinkle of lithium compared to nickel.

"The lithium is actually 2 per cent of the cell mass," he said at a presentation in 2016.

"It's a very small amount of the cell mass and a fairly small amount of the cost, but it sounds like it's big because it's called [a] lithium-ion [battery] , but our batteries should be called nickel-graphite, because it's mostly nickel-graphite."

About 50 kilograms of nickel goes into each Tesla battery.

A report by the CSIRO shows about five times as much nickel (48,006 kilotonnes) will be needed to meet global demand by 2050 as lithium (8,990 kilotonnes).

The problem the world now faces is finding enough nickel to make all the batteries needed.

The search is on to find more nickel to meet the growing demand for the critical battery metal.(Supplied: Panoramic Resources)

Nickel lost its shine

Australia was once a world-leading producer of the shiny metal.

Such was its demand, nickel fetched as much as $US52,000 ($73,700) per tonne in 2007.

But just as prices were rising, the global financial crisis hit, sending the commodity spiralling down, to as low as about $US9,000 ($12,700) in October 2008.

Dozens of mines closed, including a brand new nickel mine opened by BHP in Ravensthorpe, in the south of Western Australia. It went under in January 2009, having operated for less than a year.

For years, BHP tried to sell its Nickel West business, but by the mid-2010s it decided to hold onto it and invest in the commodity.

Now, BHP is ramping up its nickel production and is on the hunt for more mines.

The search for nickel

Last week, BHP announced an unsolicited offer to buy nickel and copper miner Oz Minerals for $8.3 billion.

Oz Minerals advised shareholders to reject the bid, saying it was "highly opportunistic" and significantly undervalued the company.

BHP has deals to sell its nickel to three major car makers.

"I think there's a fantastic opportunity with the Tesla, the Ford and the Toyota agreements," BHP Nickel West asset president Jessica Farrell told The Business.

"I think it is a sign of a direct relationship with the miner and the car manufacturers and we're very well placed to provide sustainable nickel to the battery sector."

BHP Nickel West's Jessica Farrell wants to increase its nickel reserves so it can fulfil orders from car manufacturers.(ABC News: John Gunn)

While Ms Farrell said BHP had enough nickel to fulfil those deals, it clearly wants more.

"We have the second-largest nickel sulphide deposit globally in the Agnew-Wiluna belt, which is an incredible deposit," she said.

The Agnew-Wiluna belt is a geological strip of land rich in nickel and other commodities that stretches south, roughly through the middle of Western Australia, where other miners also operate.

"We're certainly not short of customers … in terms of what we see in the demand trajectory," she said.

"We're actively exploring globally, and we've significantly increased our own exploration spend within the portfolio of the land tenure that we have."

BHP is set to spend billions of dollars because it sees demand only rising.

"If we look out to 2030, we see a 60 per cent increase in electric vehicles and then out to 2040 we see that going up another 30 per cent, to 90 per cent," she said.

"So, we see an incredibly good trajectory for demand — and that's globally.

"We'll also see that transition locally, I think, a lot faster than we expect."

More mines needed

BHP isn't the only company expanding its nickel operations.

In June, the ink dried on a deal that saw Australian company IGO buy nickel miner Western Areas for $1.3 billion.

The deal adds another two nickel mines to IGO's portfolio: the already-in-production Forrestania mine as well as Cosmos, where mining is due to start by the end of this year.

IGO produced 24,000 tonnes of nickel metal concentrate from its Nova mine last financial year.(ABC News: Jon Kerr)

It also extends the life of its existing Nova site, where it has been mining nickel since 2017.

"Since then, it's just been delivering fantastically consistent production levels for IGO and fantastic financial returns," IGO managing director Peter Bradford told The Business.

Peter Bradford runs one of the major nickel and lithium miners in Australia.(ABC News: John Gunn)

But it is not the first time IGO has tried to add to its nickel portfolio.

In 2019 it attempted to buy Panoramic Resources, a company with a nickel mine called Savannah in the Kimberley region, in the far north-east of Western Australia.

While Mr Bradford is remaining tight-lipped on whether it will make another takeover attempt, its purchase of Western Areas does give it a 21.5 per cent stake in Panoramic.

It also has about 10,000 square kilometres of land around Panoramic's mine that it is currently searching for nickel.

"What we're exploring for is a repetition of Nova or a repetition of the Savannah mine that Panoramic have," he said.

"What we may or may not do with the 21.5 per cent interest in Panoramic will depend on the success around that exploration of assets in the Kimberley."

Panoramic's managing director, Victor Rajasooriar, told The Business he was focused on expanding operations, regardless of IGO.

"At the end of the day, they have 21 per cent of the company, they are a supportive shareholder and we can coexist," he said.

Panoramic Resources managing director Victor Rajasooriar says he's focused on delivering for shareholders, not another potential takeover by IGO.(ABC News: John Gunn)

"Our main purposes is to get this project up and running properly, ramp up to nameplate capacity, work safely and increase shareholder wealth, and they will benefit from that.

"That's what we can control, and that's what we will do."

Price play

The vast majority of nickel mined in the world doesn't go into batteries – it's used to make stainless steel.

"But certainly over time, expectations are that [electric vehicles] will become a much larger piece of the demand pie for nickel," resources division director at Macquarie Hayden Bairstow told The Business.

"It is about 15 per cent now of the global nickel demand market, if you like, for electric vehicles.

"That's certainly grown from basically nothing a few years ago, and the expectations are that it will move into the 20s and 30 per cent of the total, and beyond that over time, as the EV market gets larger and larger."

As that demand grows, so too does the price, which swung wildly at the start of 2022.

At the end of 2021, nickel was selling for roughly $US20,000 – a far cry from the pre-GFC peak, but more than double its 2008 low.

It had been increasing fairly steadily for the last few years, along with battery demand.

But as Russia invaded Ukraine the price soared, briefly to as high as $US100,000 a tonne before the London Metals Exchange halted trading and cancelled the day's transactions.

Russia is one of the biggest global suppliers of nickel and there were fears of a massive shortage, just as demand was growing.

The nickel price has once again stabilised to about $US24,000 a tonne.

Space to play or pause, M to mute, left and right arrows to seek, up and down arrows for volume.

The next iron ore of mining

With prices now back rising in a more normal range and car makers pleading with miners to find more nickel, the sector is trying to expand as fast as it can.

"But nickel is very hard to find," explained David Southam, the outgoing managing director of nickel miner Mincor.

"It's a race to secure those critical minerals and the Western world has probably fallen a little bit behind [and] is now playing catch up."

David Southam stepped down as Mincor Resources managing director this month.(Supplied: Mincor Resources)

David Southam stepped down as Mincor Resources managing director this month.(Supplied: Mincor Resources)

While Mr Southam may be leaving the company (Mincor's new managing director, Gabrielle Iwanow, steps into the role later this year), he only sees growth for the sector.

"It's that fundamental shift in the supply-demand, with the demand for electric vehicle batteries, for battery storage, where nickel content gives you the longevity in the battery that means you can travel further, that has fundamentally shifted," he explained.

"It's almost like iron ore, with the Chinese infrastructure boom, that took off, and nickel is very similar."

"The price has gone up, which has enabled projects to get off the ground," he told The Business.

"With this fundamental shift in the market, if you can produce clean, green nickel, because it will be traced right through to the vehicle, you've probably got a pretty good future ahead of you."

Global Vanadium Ore Market Drivers, Trends And Restraints For 2022-2031

Originally posted on Newswires

NEWS PROVIDED BY

TBRC Business Research Pvt Ltd.

August 15, 2022, 18:45 GMT

The Business Research Company’s Vanadium Ore Global Market Report 2022 – Market Size, Trends, And Global Forecast 2022-2026

LONDON, GREATER LONDON, UK, August 15, 2022 /EINPresswire.com/ -- As per The Business Research Company's "Vanadium Ore Global Market Report 2022”, the vanadium ore market is expected to grow from $2.53 billion in 2021 to $2.77 billion in 2022 at a compound annual growth rate (CAGR) of 9.4%. The global vanadium ore market size is expected to grow to $3.93 billion in 2026 at a compound annual growth rate (CAGR) of 9.1%. The increasing use of vanadium in automobile industry will drive the vanadium ore industry growth.

Request a Sample now to gain a better understanding of vanadium ore market:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2024&type=smp

Key Trends In The Vanadium Ore Market

The use of vanadium redox flow batteries (VRFB's) for energy storage is an emerging trend market. This trend will drive a structural change in the vanadium ore mining market dominated by steel manufacturers.

Overview Of The Vanadium Ore Market

The vanadium ore market consists of sales of vanadium ores and concentrates and related services.

Learn more on the global vanadium ore market report at:

https://www.thebusinessresearchcompany.com/report/vanadium-ore-global-market-report

Vanadium Ore Global Market Report 2022 from TBRC covers the following information:

Market Size Data

• Forecast period: Historical and Future

• By region: Asia-Pacific, China, Western Europe, Eastern Europe, North America, USA, South America, Middle East and Africa.

• By countries: Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA.

Market Segmentation

• By Type: FeV40, FeV50, FeV60, FeV80

• By Application: Iron and Steel, Chemical, Energy Storage, Others

• By End-Use Industry: Automotive, Aerospace and Defense, Steel Industry, Others

• By Geography: The global vanadium ore market is segmented into North America, South America, Asia-Pacific, Eastern Europe, Western Europe, Middle East and Africa. Among these regions, Asia-Pacific holds the largest share in the market.

Major market players such as AUROX RES., Atlantic, Treibacher Industrie AG., Essel Mining, Tremond Alloys & Metals Corp., Globe Specialty Metals, Inc., Largo Resources, YELLOW ROCK RES., REED RESOURCES, AMERICAN REOURCES, LARGO RES., CONTINENTAL PRECIOUS MIN., Hickman, Williams & Companies, Bear Metallurgical Company, Gulf Chemical and Metallurgical Corporation and Core Metals Group.

Trends, opportunities, strategies and so much more.

Vanadium Ore Global Market Report 2022 is one of The Business Research Company’s comprehensive reports that provides vanadium global ore market outlook. The market report analyzes vanadium ore global market size, vanadium ore global market growth drivers, vanadium ore global market segmentation, vanadium ore global market major players, vanadium ore market growth across geographies, and vanadium ore market competitors’ revenues and market positioning. The vanadium ore global market report enables you to gain insights on opportunities and strategies, as well as identify countries and segments with the highest growth potential.

Not what you were looking for? Go through similar reports by The Business Research Company:

Metal Ore Global Market Report 2022

https://www.thebusinessresearchcompany.com/report/metal-ore-global-market-report

Mining Global Market Report 2022

https://www.thebusinessresearchcompany.com/report/mining-global-market-report

Metal Global Market Report 2022

https://www.thebusinessresearchcompany.com/report/metal-global-market-report

About The Business Research Company

The Business Research Company has published over 3000 industry reports, covering over 3000 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets.

Call us now for personal assistance with your purchase:

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

The Business Research Company

Email: info@tbrc.info

Follow us on LinkedIn: https://bit.ly/3b7850r

Follow us on Twitter: https://bit.ly/3b1rmjS

Check out our Blog: http://blog.tbrc.info/

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

Twitter

LinkedIn

Market Research Products, Services, Solutions For Your Business - TBRC

Tesla Big Battery In South Australia Delivers (Again), This Time On Inertia Services

Originally posted on Seeking Alpha

by Keith Williams

Summary

Tesla Lithium batteries are now validated by Australian Energy Marketing Authority for grid-scale inertia services using Tesla’s Virtual Machine Mode software.

This is a world first for inertia services on an established grid, and it represents a significant step towards exit from fossil fuel-based power.

Big lithium batteries now have an additional functionality validated (in addition to frequency regulation, short-term time shifting, etc.).

At the same time, scale-up of flow batteries is happening.

News about inertia services broadens the value of Tesla’s energy storage offerings.

Tesla (NASDAQ:TSLA) is a huge presence in the world of electrified transport, and Elon Musk seems quite serious about building production of Tesla BEVs (Battery Electric Vehicles) to 20 million annually by 2030. This is a mammoth goal since the world's largest car manufacturer currently, Toyota (TM), produced 10.5 million vehicles in 2021. Tesla's Gigafactories are moving to produce 2 million vehicles annually, so 10-12 Gigafactories need to be in operation by 2030 to achieve 20 million vehicles. Given the above, it isn't a surprise that the other side of Tesla, grid scale battery offerings, is often overlooked. Here, I describe a significant new development in the battery storage story, which heralds a major reconsideration about how batteries are going to contribute to decarbonization of global power grids. Tesla is a key part of this development, and this is why Elon Musk insists that battery storage will eventually become half of Tesla's business. When considering an investment in Tesla, this is worth keeping in mind.

Tesla's Battery Software Products

It is easy to overlook Tesla's achievements that define the company. While Tesla's cars involve innovation at every level, from whole body casting to heat pump-based temperature control, the essence of Tesla is information collection and management. Tesla has a series of software products in the area of battery storage that is just as significant as its autonomous driving technology for its BEVs. Tesla lists five software products involved with its battery technology that are of interest to customers at all levels of battery storage. These are:

1. Autobidder

This product enables power producers, utilities and capital partners to monetize battery assets. It is a real-time trading platform that is about risk management and maximising revenue.

2. Powerhub

This is a monitoring and control platform for distributed energy resources, renewable power plants and microgrids. It is about maximising operational efficiency, uptime and asset value.

3. Microgrid Controller

This software maintains grid stability and reduces operating costs for energy sources within a microgrid. It is integrated with the Powerhub platform. It incorporates load and solar forecasting.

4. Opticaster

This software is designed to maximise economic benefits and sustainability objectives for distributed energy resources.

5. Virtual Machine Mode

This software helps replace mechanical inertia for a grid, which is traditionally provided using fossil fuel based resources. The software virtually emulates mechanical inertia. This means that megapack batteries have grid-forming dynamics to provide grid strength allowing response to added and rejected loads, maintaining quality voltage at interconnection points.

Here I consider two of the Tesla software products that are relevant to grid scale batteries.

Tesla's "Autobidder"

I've covered Tesla's Autobidder technology in relation to Australian renewable energy company Genex Power's (ASX:GNX) 50 MW/100 MWh Bouldercombe battery project. This involved Tesla supplying 40 megapacks for the energy storage and the Autobidder energy trading platform. Included in the deal was long-term revenue support from Tesla.

Today Genex announced acquisition of a second and much bigger (up to 2GW) battery storage project, Bulli Creek, also in Queensland, Australia. This involves a 5-stage project, with the first stage being a massive 400 MW/ 1600 MWh big battery energy storage system.

In its release, Genex provides hints about how it will finance this project based on its previously successful Bouldercombe Battery Project. Part of that deal involved a creative partnership with Tesla. I think there is a good chance that Tesla will be successful as the provider of its battery megapacks and Autobidder software.

Tesla's "Virtual Machine Mode"

In a world first, South Australia's big Tesla battery at Hornsdale (owned by Neoen (OTC:NOSPF)) has been approved by the Australian Energy Market Operator (AEMO) to deliver grid-scale inertia services.

The Hornsdale Power Reserve in South Australia can provide up to 3 GW seconds of inertia in Virtual Machine Mode, which is ~50% of South Australia's entire inertia needs.

This is a historic key step in renewables providing grid services with no requirement for fossil fuel backup. This has obvious relevance to Tesla's emerging big battery energy storage business.

Flow Batteries

The above discussion focuses on lithium batteries because they are the technology that is increasingly being rolled out in partnership with renewables (solar PV and wind) projects. The lithium battery projects keep getting bigger and now GWh scale projects are being implemented. The actual kind of lithium batteries that are optimal for grid scale storage is an evolving story, which I'll consider elsewhere, but it is becoming clear that both NMC (Nickel, Manganese, Cobalt) and LFP (Lithium Iron Phosphate) batteries are being used.

Flow batteries represent another kind of battery technology which, while not suited to transport because the batteries are heavy, offers prospects to complement lithium batteries, which are perhaps better suited to shorter duration applications (e.g., frequency regulation, 0-4 hour storage operations). Flow batteries have the possibility of longer-term storage, and they can be completely charged/discharged on a daily basis. Flow batteries have been seen as a possible solution for many years, although the success of lithium batteries has meant that flow batteries have struggled to get scaled up and down the cost curve.

This may be changing as very recently a huge Vanadium Redox Flow Battery (VRFB) is being installed in China. This battery is based on technology developed with US flow battery company UniEnergy Technologies, even though this company was declared bankrupt last year. Chinese company Rongke Power has worked with UniEnergy over six years to build a 100MW/400MWh battery in Dalian, China. This battery was connected to the Dalian Grid in May 2022. This battery is the first stage of a project that will have a capacity of 200 MW/ 800 MWh. A second VRFB battery in China is being built by Canadian headquartered VRB Energy, whose majority shareholder is Ivanhoe Electric (IE), a mineral exploration company which has recently listed on the NYSE. This VRFB battery might have similar technology to the Rongke Power battery since both were part of a flow battery program in China.

Henry Miles' recent article mentions heavyweights Lockheed Martin (LMT) and Honeywell (HON) both with flow battery technologies, although the precise details of their flow battery chemistries are shrouded in secrecy. Both are talking about GWh scale of flow batteries.

Even if flow batteries become successful, it seems almost certain that lithium batteries will continue to have a significant place in grid level battery storage and this could become a crossover application with electric vehicles as V2G (Vehicle to the Grid) technology becomes adopted. Batteries with LFP chemistry might be more suited to V2G applications.

Conclusion

Most analysis of Tesla concerns its automotive business, no doubt because Tesla has transformed the electrification of transport, pulling just about every major manufacturer to plan to exit ICE (Internal Combustion Engine) manufacture in favour of BEV (Battery Electric Vehicle) manufacture. Since transport represents the biggest emissions sector (27%) in the US, the focus on Tesla's auto business is relevant. Emissions from energy (25%) and Industry (24%) are almost as large and so the new battery functionality reported here is a major development in the energy sector, which will facilitate exit from fossil fuels. The way that big battery projects get rewarded is evolving, but it is clear that energy storage through batteries is becoming increasingly important in the energy transition. This is not only about the batteries, and Tesla is pioneering software applications that not only enable technical features such as providing inertia services (Virtual Machine Mode) mentioned in this article, but also other aspects of commercialisation of big battery technology, such as Autobidder which is implemented in the Neoen Hornsdale facility in South Australia and will be part of the Genex Bouldercombe Battery project. These are important products that add value to the battery hardware.

Tesla is a challenge for investors to get their heads around, and most commentary focuses just on the automotive side of the business. Of 16 Seeking Alpha authors in the past 30 days, there were five buy, two sell and two strong sell recommendations, with seven authors on the fence with a hold recommendation. The 37 Wall Street analysts in the past 90 days were more bullish with 14 strong buy, seven buy as opposed to four sell and one strong sell; 11 analysts had a hold rating. I still struggle to find a good entry point, but I am clear that Tesla is a much bigger investment opportunity than just considering its BEV business.

I am not a financial advisor, but I follow closely the dramatic changes happening as energy and transport begin to become decarbonized. I hope that my commentary about Tesla helps you and your financial advisor to get a fuller picture of the overall Tesla offering as you consider investment in this space.

Vanadium flow battery M&A: SPAC ups CellCube stake to 25%, up-downstream deal in Australia

Originally posted on Energy Storage News

Mustang Energy was part of a consortium that invested in CellCube in April 2021. Image: Enerox/Cellcube.

SPAC Mustang Energy PLC is increasing its effective stake in CellCube to around 25% while a company launching a vanadium mine project in Australia has injected US$3.5 million in a new flow battery maker.

Mustang Energy increases stake in CellCube

Special purpose acquisition company (SPAC) Mustang Energy has agreed to buy a 27.4% interest in VRFB Holdings Limited from Acacia Resources for US$10.5 million, increasing its stake to 49.5% having already bought 22.1% in April 2021.

VRFB Holdings Limited is a 50% shareholder in Enerox Holding Limited, a vehicle which owns 100% of Enerox GmbH, the Austria-based vanadium flow battery company better known by its brand name CellCube.

Through the intermediary of VRFB Holdings, the transaction means Mustang Energy will effectively hold around 25% of CellCube’s parent company as does stock-quoted vanadium producer Bushveld Minerals, which owns the other 50.5% of VRFB Holdings.

The two were part of a consortium that invested in Enerox/CellCube in April last year through the VRFB Holdings Limited vehicle, reported by Energy-Storage.news at the time. The consortium in total injected US$30 million into the company to scale up its production of vanadium redox flow batteries (VRFBs) to 30MW by 2022.

Dean Gallegos, Mustang Energy managing director, said: “The opportunity to increase Mustang’s interest in Enerox represents an exciting opportunity for our stakeholders, thanks to Enerox’s research and development initiatives in the energy storage sector, and its state-of-the-art vanadium-based technology.”

CellCube has deployed 130 systems globally totalling 23MWh. Recent notable project announcements include an 8MWh microgrid project in Illinois, US, and a potentially huge rollout in South Africa with Kibo Energy, which just agreed to procure two proof of concept projects to that end.

Richmond Vanadium Technology invests in Ultra Power Systems

Richmond Vanadium Technology, a company launching a vanadium mine in Queensland, Australia, has agreed to invest up to AU$5 million (US$3.5 million) in Ultra Power Systems, a new vanadium flow battery company.

The deal also gives Richmond Vanadium Technology (RVT) the right to supply all vanadium offtake to UPS and give it a seat on UPS’ board. It is subject to RVT’s successful listing on the Australian stock market and completion of due diligence of UPS’ products.

RVT is currently completing a bankability feasibility study for the Richmond Vanadium Project, located in north Queensland where it has five Mineral Exploration Permits for potential vanadium extraction. The company is 25% held by Horizon Minerals, a mid-tier gold producer.

The pre-feasibility study was concluded based on a vanadium price of V2O5 Flake of AU$16.44/lb (US$11.48).

Ultra Power Systems says it is Western Australia’s first vanadium battery manufacturer. It is taking orders for its V40 product, a 6KW/40kWh modular solution which it says is for the ‘harshest of environmental conditions’.

Horizon Minerals investee Richmond Vanadium Technology plunges $5 million into Ultra Power Systems; secures vanadium offtake deal

Originally posted on Proactive Investors

by Phoebe Shields

Richmond Vanadium Technology MD Shaun Ren said the partnership would contribute to the company's aim of "establishing a significant mine to metal to battery corridor right here in Australia".

Left to right; Brad Appleyard, Ultra chair and CEO, Jon Price, Horizon managing director and RVT non-executive director, Dr Shaun Ren, RVT managing director and Brendon Grylls, RVT chair.

Horizon Minerals Ltd (ASX:HRZ) investee Richmond Vanadium Technology (RVT) has signed a binding term sheet agreement to invest up to $5 million in Ultra Power Systems (UPS) – an Australian-based vanadium redox flow battery (VRFB) manufacturer – and obtain the rights to supply all vanadium offtake to UPS, subject to cost, quality and timing.

Horizon Minerals holds a 25% interest in Richmond Vanadium Technology, which owns a 1.8-billion-tonne vanadium resource in the form of the Richmond Vanadium Project in Queensland.

RVT will subscribe for 20 million UPS shares at $0.25 per share, subject to the successful listing and IPO of Richmond Vanadium and completion of due diligence on UPS systems.

UPS has developed its own VRFB system, the Ultra V40 battery module, and a standalone power station which integrates solar and wind turbines into a mobile, scalable power generation system designed for off-grid applications.

Building a mine to metal to battery corridor

“As Richmond Vanadium continues to advance its world class Richmond Vanadium Project in north Queensland, having a partner like Ultra who is already successfully developing VRFBs contributes to our aim of establishing a significant mine to metal to battery corridor right here in Australia,” Richmond Vanadium Technology managing director Shaun Ren said.

While the steel industry has traditionally been the largest consumer of vanadium, Vanitec – a not-for-profit international global member organisation focused on vanadium use – has stated the material is increasingly being used in VRFBs.

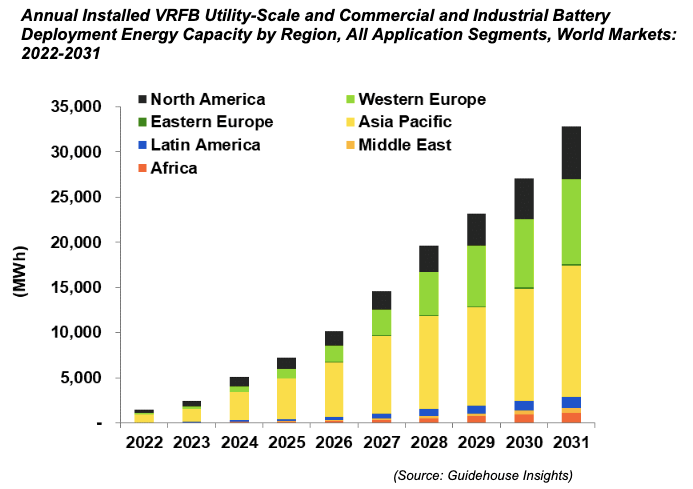

Analysis by independent market intelligence and advisory firm Guidehouse Insights has revealed the global annual deployment of VRFBs is expected to reach 32.8 giga-watthours per year by 2031, a compounding annual growth rate (CAGR) of 41% over the period.

This forecast would equate to between 127,500 and 173,800 tons of new vanadium demand per year by 2031, more than twice the vanadium currently produced annually.

“We are taking the next step in creating a strategic partnership, the additional funding will facilitate the acceleration of Ultra’s development and planned modular electrolyte production,” Ultra Power Systems chair and CEO Brad Appleyard said.

“We look forward to working together as this new industry grows exponentially.”

Two simple charts show why green energy is all about mining

Originally posted on Mining [Dot] Com

by Frik Els

Image: JACLOU-DL, Pixabay

Lots of ink has been spilled on the green energy transition on these pages.

In 2019 MINING.COM called Greta Thunberg and Alexandria Ocasio-Cortez mining’s unlikely heroines as they were saying that the “exponential expansion of global mining is the dirty little secret – and glaring blind spot – of Green New Deal evangelists and zero-carbon climate warriors.”

Fast forward three years, and there’s still little or no acknowledgement from climate crisis actors for the need for rapidly growing metal and mineral extraction. The nescience of climateers when it comes to mining remains striking and helps explain the applause for Secretary General António Guterres at the opening of the COP26 summit for these words:

“It is time to say enough! […] enough of burning and drilling and mining our way deeper. We are digging our own graves.”

Fitch Ratings: Metals, Mining Faces Diverse Impact from Energy Transition May 2022

A recent report by Fitch Ratings assessing the risks of climate change to various sectors featured two graphs that vividly illustrates just how central metals and mining is to decarbonization.

The latest UN Forecast Policy Scenario anticipates a substantial increase in electricity generation from renewables – comprising hydro, wind and solar – across all regions.

Renewables are set to be the largest source of power globally by 2050, at 73% of the total compared to 25% in 2020. Wind and solar will increase their share of global renewables generation to 85% by 2050 from 34% in 2020.

Couple this with the metal intensity of renewable energy resources and it is clear that even if the installation of renewable energy capacity falls far short of expectations, the impact on metals and mining would be immense.

Fitch Ratings: Metals, Mining Faces Diverse Impact from Energy Transition May 2022

First phase of 800MWh world biggest flow battery commissioned in China

Originally posted on Energy Storage News

by Andy Colthorpe

Detail of cell stacks at the completed demonstration system at VRB Energy’s project in Hubei Province. Image: VRB Energy.

Commissioning has taken place of a 100MW/400MWh vanadium redox flow battery (VRFB) energy storage system in Dalian, China.

The biggest project of its type in the world today, the VRFB project’s planning, design and construction has taken six years. It was connected to the Dalian grid in late May, according to a report this week by the China Energy Storage Alliance (CNESA) industry group.

The system is in Dalian City’s Shahekou District, which is in Liaoning Province in northeastern China. It will contribute to lowering the peak load on the grid in Dalian City and could even play a role at provincial level, improving power supply and the capability to connect new generation sources like renewable energy to the grid.

VRFB developer and manufacturer Rongke Power supplied the battery technology. The company is a spin-off from the Dalian Institute of Chemical Physics of the Chinese Academy of Sciences and the institute has overseen the project through doctoral supervisor and head of its energy storage department Li Xianfeng.

Rongke Power had been cited to be working with US-headquartered flow battery technology company UniEnergy Technologies on the project previously, but that company’s Chapter 11 bankruptcy was widely reported late last year and even its website now appears to be offline.

An update on the project’s progress which was issued in June by the trade group Zhongguancun Energy Storage Industry Alliance from Beijing said the VRFB technology was developed by the Dalian Institute of Chemical Physics team.

Together, the academics have worked with Rongke Power on almost 40 commercial demonstration flow battery projects already, the alliance said, including projects both in China and overseas, such as a 10MW/50MWh system which was the world’s biggest when completed in 2013 and a 10MW/40MWh project at a wind farm.

Previously, the biggest flow battery installation in the world was a 15MW/60MWh system deployed in 2015 in northern Japan by Sumitomo Electric. Sumitomo Electric brought online a second, 51MWh large-scale system in April this year, which again would still rank among the world’s biggest for a technology which is regarded highly for its technical capabilities but has so far largely been unable to scale up.

However, the Dalian project is, as well as being a demonstration project and part of a wave of large-scale VRFBs China is looking to deploy, only at its first phase of construction. A second phase will bring it up to 200MW/800MWh.

Scale of China VRFB projects dwarf anything else in the world so far

It was the first project to be approved under a national programme to build large-scale flow battery demonstrations around China back in 2016 as the country’s government launched an energy storage policy strategy. It is thought that various factors including unexpected volatility in the price of vanadium and demand for the metal in other industries like construction had slowed the programme somewhat according to sources Energy-Storage.news had spoken to previously.

Elsewhere, in China’s Hubei Province, another (very) large-scale VRFB is being built in phases that was approved through the same programme. Canada-headquartered VRB Energy is constructing that 100MW/500MWh facility, with a ceremony held to signal the start of construction in August last year for an initial 100MWh phase.

VRB Energy and its local partners had already built a successful 3MW/12MWh demonstration project in Hubei and a VRFB factory with 1,000MWh annual production capacity could be built at the site at a later date too.

The Hubei project’s cost for 500MWh of VRFB, along with a combined 1GW of solar PV and wind generation from which it will charge, was cited as around US$1.44 billion.

The first phase of Rongke Power’s Dalian project meanwhile was given as RMB1.9 billion (US$298 million) in CNESA’s announcement, equivalent to RMB4.75/Wh (US$0.7/Wh).

Although not on the scale individually of either Chinese project, some megawatt-scale flow battery projects have been completed, announced or begun construction in recent months around the world.

In the UK, the world’s largest battery storage system to hybridise lithium-ion and vanadium flow went officially into commercial operation this summer, pairing 50MW/50MWh of lithium with a 2MW/5MWh VRFB system.

The flow battery company behind that project, Invinity Systems, is also supplying Australia’s first grid-scale flow battery storage, a 2MW/8MWh system co-located with a 6MWp solar PV plant in South Australia. Invinity will also supply a 2.8MW/8.4MWh battery storage system at a demonstration project in Alberta, Canada.

At the larger end of the scale, California non-profit energy supplier Central Coast Community Energy (CCCE) picked three VRFB projects as part of a procurement of resources to come online by 2026, ranging from 6MW/18MWh to 16MW/128MWh and totalling 226MWh.

One thing limiting the size and scale of flow batteries today is access to vanadium pentoxide, which is used in their electrolytes. While vanadium itself is abundant in both its raw primary form and as a secondary byproduct of steel production, not many facilities to process it into electrolyte exist.

This has led some flow battery companies like Austria’s CellCube and others to focus on the commercial and industrial (C&I) and microgrid segment of the energy storage market, at least for the time being.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Asia, 11-12 July 2023in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.

Saudi Focus on Minerals Needed in Power Transition, EVs

Originally posted on Asharq Al-Awsat

Riyadh - Fatehalrahman Youssef

Saudi Arabia pushes to intensify mining investments amid focus on minerals with future demand (Asharq Al-Awsat)

Saudi Vice-Minister for Mining Affairs Khalid Al-Mudaifer has predicted a fourfold increase in the demand for minerals used in clean energy technologies and electric vehicles by 2040.

Al-Mudaifer stressed that the Kingdom of Saudi Arabia is focused on benefiting from the knowledge and experience of developed mining regions.

The vice-minister noted that net consumption of minerals like graphite, cobalt, vanadium, and nickel will exceed demand by two-thirds by 2050.

Moreover, current supplies of copper, lithium and platinum are insufficient to meet future needs. Al-Mudaifer projected a 30%- 40% supply gap for those minerals.

He explained that the new mining strategy in the Kingdom launched more than 40 initiatives designed to improve the general climate for mining and attract the investment required for the success of this new industry.

According to Al-Mudaifer, Saudi Arabia is focused on developing sustainable integrated value chains, which are enabled by creating an investment environment based on simple licensing and sustainability processes.

Additionally, Al-Mudaifer mentioned the benefits of devoting financial and human resources to bring about a rapid transformation in the mining sector in Saudi Arabia.

Al-Mudaifer noted that the mining investment system in the Kingdom provides a clear regulatory environment, as well as a transparent digital process for requests for licenses and approvals.

He added that the Kingdom’s efforts to create one of the best mining investment climates in the world has led to a 27% year-on-year growth in Saudi mining revenues in 2021.

“We have made great progress creating one of the most favorable mining investment climates in the world, resulting in a 27% year-on-year growth in mining revenues in 2021, totaling more than $8-billion in foreign direct investment attracted by the Ministry,” Al-Mudaifer told Mining Weekly.

Moreover, a recent survey reveals the enthusiasm expressed by mining industry investors regarding the opportunities in Saudi Arabia, with nearly 80% of those surveyed considering investing in the sector. This relative optimism, Al-Mudaifer said, speaks to the success of the Saudi Arabian mining sector transformation.

Vanadium set for “disruptive” demand growth as battery energy storage boom gains momentum: Vanitec

Originally posted on Vanitec

by Dr Yu Li

According to an independent analysis by market intelligence and advisory firm, Guidehouse Insights, global annual deployments of vanadium redox flow batteries (VRFBs) are expected to reach approximately 32.8 GWh per annum by 2031. This represents a compound annual growth rate (CAGR) of 41% over the forecasted period.

The VRFB deployment forecast by Guidehouse Insights would equate to between 127,500 and 173,800 tons of new vanadium demand per year by 2031, according to Vanitec calculations based off Guidehouse’s projection. That would be more than twice as much vanadium as is currently produced annually today.

In a report on the metals required for clean energy commissioned by Eurometaux – Europe’s metals association – VRFBs were identified as one of the alternative energy storage technologies that may grow in importance and might reach penetration rates of 20% of the market. These findings point towards significant vanadium demand increases equivalent to +110% of current demand, and echo Guidehouse Insights’ demand forecast.

Vanitec, the not-for-profit international global member organisation whose objective it is to promote the use of vanadium-bearing materials, says that while vanadium is mainly used within the steel industry, vanadium is increasingly being recognised for its use in VRFBs. These long duration batteries can store large amounts of electrical energy produced by solar and wind power generators on a daily basis as a means to drive the deep decarbonization of electric power systems.

Vanadium has therefore been classified as a critical raw material by several countries around the world. The European Commission identified and formally registered vanadium on the 2017 list of Critical Raw Materials for the European Union, while the United States, Canada and Australia have also listed vanadium as critical to supporting their economies.

As power grids across the world continue to replace fossil fuel power plants with large scale renewable energy solutions, long-duration energy storage is critical to ensuring reliable grid operation. VRFBs assist by smoothing out peaks and deficits in power demand, thereby maintaining a consistent and uninterrupted flow of electricity to the grid.

Vanitec CEO John Hilbert says renewable energy has become one of the most talked-about topics in recent times. “Solar and wind power are fantastic sources of low-carbon energy. However, renewable energy is a variable power source that poses a key challenge in the global effort to displace fossil fuels with renewable energy generation. Energy storage solutions like VRFBs are essential in enabling the energy transition to a carbon neutral world, as they provide stationary, utility-scale and long-duration energy storage with low maintenance costs, safe operation, and little environmental impact.”

The VRFB market is poised for steeper growth in the coming years, especially as demand for long-duration storage capabilities increases, but also owing to the technology’s durability and safety. Other advantages of VRFBs include:

Application: Stores large amounts of variable renewable energy to be used at other times of the day, when the electricity is demanded.

Durability: Minimal capacity degradation resulting in significantly longer cycle lifetimes than Li-ion battery technology. VRFBs could be fully discharged multiple times each day without impacting the longevity of the system.

Reusability: Liquid electrolytes used in VRFBs can be reused in another battery after the rest of the battery components have worn down. This improves the battery’s economics and sustainability.

Safety: Flow batteries use aqueous electrolytes, which are largely composed of water and inherently non-flammable. VRFBs do not present the same explosion or fire risks that Li-ion systems do.

“VRFBs are also supported by existing industries in their scale up. Many vanadium industry stakeholders see VRFBs as a major source of new demand for the metal that has traditionally been used in steel alloys,” states Mikhail Nikomarov, Chairman of the Vanitec Energy Storage Committee (ESC) and CEO of Bushveld Energy.

VRFBs are a proven and rapidly growing commercial-scale technology that can store energy from renewable sources and provide on-demand, round-the-clock, carbon-free power.

Rising flow battery demand ‘will drive global vanadium production to double by 2031’

Originally posted on Energy Storage News

by Andy Colthorpe

Cell stacks at a large-scale VRFB demonstration plant in Hubei, China. Image: VRB Energy.

The vanadium redox flow battery (VRFB) industry is poised for significant growth in the coming years, equal to nearly 33GWh a year of deployments by 2030, according to new forecasting.

Vanadium industry trade group Vanitec has commissioned Guidehouse Insights to undertake independent analysis of the VRFB energy storage sector. These have been collected in a white paper, “Vanadium redox flow batteries: Identifying opportunities and enablers”.

The research and market intelligence firm found that while lithium-ion dominates global energy storage deployments today by market share, various attributes of VRFBs make them a promising option in tandem with existing chemistries.

Advantages include the long lifespan and durability of VRFBs, their low operating costs, non-flammable design and a low environmental impact, both in manufacturing and in operation. Meanwhile, they can meet the needs of developers that require long-duration energy storage and can be operated with minimal maintenance for a 20-year lifespan, Guidehouse said.

Major R&D efforts have been made into the technology invented at the University of New South Wales in Australia, by both private and public companies and institutions since patents began expiring in the early 2000s.

Guidehouse noted however that despite the progress and attractive features of VRFBs, commercial challenges that have prevented them from take-off persist.

VRFBs have a higher capital cost than lithium-ion battery energy storage system (BESS) technology but can offer a lower cost of ownership and levelised cost of energy storage over their lifetime. Yet this detail is often missed when procurement decisions are made.

There is also what the analysts described as an over-reliance on lithium in the market today, but if VRFB manufacturing and deployment can scale up, continuous growth in the industry could be unlocked.

Forecasted CAGR of VRFB deployments worldwide. Image: Vanitec / Guidehouse Insights.

Forecasting a healthy growth trajectory for VRFBs

The white paper picked up on a couple of major projects that it said was evidence of growing interest in flow batteries internationally.

These were a 800MWh project in China by Rongke Power/UniEnergy that is scheduled to come online this year and a 200MWh project in South Australia which is in development through manufacturer CellCube, while the biggest VRFB installation in the world today is a 15MW/60MWh system brought online in northern Japan by maker Sumitomo Electric a few years ago.

Revenues from VRFB project deployments are expected to be worth about US$850 million this year and projected to rise to US$7.76 billion by 2031.

That means annual global deployments of an estimated 32.8GWh per year by that later year and a compound annual growth rate of 41% in the market over this decade.

In terms of regions, Guidehouse expects Asia-Pacific to lead installation figures, with Western Europe and North America the other top global regions. Asia-Pacific deployments are predicted to reach about 14.5GWh annually, Western Europe about 9.3GWh and North America about 5.8GWh according to the white paper.

Vanadium is currently used in a number of industries, with the biggest share today being as an additive that can greatly strengthen steel alloys used in construction with even just a small amount of vanadium added.

As we noted in an article last year for the journal PV Tech Power, there are however only three primary vanadium producers in the world, with the majority of vanadium coming from secondary sources as a byproduct of steel production.

That said, there are efforts ongoing to create bigger resources of vanadium feedstock, not least of all in Australia where financial support has been extended to companies looking to extract vanadium from the ground and turn it into electrolyte.

Guidehouse Insights forecasts that the growth of VRFBs will be such that by 2031, between 127,500 and 173,800 tonnes of new vanadium demand will be created, equivalent to double the demand for the metal today.

The electrolyte constitutes around 30% to 50% of the total system cost of a VRFB energy storage project, which Guidehouse noted is the highest percentage cost for a key mineral in any type of battery. However, the batteries could be capable of 10,000 to 20,000 cycles during their lifetime without requiring rest periods or experiencing capacity degradation, which raises their operational availability versus an average of around 3,000 cycles for Li-ion batteries.

The paper does acknowledge some of the technology’s downsides, albeit whilst pointing out that the industry is working to address those, such as: lower round-trip efficiency (flow batteries average 70% to 85%, versus 90% to 95% for Li-ion), lower energy density and therefore larger footprint and the most pressing barrier, the need to “substantially reduce costs,” in light of the technology’s vulnerability to spikes in the price of vanadium and high capital cost.

The white paper can be viewed on Vanitec’s website here.

EV industry moving in right direction to close gap with internal combustion engines – report

Electric cars on parade. (Image by Dept of Energy Solar Decathlon, Flickr).

Although there is still a way to go for electric vehicles to close the performance, safety, and cost gap with internal combustion engines, a recent report by IDTechEx says some specific moves by the EV industry are steps in the right direction.

According to the report’s author, Luke Gear, one major positive trend is the increased electrification of a variety of sectors, not just automotive.

“A decade ago, IDTechEx’s 2011 report ‘bullishly’ predicted 1.5 million battery-electric car sales by 2021 – this turned out to be an underestimate by over half, as China, the US, and Europe all grew their markets last year,” Gear points out. “The sheer volumes and successes of electric vehicles in the automotive market are driving down costs, creating opportunities for many other mobility sectors.”

Boats and ships are among those experiencing an electrification boom, with electric ferry deliveries having grown to ~80MWh yearly as battery pack costs fell below $600 per kWh, energy densities improved and thermal management innovations vastly increased safety.

In the author’s view, similar drivers are pushing forward investment into electric air-taxis, as American Airlines, Virgin Atlantic, United Airlines, UPS and Avolon have all placed pre-orders.

“Electrification is not so much unstoppable as inevitable and will continue to play a dominant role in the decarbonization of mobility,” the report reads.

When it comes to batteries, the market analyst forecasts that lithium-based batteries will continue to be the great enabler for electrification, particularly if the industry expands its efforts to increase the sustainability of raw materials and supply chains whilst ensuring there is still enough supply to meet the growing demand.

“Later in the decade, a move beyond li-ion towards the holy grail of solid-state and lithium-metal batteries is critical for a step-change in safety and performance, and to open the door to new applications such as electric long-haul aircraft,” the report states.

Motors and powertrains

For Gear, another move that is expected to gain traction in the coming years is the utilization of magnet-free and even copper-free motor solutions as automakers start adopting several technologies to balance performance, sustainability, market demand, and cost.

The expert explains that due to their high performance and superior efficiency, permanent magnet motors are the default technology for traction applications and their market has naturally grown with the runaway success of electric cars. However, magnets make end-of-life recycling difficult, and raise concerns regarding price volatility and sustainable mining practices, with most material mined and sourced in China.

“Long-term reliance solely on permanent magnet machines is looking increasingly unsustainable, with warning signs starting to show in high neodymium prices – the primary ingredient of rare earth magnets.”

On a similar note, it is likely that more and more automakers will switch to wide bandgap power electronics, especially silicon carbide MOSFET devices.

IDTechEx data predict roughly half the electric car market switching to these efficient devices by 2030, thus enabling efficient high voltage powertrains.

“Early in 2022, Mercedes showcased the Vision EQXX concept capable of 1000km. While there is a lot of technology behind this concept, including solar bodywork, design (drag factor), silicon anode batteries, and axial flux motors, a key enabler is the 900V platform – something only practical with silicon carbide,” the dossier states.

Key safety features

Finally, increased attention to safety features is expected to be key in the years to come, particularly when it comes to the thermal management of electric motors and power electronics.

“Permanent magnet motors require a specific operating temperature to avoid damage. Additionally, allowing the copper coils in a motor to get too hot can lead to reduced efficiency or damage to the winding insulation,” Gear writes.

“The silicon carbide transition in power electronics is also presenting a host of package-level thermal challenges to deal with the increased junction temperatures including wire bonding, die-attach, and substrate technologies.”

In the battery realm, the analyst highlights the fact that battery chemistry is evolving with higher nickel cathodes being adopted, LFP batteries making a resurgence and more attention being paid to solid-state batteries.

“These changes have a profound impact on the requirements around thermal management and materials in EV batteries,” Gear points out. “Outside the cell, we see OEMs transitioning towards cell-to-pack designs with announcements from Tesla, Stellantis, BYD, VW and more. This fundamental change in battery pack structure leads to changes in how thermal strategies and materials are incorporated, including thermal interface materials, coolant channels and fire protection.”

David Rosenberg: Junior mining and exploration boom needed to push EVs over the top

The transition to electric vehicles will require huge investments into mining for the key resources that go into batteries

David Rosenberg

Petro Canada's electric vehicle charging station is shown on display at the Canadian International Auto Show in Toronto. PHOTO BY THE CANADIAN PRESS/CHRISTOPHER KATSAROV FILES

By David Rosenberg and Ellen Cooper

Electric vehicles are quickly becoming mainstream as government subsidies, company investments and consumer demand speed up the transition away from internal combustion engines.

But with the world electrifying, will we have enough natural resources to meet this surging demand? The answer is yes, though investments in extraction and processing will need to be ramped up and there are important environmental, social and corporate governance (ESG) considerations that will need to be addressed to make the shift sustainable.

Given current policy scenarios, the International Energy Agency (IEA) estimates the global stock of EV cars will surge to 125 million in 2030 from around 10 million in 2020. Under a sustainable development scenario (where the world reaches net-zero emissions by 2070), this figure could be more than 200 million units. This is still nowhere close to replacing the 1.3 billion vehicles on the road currently, but the future of transportation may involve more public transit and far fewer individual cars than what we see these days. Internal combustion engine (ICE) vehicles will be with us for several decades more, likely not phased out until mid-century.

The transition to EVs will require huge investments into mining for the key resources that go into batteries, namely lithium, cobalt, manganese, copper and nickel. Indeed, the IEA estimates a six-fold increase in minerals will be required by 2040 to meet net-zero targets under the Paris Agreement. This includes a 40x increase in demand for lithium, a 20-25x increase for cobalt and nickel, and a doubling in copper demand.

Whether the world has enough reserves to meet this demand is a bit of a misleading question. Reserves go up as exploration expands, prices go up (making more difficult reserves economical to exploit), technologies improve and regulations change. These kinds of “peak EV resource” predictions are reminiscent of the calls throughout the past half-century for “peak oil.” Remember, new technologies (for example, fracking in the United States and horizontal drilling techniques) unlocked reserves that were previously not economical. Nowadays, when we discuss “peak oil,” the fear isn’t that we run out of reserves, but that some reserves will become stranded assets as we transition to the electric economy.

That said, there is a simmering concern that mining companies have not made the required investments to address growing demand needs. The global mining industry will need to more than double its annual capex expenditures — from around US$80 billion annually to US$180 billion — to meet the net-zero target by 2050, according to Bank of America Global Research. And there continues to be a heavy reliance on countries such as China (rare earths) and the Democratic Republic of Congo (cobalt) where environmental and governance standards are lax. ESG concerns such as child labor, using coal to power mining activities and poor reporting standards in many key mining jurisdictions will need to be addressed and threaten production.

If the U.S. and other western countries hope to secure supplies of many of the key commodities required for the energy transition ahead, they will need to rely on friendlier partners such as Australia, Chile, India and Brazil that have significant reserves of rare earths, lithium and cobalt. This is yet another argument for closer ties with India. The country is home to six per cent of global rare earth deposits, but its production is an underwhelming 1.4 per cent, meaning there are opportunities to engage in resource diplomacy with the country in an effort to counter China and Russia’s commodity dominance.

Strengthening supply is critical. We have all become abundantly aware of how disruptive supply chains can become when they experience major shocks.

Given the concern around supply chains, some of this development will be done closer to home. The U.S., for example, released its National Blueprint for Lithium Batteries in June, which included five goals for the domestic lithium-ion battery supply chain, and the No. 1 goal was securing access to raw materials domestically (where possible). Part of that also means investing in research and development to find ways to decrease demand for cobalt and nickel. Innovations in EV battery technology to remove cobalt are underway, which could shift the composition of resource demand over time. Other key goals are to support U.S.-based materials processing, develop a manufacturing sector able to produce electrodes and cells, and, finally, enable mass recycling of EV battery cells (the European Union has already put in place recycling standards in this regard).

Ultimately, as governments globally invest in better charging infrastructure and the world reaches a critical mass of adoption, ICE-age vehicles will be phased out at an increasing rate, meaning mining will have to keep up to match demand. This means a junior mining and exploration boom is coming, with bullish implications for mining and infrastructure stocks and supercycle EV commodities such as lithium, manganese, cobalt and nickel.

David Rosenberg is founder of independent research firm Rosenberg Research & Associates Inc. Ellen Cooper is a senior economist there. You can sign up for a free, one-month trial on Rosenberg’s website .

The raw-materials challenge: How the metals and mining sector will be at the core of enabling the energy transition

As the world gears up for net zero, demand for raw materials is set to soar. The energy transition presents unique challenges for metals and mining companies, which will need to innovate and rebuild their growth agenda.

The transition to a net-zero economy will be metal-intensive. As the move toward cleaner technologies progresses, the metals and mining sector will be put to the test: it will need to provide the vast quantities of raw materials required for the energy transition. Because metals and mining is a long lead-time, highly capital-intensive sector, price fly-ups and bottlenecks will be unavoidable as demand outstrips supply and price volatility creates uncertainty around the large up-front capital investments needed for production. Supply, demand, and pricing interplays will emerge across different commodities, leading to feedback loops followed by a combination of technology shifts, demand destruction, and materials substitution. Metals and mining companies will be expected to grow faster—and more cleanly—than ever before. At the same time, end-user sectors will need to factor potential resource constraints into technology development and growth plans.

-

This article is a collaborative effort by Marcelo Azevedo, Magdalena Baczynska, Patricia Bingoto, Greg Callaway, Ken Hoffman, and Oliver Ramsbottom, representing views from McKinsey’s Metals & Mining Practice.

By the end of the November 2021 United Nations Climate Change Conference (COP26), it became clear that momentum had shifted. Climate commitments made in Glasgow have entrenched the net-zero target of reducing global carbon emissions (aimed at preventing the planet from warming by more than 1.5°C) as a core principle for business. At the same time, another reality became apparent: net-zero commitments are outpacing the formation of supply chains, market mechanisms, financing models, and other solutions and structures needed to smooth the world’s decarbonization pathway. Even as debate continues over whether the conference achieved enough, it is evident that the coming decade will be decisive for decarbonizing the economy. While every sector in the global economy faces common pressures—such as stakeholder and investor demands to decarbonize their own operations—metals and mining companies have been presented with a special challenge of their own: supplying the critical inputs needed to drive the massive technological transition ahead.

Raw materials will be at the center of decarbonization efforts and electrification of the economy as we move from fossil fuels to wind and solar power generation, battery- and fuel-cell-based electric vehicles (EVs), and hydrogen production. Just as there are several possible trajectories through which the global economy can achieve its target of limiting warming to 1.5°C, there are corresponding technology mixes involving different raw-materials combinations that bring their own respective implications. No matter which decarbonization pathway we follow, there will be fundamental demand shifts—and these will change the metals and mining sector as we know it, creating new sources of value while shrinking others.

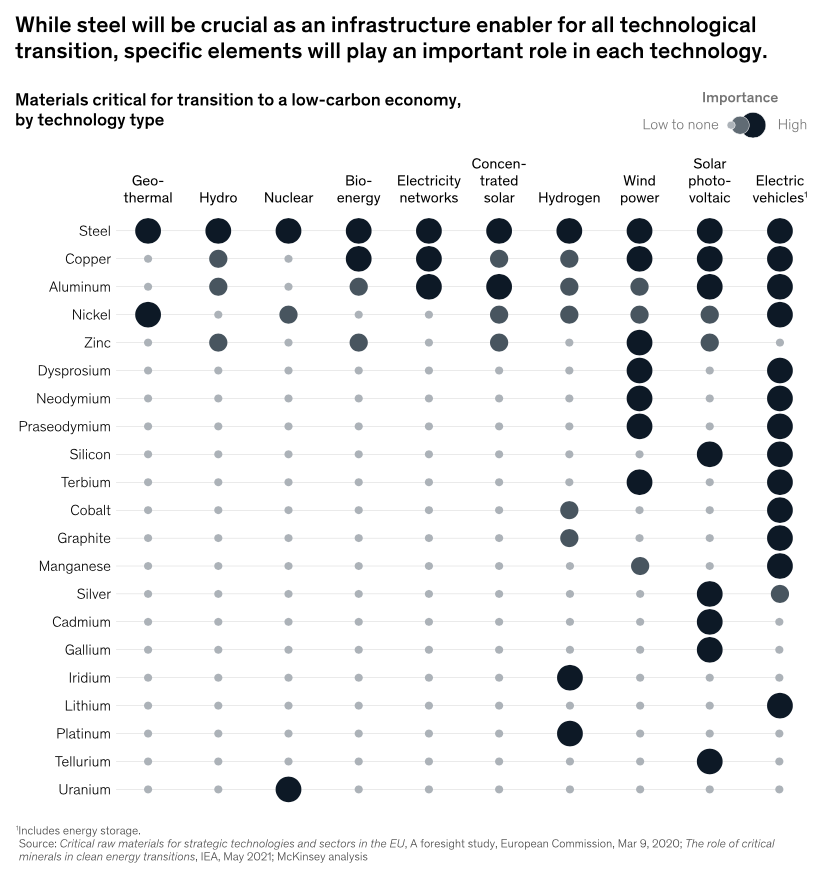

Requirements for additional supply will come not only from relatively large-volume raw materials—for example, copper for electrification and nickel for battery EVs, which are expected to see significant demand growth beyond their current applications—but also from relatively niche commodities, such as lithium and cobalt for batteries, tellurium for solar panels, and neodymium for the permanent magnets used both in wind power generation and EVs (Exhibit 1). Some commodities—most notably, steel—will also play an enabling role across technologies requiring additional infrastructure.

Exhibit 1

-

Rare-earth metals’ existing global reserves (in aggregate across different metals) are believed to be 120 million metric tons of rare-earth-oxide (REO) equivalent, representing 500 years equivalent of the global estimated production of 240,000 metric tons in 2020.1 However, when looking closer, a number of factors stand out. First, these elements occur in relatively low concentrations; therefore, identifying and bringing assets to production would likely come with higher investment needs and lead times. Second, specific elements (for example, neodymium), which are critical for the transition, occur at very different proportions within those deposits. This makes the availability and economics of specific metals much more nuanced than a superficial analysis can reveal. Third, there is a significant geographical concentration of known reserves: 40 percent of REO-equivalent reserves are estimated to be in China. Therefore, additional geological exploration would be needed to identify other economically viable deposits in specific geographies. Finally, in addition to the availability of raw materials, processing and separation of the specific elements is crucial. To date, most of the processing and separation capacity, as well as the technical capabilities, are also concentrated in China. Energy transition will therefore require a regional redistribution of processing capacity and reorganization of supply chains.

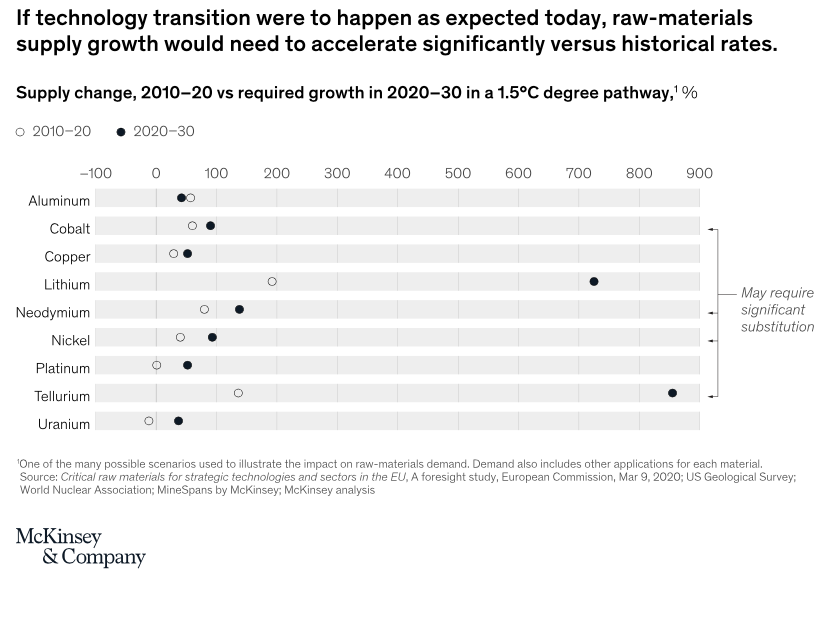

The required pace of transition means that the availability of certain raw materials will need to be scaled up within a relatively short time scale—and, in certain cases, at volumes ten times or more than the current market size—to prevent shortages and keep new-technology costs competitive (see sidebar “Rare-earth metals”).

Economic growth, technology development, and material intensity as drivers of demand growth

-

Tellurium, a relatively niche metal used in certain types of solar panels, has a global mine production of approximately 500 metric tons.1 A tellurium-only mine does not exist, as it is exclusively produced in small quantities as a by-product of the smelting and refining of other metals (more than 90 percent of tellurium is produced from anode slimes collected from electrolytic copper refining2 ). As such, while demand growth driven by solar capacity may be prodigious, growth in supply is expected to be capped at the growth rates of metals such as copper. Even though copper demand is also expected to experience significant growth due to the energy transition, its mine supply is unlikely to expand at the rates that solar-panel production needs in a net-zero-transition scenario.

Road-transport and power-generation are examples of sectors that are relatively advanced with respect to their technological readiness to reduce greenhouse-gas (GHG) emissions. But building a low-carbon economy and reducing the emissions intensity within these sectors will be materials-intensive (Exhibit 2). For example, generating one terawatt-hour1 of electricity from solar and wind could consume, respectively, 300 percent and 200 percent more metals2 than generating the same number of terawatt-hours from a gas-fired power plant, on a copper-equivalent basis,3 while still drastically reducing the emissions intensity of the sector—even when accounting for the emissions related to the materials production.4 (See sidebar “Mine supply and solar-panel production” for more on how supply of an essential raw material is currently limited.) Similarly, producing battery or fuel-cell EVs will be more materials-intensive than building an internal combustion engine (ICE) vehicle.

Exhibit 2

When building new power-generation capacity or producing new vehicles, factors other than material intensity also influence each technology’s carbon footprint.5 First, there are the emissions derived from use of the technology throughout its life cycle (such as the burning of fossil fuels in power generation, or the use of electricity in running a battery EV). Second, the emission intensity of each technology will depend, to a certain extent, on the choice of material (for example, steel versus aluminum in the case of vehicles). Third, even when using the same material, choice of supplier can make a significant difference, since the carbon footprint of the same commodity can vary greatly depending on its origin. Finally, each sector will have its own specificities. In the case of power generation, renewable capacity has lower capacity factors than fossil-fuel-based capacity. As such, more generation capacity and, hence, more metals are needed to generate the same amount of electricity. In the case of road transport, the average mileage of different powertrains could also play a role (for example, if battery EVs and fuel-cell EVs were to be driven for longer distances over their lifetimes compared with ICEs).

How quickly can supply react?

Looking ahead, under a scenario in which materials are required at steadily growing levels to meet evolving needs but markets fail to adapt to varying technology mixes6 and materials intensities over time, hypothetical shortages of raw materials would emerge—as demand is expected to grow significantly faster than supply. Under the scenario presented in Exhibit 3, lithium mine supply, for example, would need to grow by around a factor of seven versus today’s required growth. Meanwhile, metals with smaller mine supply (such as tellurium) would need to show even faster growth—as such, these are the main candidates for required substitution and technological innovation. Other metals, such as copper and nickel, would also need to see accelerated supply growth compared with what has been observed in the past. While the required growth in such metals may seem less ambitious, this should be considered relative to the significantly larger-scale industries surrounding them, as well as the significant capital required, increasingly challenging geological conditions (such as smaller deposits and lower grades), long lead times, and growing processing complexity involved. For copper and nickel alone, we estimate that meeting demand growth of the order of magnitude shown in Exhibit 3 would require $250 billion to $350 billion cumulative capital expenditures by 2030, both to grow and replace depletion of existing capacity. Despite a relatively large pipeline of projects to scale up supply in some of these commodities, and efforts to reduce the capital and operating costs associated with a number of them (such as direct lithium extraction), the task at hand is not trivial. In fact, in the scenario presented in Exhibit 3, we could see copper and nickel demand exceeding supply by five to eight million and 700,000 to one million metric tons, respectively. As such, incentives for new supply growth will be necessary.

Exhibit 3

Price incentives

-

Nickel, which is used in battery production, is widely available in the earth’s crust. However, it is subject to a number of commodity-specific factors. First, while battery-suitable nickel (that is, class 1 nickel) can be produced from the various deposit types (sulfides, laterites), relatively long lead times of ten years or more from discovery to feasibility, construction, and ramp-up, along with the high capital intensity of greenfield assets, could lead to short-term deficits. Second, nickel is a relatively established market, but it is primarily used in stainless-steel production (around two-thirds of the global nickel supply was used in stainless-steel production in 2020). The fast growth in nickel demand from batteries, therefore, may potentially lead to a fly-up in prices and require large-scale substitution and technological innovation to rebalance the market—either in batteries themselves, forcing a move to different battery chemistries, or in established markets such as stainless steel, driving a shift in stainless-steel-series production, or both—unless capacity starts to rise quickly, combined with conversion of lower-grade class 2 nickel into class 1 nickel.

Thus, while there may not necessarily be physical resource scarcity for some of these raw materials in the earth’s crust, and acknowledging that recycled materials will play an increasingly important role in decarbonization in the future, the trajectory toward materials availability will not be a linear one. We expect materials shortages, price fly-ups, and, given the inability of supply to react quickly, the need for technological innovation and substitution of certain metals (possibly at the expense of performance and cost of the end-use application). While raw-materials needs will grow exponentially for certain metals, lead times for large-scale new greenfield assets are long (seven to ten years) and will require significant capital investment before actual demand and price incentives are seen. At the same time, with increasingly complex (and largely lower-quality) deposits needed, miners will require significant incentive (for example, consistent copper prices of more than $8,000 to $10,000 per metric ton and nickel prices of more than $18,000 per metric ton) before large capital decisions are made (see sidebar “Nickel and battery production”). Without slack in the system (such as strategic stockpiles and overcapacity), the industry will not be able to absorb short-term (less than five to seven years) exponential growth. As seen, for example, with past reduction of cobalt intensity in batteries, a combination of technological development on the supply side and large-scale substitution and technological development on the demand side will occur. Substitution in noncritical applications will take place and new extraction and processing technologies will emerge. An individual sector’s ability to rapidly ramp up supply, as well as other factors such as continued technological development and performance, available material alternatives and carbon-footprint implications for end-use applications, to name a few, could all impact the extent of substitution for individual commodities. Hence, we see commodities such as tellurium, with its small volumes and by-product nature, likely requiring substitution, while lithium, despite the fast expected growth, perhaps not as much, given the relatively large pipeline of projects and continued development of new production technologies.

How market balance is achieved

Despite the potential for shortages, as discussed above, supply will always equal demand. As sectors and countries decarbonize, each individual commodity market will face specific supply-and-demand balances. The resulting picture will not mirror any specific forecasted commodity demand, including the scenario outlined in Exhibit 3, but what we will see is a constant feedback loop between supply, demand, and prices. We believe that commodities facing an upside in demand from the energy transition will follow one of three trajectories, as demand accelerates (Exhibit 4):

Supply responds to prices. As demand accelerates and prices react, the industry is able to bring in new supply (for example, lithium) relatively quickly. In such cases, the technological transition follows the “expected” growth, where the commodity does not become a structural bottleneck, even if there is short-term volatility.

Demand accelerates, prices react strongly, and materials substitution kicks in. The industry is unable to bring in new supply fast enough and technological innovation leads to materials substitution within that application (for instance, cobalt after a price spike). In such cases, performance of the technology deployed may be compromised, with implications for overall needs, for example, lithium iron phosphate (LFP) batteries being less energy dense than NMC7 batteries.

Demand accelerates, prices react strongly, and technology substitution kicks in. In this case, rather than materials substitution within the application, the end-user sector is forced to shift its technology mix. In such a scenario, a different bottleneck may emerge. For example, non-tellurium-based solar panels may have lower performance, which may lead to a shift toward more wind-generated power, adding pressure on neodymium.

Exhibit 4

We have observed the second trajectory within the battery sector, where there are three very distinct phases in the feedback loop. Initially, batteries with a relatively high cobalt content were common. As adoption began to accelerate, and cobalt prices reached $100,000 per metric ton in 2018, batteries with cathodes containing more nickel started gaining share. This substitution was in the end seen as a win–win result for the industry, leading to lower battery costs and higher energy density.