Tesla Battery Metals Bill Balloons to $100 Billion

Originally posted on Mining.com

Elon Musk congratulates Tesla’s Shanghai gigafactory workers after producing one million vehicles. Image: Tesla via Twitter

Elon Musk had plenty of advice for the mining and metals industry at the company’s Battery Day event in September 2020, where the road map to a $25,000 Tesla was laid out.

A couple of days after the event Musk confirmed in a tweet that Tesla will reach production of 20 million vehicles per year “probably before 2030.”

Tesla has been ramping up output at an impressive pace despite lockdowns and power problems in China and a late start in Germany, but the scale of the task is put into perspective by Musk’s proud announcement earlier this month that the Texas-based company has now reached the 3 million vehicle-mark – since its first production model launched in 2008. Tesla is expected to deliver 1.4–1.5 million vehicles in 2022.

Not only did Tesla stop working on a cheap and cheerful Model 2, crucial to achieving those lofty goals, now new data compiled by MINING.COM show the run up in metal prices would make a mass market Tesla at that price point almost impossible to build and the bill of materials for 20 million vehicles a year hard to swallow even for a company that is showered with cheap capital.

Combining data from Benchmark Mineral Intelligence, a London-headquartered price reporting agency, and battery supply chain consulting firm, Toronto-based Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 100 countries, shows just how much has changed since that September 2020 tweet.

Extrapolating the current numbers for Tesla’s sales-weighted end-use of metals from the Adamas database and accounting for trends in the carmaker’s battery deployment, including greater use of lithium iron phosphate batteries and future model releases, Adamas calculated the raw materials needed to produce 20m cars and trucks (fingers crossed for the cybertruck before 2030 everyone!) per year.

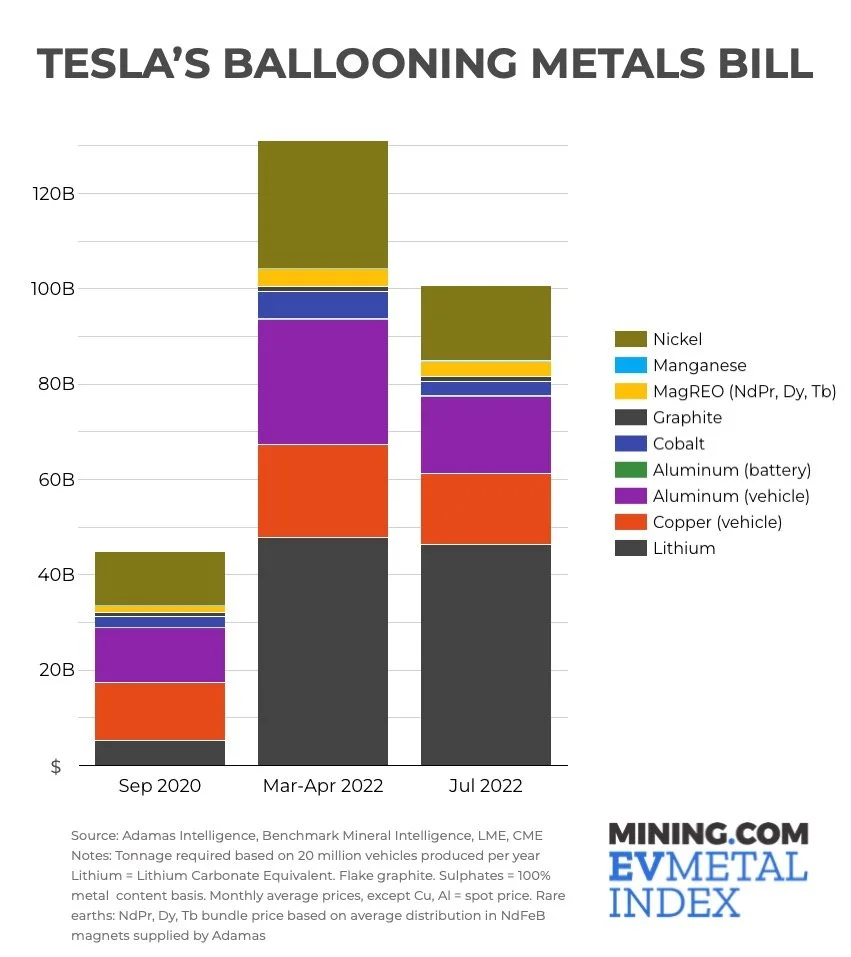

At today’s price Tesla is on the hook for a bit over $100 billion for the 11.1 million tonnes of raw materials it needs to build 20m cars.*

That’s up from $44.8 billion for the metals entering the battery and electric motor supply chain at the time the production goal was announced.

The jump is mostly on the back of an astonishing 8-fold rise in the price of lithium over the period, which in July averaged more than $60,000 per tonne. In July, lithium made up 46% of the total cost while in September 2020 it was only 11.6%. The persistent high price of lithium is also playing havoc with the economics of LFP batteries – which most EV-makers want for entry-level runabouts.

Nickel made up 25% of the overall bill of materials two years ago, now that portion is 15.7% despite a 40% increase in the price of the metal since then.

In March-April when battery metals were hitting multi-year and all-time highs that total was $131 billion.

Bar lithium, prices have pulled back sharply since March (cobalt is down from a peak of $92,000 to under $50,000) but through to the end of the decade most, if not all these commodities will likely become more expensive as supply struggles to keep up with demand.

As automakers (and the renewable energy sector) scramble for lithium, nickel, cobalt, graphite, rare earths, aluminium, manganese and copper securing supply may ultimately be a bigger issue than costs.

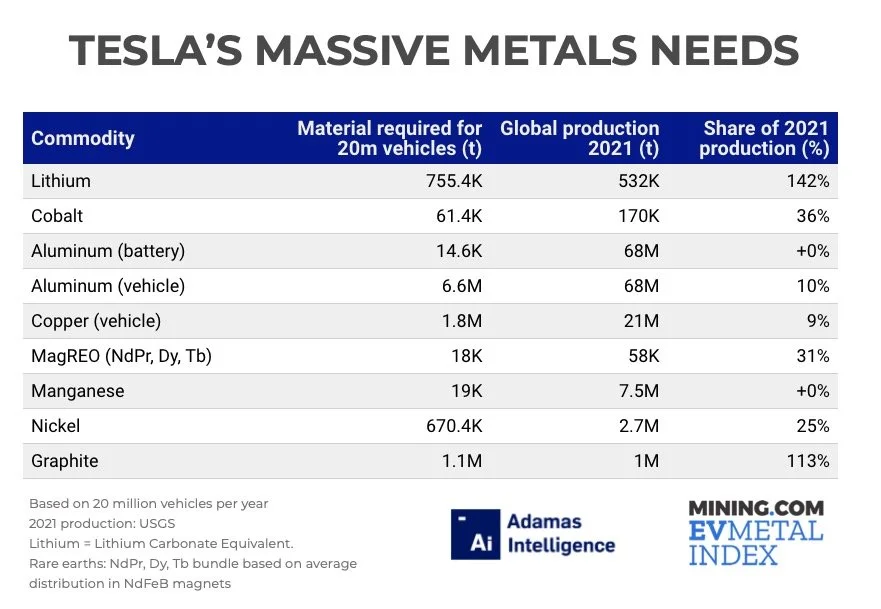

To produce 20m vehicles Tesla alone needs more than the total volume of lithium and natural graphite produced last year, almost a third of the magnet rare earths, 36% of the cobalt, and so on.

No single enterprise consumes 1.8m tonnes of copper per year, not even China’s state grid, and laying your hands on a quarter of the world’s nickel may prove impossible, no matter how many times you meet with the Indonesian president.

$100 billion is a nice round number for mining companies hoping to supply the raw materials for the world’s number one electric carmaker.

So is $1 trillion when every automaker is an electric one.

*To better reflect the market opportunity for the mining industry, the chart represents upstream prices where relevant. For instance, synthetic graphite costs much more than mined flake and downstream value added products like CSPG (coated spherical purified graphite) used in battery manufacture are many times more expensive still.

Also keep in mind the kilograms that end up in every newly sold Tesla are fractions of what would have been procured upstream — a factor that is sometimes omitted from estimates of metal requirements is low yields in the conversion and manufacturing process, with a not insignificant portion ending up on battery factory floors as so-called black mass.