Headlines

Eager to cut China dependence, EU eyes processing 40 per cent of its strategic raw materials by 2030

Originally posted on scmp.com

The European Union wants to process 40 per cent of the strategic raw materials it uses by 2030, as it looks to slash its dependence on China for the minerals that will power industries of the future.

It also aims to ensure it will not rely on third countries for more than 70 per cent of any of 30 critical minerals, according to a leaked proposal to be unveiled next Tuesday and seen by the South China Morning Post.

The moves come amid a surge in anxiety about Europe’s dependence on China and other autocratic states for inputs that are essential to achieving its environmental and technological transition goals.

The lists of minerals include cobalt and lithium used in advanced batteries, scandium and vanadium used in aerospace equipment and weaponry, and gallium and germanium that are used to make semiconductors.

Also on the lists are the light and heavy rare earth elements that are dominated by China, which either mines or processes the vast majority of the global supply.

Of the rare earth minerals used in Europe, 98 per cent come from China, according to Brussels’ own statistics. These are essential to ramping up solar and wind power facilities and charging up electric vehicles and other smart devices that the EU sees as critical to its industrial development.

As well as having abundant domestic supplies for some materials, Beijing has become a dominant exporter of processed minerals, hoovering up mines that churn out critical metals like lithium and cobalt across Africa, Australia and Latin America.

The coronavirus pandemic and Russia’s invasion of Ukraine have stoked suspicion across the West that such dependencies can be weaponised.

In Brussels and beyond, the debate has turned to how Europe can rival China for such concessions.

This has given fresh impetus to free-trade deals with resource-rich countries such as Australia, Chile and Thailand, and to discussions about “strategic partnerships” with countries like South Africa and the Democratic Republic of Congo, home to some of the largest mineral reserves on earth.

“For some raw materials, the [EU] is almost fully dependent on a single foreign supplier,” according to a draft of the Critical Raw Materials Act.

“Such dependencies can create a high risk of supply disruption, as was the case when the Chinese supply of magnesium was cut off in 2021, which at that moment represented around 95 per cent of the union’s supply of magnesium,” it continued, referring to a metal commonly used in the automotive supply chain.

Despite consuming 30 per cent of all metals and minerals mined globally, the EU produces just 3 per cent itself.

By cutting red tape, speeding up licensing and extending funds, it hopes that by 2030 it can mine 10 per cent of its own supplies within its own borders. A further 40 per cent would come from ores and minerals sourced around the world but processed in Europe, while an extra 15 per cent would come from recycled metals.

It will establish a central purchasing agency that would gauge needs among its member states and industries, before buying in bulk and distributing accordingly. The EU also aims to stockpile critical materials in case of future emergencies.

The bloc also hopes to combine resources with allies.

European Commission President Ursula von der Leyen is expected to strike a limited trade deal with US President Joe Biden in Washington on Friday that would give EU firms access to Biden’s flagship green bonanza, the Inflation Reduction Act (IRA).

She is also hoping to advance “a critical raw materials club” that would entail transatlantic cooperation to help shore up supplies.

“We see today that, for example, China produces 98 per cent of Europe’s supplies of rare earths. And Europe needs to de-risk this dependency. This is of course immediately the reason why Europe seeks to work together with trusted partners,” von der Leyen said on a visit to Ottawa this week.

She noted that Canada was the only northern hemisphere country “with all the raw materials needed to produce lithium-ion batteries”.

Noah Barkin, managing editor at think tank Rhodium Group’s China practice, said the EU-US deal would “kill two birds with one stone”.

“It alleviates EU concerns about the IRA by broadening the definition of local content and it sends a broader signal about transatlantic cooperation on green technology supply chains,” Barkin said.

“It is not a miracle solution for addressing deep dependencies on China for critical raw materials. But if this agreement can be extended to other like-minded countries, it maps out a path for collective action in reducing those dependencies over time,” he added.

However, it could be years before the EU’s act becomes law.

After the commission makes its proposal next week, the European Council and Parliament will come up with their own versions, after which they will try to land on a negotiated text that could take years to reach.

It should, in theory, be well received in both chambers. Governments and lawmakers in recent months have been publicly fretting about how to wean Europe off Chinese resources and technology.

Meanwhile, Chinese tech companies have suffered a spate of setbacks over the past fortnight.

Short video app TikTok was banned from use on work devices at the EU institutions in February. On Wednesday, it was labelled a “security threat” in the Czech Republic.

“The amount of data being collected and handled, combined with the legal environment in China and the growing number of users in the Czech Republic, leaves us with no choice but to label TikTok a security threat,” said Lukáš Kintr, director of the country’s cybersecurity office.

In Germany, media reports said the government was on the verge of banning Huawei Technologies and ZTE equipment from certain parts of the country’s 5G network.

The Dutch government announced this week it would block shipments of equipment used for making microchips to China, freezing Beijing out of some of the high-end photolithography machines made by market leader ASML.

The need to rival Beijing for securing resources has also led officials to adopt more muscular language when discussing the EU’s much-maligned infrastructure drive, Global Gateway.

“It’s geopolitics on steroids, with a vengeance,” said a senior EU official briefing journalists following the announcement of 87 initial projects in Brussels this week.

Brussels had been approached by governments in countries for which Chinese companies had built roads and highways that were “swept away by the rain”, the official said, describing a gap in the market that the EU hoped to fill.

“Chinese companies build ‘fast and solid’, but that is not sustainable in the medium and long term and it puts in danger the financial sustainability of countries that now come to us,” the official added.

Battery metal frenzy outshines recovery fears at PDAC

Originally posted on Mining.com

Tepid global demand for metals driven by recession fears and China’s weak economic recovery have done little to shake the belief among miners that battery materials are heading for an epic bull run.

That was the sentiment of thousands of executives, investors, government officials and bankers who crammed into a conference center in Toronto for the past four days to showcase their assets, network and strike deals. For the event organizer, the Prospectors & Developers Association of Canada gathering highlighted the industry’s push to be part of the solution in the worldwide transition to cleaner energy.

“The theme is truly getting the general public to understand their vision of the future — which is zero emissions — and the true importance of the mining industry to help us achieve that,” PDAC President Alex Christopher said in a Wednesday interview. Copper — the wiring metal that’s key to the energy transition — was top of mind for base metals producers at the gathering, though “lithium” was the most-searched word on the organizer’s website, he said.

The rush for battery metals has prompted a flurry of activity from investors not typically associated with the mining industry, including automakers and pension funds — a theme that came up during panel discussions. Governments in North America and Europe have also started making moves to encourage domestic metals production to counter China’s dominance.

Read More: Argentina’s copper rush lures top power generator Central Puerto

One small firm, Giga Metals Corp., drew lots of people to its booth to learn about its joint venture with Mitsubishi Corp. to advance a nickel project in the western Canadian province of British Columbia, according to development manager Lyle Trytten. The Vancouver-based firm even received a pitch from an artificial intelligence provider.

“We always need to welcome those new ways of thinking about things in what is sometimes seen as a legacy business,” Trytten said in an interview.

Lancaster Lithium Inc.’s Chief Executive Officer Penny White came to the event mainly to speak with the financial community about the West Vancouver-based firm’s lithium brine property in New Mexico before going public via a reverse takeover. While she met brokers, financiers and investors, she also had approaches from suppliers of direct lithium extraction technology and a group offering lithium assets — prompting her to bid on one project.

“It’s been very successful,” she said in an interview. “I’ve been targeted by a lot of people who are particularly interested in this specific industry.”

Read More: Mining dealmakers set for year of hot M&A after monster gold bid

The event drew 23,819 attendees this year, more than a third higher than last year’s abbreviated June event when PDAC returned to in-person programming after a pandemic pause.

“We’ve seen a really good crowd this year, with lots of positive engagement,” said Christopher, who ends his two-year term as PDAC president when the conference closes. He’ll be succeeded by longtime mining analyst Raymond Goldie.

(By Jacob Lorinc and James Attwood)

Flake graphite market moves into deficit: Evolution Energy

Originally posted on Marketindex.com

Driven by demand for batteries and electric vehicles, the market for flake graphite has shifted into a deficit, according to Evolution Energy Minerals (ASX: EV1).

The deficit has pushed fine flake prices up 56% to approximately US$825 a tonne between late 2021 to June 2022. The price rise stalled in July and August as China, the world's largest supplier of graphite, entered into its peak mining season.

Source: Evolution Energy Minerals

"Mine supply in China will reduce substantially during the Chinese winter from November to February and as a result, the outlook for graphite prices across all flake sizes remains favourable," Evolution said in a statement.

Separately, Benchmark Minerals Intelligence estimates that approximately 97 new natural graphite mines and 54 synthetic graphite plants need to come online by 2035 to "keep up with the exceptional volumes of demand" for electric vehicles and renewable technologies.

Source: Benchmark Minerals Intelligence

"It is within this market context that the Company is seeking to develop Chilalo [Graphite Project]."

Introducing the Chilalo Graphite Project

Chilalo is a well-advanced graphite project in Tanzania with upcoming catalysts including:

A final investment decision for Chilalo is expected to take place in the March quarter, 2023.

The outdated 2020 DFS expected the project to produce 50,000 tonnes per annum of graphite concentrate, with a mine life of 18 years and net present value of US$323m.

Running up the value chain

Recent testwork and qualifications have confirmed the suitability of Chilalo's graphite for applications including graphite foil, hydrogen fuel cells and battery anode materials.

“Not all graphite is created equal and determining suitability for use in high-value applications is a matter of testwork and qualification," said Evolution Energy's Managing Director, Phil Hoskins.

"Whilst the supply of flake graphite concentrate produces solid margins, the real opportunity lies in leveraging our high-quality graphite with proven technology to produce value-added products," he added.

Evolution said it plans to advance both the development of the Chilalo Project and value-accretive downstream business strategies.

The company has commenced a review of potential downstream locations and currently mining a 500-tonne bulk sample of Chilalo ore for product qualification initiatives for both lithium-ion and alkaline battery manufacturers.

Separately, Evolution is well-advanced in its discussions with its cornerstone offtake partner, Yichang Xicheng Graphite Co about a joint venture to manufacture downstream graphite products.

DISCLAIMER: Market Index helps small-cap ASX listed companies connect with Australian investors through clear and concise articles on key developments. Evolution Energy Minerals was a client at the time of publishing. All coverage contains factual information only and should not be interpreted as an opinion or financial advice. A staff member at Market Index indirectly holds shares in Evolution Energy Minerals.

The Key Minerals in an EV Battery

Originally posted on Elements.visualcapitalist.com

Breaking Down the Key Minerals in an EV Battery

Inside practically every electric vehicle (EV) is a lithium-ion battery that depends on several key minerals that help power it.

Some minerals make up intricate parts within the cell to ensure the flow of electrical current. Others protect it from accidental damage on the outside.

This infographic uses data from the European Federation for Transport and Environment to break down the key minerals in an EV battery. The mineral content is based on the ‘average 2020 battery’, which refers to the weighted average of battery chemistries on the market in 2020.

The Battery Minerals Mix

The cells in the average battery with a 60 kilowatt-hour (kWh) capacity—the same size that’s used in a Chevy Bolt—contained roughly 185 kilograms of minerals. This figure excludes materials in the electrolyte, binder, separator, and battery pack casing.

The cathode contains the widest variety of minerals and is arguably the most important and expensive component of the battery. The composition of the cathode is a major determinant in the performance of the battery, with each mineral offering a unique benefit.

For example, NMC batteries, which accounted for 72% of batteries used in EVs in 2020 (excluding China), have a cathode composed of nickel, manganese, and cobalt along with lithium. The higher nickel content in these batteries tends to increase their energy density or the amount of energy stored per unit of volume, increasing the driving range of the EV. Cobalt and manganese often act as stabilizers in NMC batteries, improving their safety.

Altogether, materials in the cathode account for 31.3% of the mineral weight in the average battery produced in 2020. This figure doesn’t include aluminum, which is used in nickel-cobalt-aluminum (NCA) cathode chemistries, but is also used elsewhere in the battery for casing and current collectors.

Meanwhile, graphite has been the go-to material for anodes due to its relatively low cost, abundance, and long cycle life. Since the entire anode is made up of graphite, it’s the single-largest mineral component of the battery. Other materials include steel in the casing that protects the cell from external damage, along with copper, used as the current collector for the anode.

Minerals Bonded by Chemistry

There are several types of lithium-ion batteries with different compositions of cathode minerals. Their names typically allude to their mineral breakdown.

For example:

NMC811 batteries cathode composition:

80% nickel

10% manganese

10% cobaltNMC523 batteries cathode composition:

50% nickel

20% manganese

30% cobalt

Here’s how the mineral contents differ for various battery chemistries with a 60kWh capacity:

With consumers looking for higher-range EVs that do not need frequent recharging, nickel-rich cathodes have become commonplace. In fact, nickel-based chemistries accounted for 80% of the battery capacity deployed in new plug-in EVs in 2021.

Lithium iron phosphate (LFP) batteries do not use any nickel and typically offer lower energy densities at better value. Unlike nickel-based batteries that use lithium hydroxide compounds in the cathode, LFP batteries use lithium carbonate, which is a cheaper alternative. Tesla recently joined several Chinese automakers in using LFP cathodes for standard-range cars, driving the price of lithium carbonate to record highs.

The EV battery market is still in its early hours, with plenty of growth on the horizon. Battery chemistries are constantly evolving, and as automakers come up with new models with different characteristics, it’ll be interesting to see which new cathodes come around the block.

JV Article: Engaging frontline workers to achieve sustainability culture in mining

Originally posted on Mining.com

During the decade Alp Bora spent as a mechanical engineer in mining, he saw the industry’s reputation suffer in the court of public opinion due to multiple incidents of environmental disasters, corporate malfeasance, and on-site accidents.

Bora became concerned about the industry’s future as he observed the disconnect between public perception and mining’s vital role in sustainable technologies.

With the mission to help transform the mining industry for a more sustainable tomorrow, he launched his own consulting business in 2021 — Bora Consulting Inc. — specializing in operational excellence. He advises the management of mining companies on how to streamline and optimize production.

Bora’s aim is to help companies achieve greater sustainability in mining through training and coaching that engages one of its most valued assets — the frontline workforce.

After a speaking tour of several university campuses and delivering a Ted Talk last year on Why We Need Mining to Save the Environment, this month, Bora published his first book, Mining is the Future.

The book explores what Bora calls the AIM Framework: a three-step process to achieve sustainability in mining.

The book discusses the importance of meeting the increasing demand for critical minerals while protecting the environment. As the industry transitions to sustainable mining practices, it must simultaneously redouble efforts to improve the negative public perception of mining.

Without the support of a committed and well-informed public, fundamental change in mining is not possible, Bora notes.

“The book is fighting against this terrible reputation we have,” Bora says. “Historically mining has been one of the most dangerous industries out there.”

The book talks about “sustainability culture” in mining, a new way of thinking that must extend from miners and producers to manufacturers and consumers.

“The reason I use the word ‘culture’ is that I want to move beyond statistics. I want to create a deeper bond, a care factor within the industry, as well as with its end-users.”

Bora points out that many countries made pledges to achieve net-zero carbon emissions without substantive consultation with the mining industry, and now they are struggling to find the raw materials they need to accomplish these goals.

Bora emphasizes that a true culture shift can only occur when workers at all levels have an intuitive understanding of sustainability as a fundamental part of their everyday routines. Far too many workers still see terms like “sustainability” and “environmental, social & governance (ESG)” as buzzwords devoid of any real meaning.

He suggests that one obstacle to real progress in the industry is that businesses adopted the language of decarbonization, sustainability, and ESG without engaging with and educating the frontline workers about these vital initiatives.

“Corporate narratives say all the right things, and that’s great. But what about our front-line workers? Are they engaged in this fight against climate change? ” Bora asks. “I’d like to issue a kind of challenge to that perspective and bring forward the message to engage our frontline supervisors, operators, maintainers, and engineers.”

Bora emphasizes how the word “culture” can help draw a parallel to the absolute need for greater worker safety in mining. Workplace safety, he says, has become a core business in mining.

“You cannot claim to have safe production unless your frontline workers are engaged in this,” Bora points out.

“We train our people on safety in these organizations; we even train them on cybersecurity,” he says. “But still there is no training on sustainability in most mining companies. There’s no mandatory training that companies provide to their employees on the circular economy, for example.”

Bora has been working with mining companies to develop training programs focused on engaging frontline workers in reaching sustainability targets. “It is still a very high-level concept, but there are tools that are available to us to help us achieve that goal, to develop strategies on how to engage them better — and not just about how it can impact business, but also educate workers in their personal lives.”

The preceding Joint-Venture Article is PROMOTED CONTENT sponsored by Bora Consulting Inc. and produced in cooperation with MINING.com. Visit http://www.alpborainc.com for more information.

Canada has firepower to invest billions in green transition, analysts say

Originally posted on Mining.com

Parliament Hill in Ottawa, Ontario. Credit: Adobe Stock

Canada has the firepower to invest billions of dollars in the green transition over the coming years to make it more competitive with the United States, analysts said, while also ensuring its public finances stay on a sustainable path.

Prime Minister Justin Trudeau has fiscal room in this year’s budget because tax revenue has held up, covid-19 pandemic supports have ended and the economy is performing better than previously expected, said Randall Bartlett, senior director of Canadian economics at Desjardins.

“When I look at the long-term trend in the debt-to-GDP ratio, it’s trending down,” Bartlett said. Because nominal growth is forecast to be weak in the 2023/24 fiscal year, the ratio might creep up before heading downward again. Bartlett called it “just a blip on the path.”

Finance Minister Chrystia Freeland has targeted a declining net debt-to-gross domestic product (GDP) ratio each year to assure financial markets that the government has spending under control.

Freeland, who is due to present the budget in March or April, has said she will take a “fiscally prudent” approach that will not hamper the central bank’s fight against inflation, which was almost three times its 2% target in January.

But she has also promised investments in response to the US Inflation Reduction Act (IRA), which contains $369 billion in incentives for consumers and businesses to make the low-carbon transition there. She said these investments will encourage people to build the clean economy in Canada.

Many in industry say Canada must do more to be a key player in the green transition as the IRA is already spurring investment in the United States. But borrowing costs are rising and the economy could tip into recession this year, reducing tax revenues, so caution is warranted.

“At this point in the economic cycle, you’re better off saving if the spending isn’t needed,” said Rebekah Young, head of resilience economics at Scotiabank.

In the fall, Freeland forecast a gradually declining deficit and a balanced budget by 2027/28.

William Foster, vice president and senior credit officer at Moody’s Investors Service, said Canada has committed to getting deficits “back on track” after the massive pandemic spending. Moody’s has a ‘Aaa’ rating – the highest – on Canada’s sovereign bonds, with a stable outlook.

“We decided to affirm the triple A rating and maintain a stable outlook… because our expectation is the government will be will be committed to staying on a fiscally responsible track,” Foster said.

How much fiscal room is there?

Bartlett estimates Canada could spend an additional C$20 billion ($14.9 billion) per year and keep the net debt-to-GDP ratio below 2021/22’s 45.5%, which was the lowest in the G7.

Promised investments in the green transition will not “be overly inflationary” and they would provide certainty for investors and businesses, Bartlett said.

Young at Scotiabank said she expects debt-to-GDP to stay level with an additional “very ballpark” C$15 billion in expenditure.

“They’ll build themselves a buffer,” Young said, because future economic shocks could undermine growth and therefore make it more difficult to lower the ratio.

If that buffer were half of Bartlett and Young’s estimates, it would allow an additional C$7.5 billion to C$10 billion in annual expenditure.

Freeland’s office declined to comment on its potential spending in the budget.

These estimates take into account the C$46.2 billion ($34.64 billion) in new healthcare spending over the next decade announced earlier this month.

Canada has only one chance to attract investment in the electric vehicle supply chain, said Flavio Volpe, president of the Automotive Parts Manufacturers’ Association.

“Every single automaker in North America, and there’s about 15 of them of consequence, has to electrify” by the 2030s, he said. “All of them will need to buy batteries at scale from facilities that don’t exist currently.”

($1 = 1.3427 Canadian dollars)

(By Steve Scherer; Editing by Josie Kao)

North to the critical mineral future

Originally posted on Miningnewsnorth.com

The increasing number of electric vehicles charged with renewable energy, connected to 5G networks, and boasting the computing power of 200 laptops to autonomously traverse global highways is creating a meteoric rise in demand for the minerals and metals critical to clean energy and high-tech.

Benchmark Mineral Intelligence, the foremost authority on lithium battery supply chains, estimates that more than 300 new mines will need to come online by 2035 – just to produce the cobalt, graphite, lithium, and nickel that go into EV batteries.

This does not account for the enormous quantities of copper needed to wire a world that has more energy delivered by powerline and less by pipeline, or rare earths that make EVs and wind power generation more efficient, or the tellurium in American made solar panels, gallium that goes into 5G networks, germanium for long-distance fiber optics, and the list goes on.

From zinc and germanium recovered at the Red Dog Mine in Alaska, to copper from the Red Chris Mine in British Columbia's Golden Triangle, and rare earth elements being shipped from the Nechalacho Mine in Northwest Territories, North America's northern mining jurisdictions are already feeding critical minerals and metals into the supply chains.

Alaska, Northern BC, and Northwest Territories are also positioned to deliver bismuth, cobalt, graphite, and tungsten from projects that are in the advanced stages of exploration or early development. These northern mining jurisdictions are also highly prospective for virtually every other mineral and metal deemed critical to Canada and the United States.

Given the global competition for the enormous volumes of mined materials needed to build the envisioned clean energy future, coupled with rising geopolitical considerations surrounding Russia's invasion of Ukraine and America's tenuous relationship with China, Ottawa and Washington, DC, are investing hundreds of billions of dollars to establish secure and reliable critical mineral supply chains in North America.

Alaska, Northern BC, and NWT are positioning themselves to leverage their critical minerals abundance to be important links at the front end of these emerging supply chains.

Alaska's time is now

With the urgency to develop domestic supplies of critical minerals and metals that are abundant in Alaska on the rise, state and federal academic, government, and industry leaders convened in August on the University of Alaska Fairbanks campus for the "Alaska's Minerals – A Strategic National Imperative" summit.

During her opening address, UAF President Pat Pitney compared the need to develop Alaska's rich critical mineral resources to previous national imperatives such as the Alaska Highway, built to protect America's interest in the Pacific theater during World War II, or the Trans-Alaska Pipeline System, built to stave off oil shortages during the 1970s energy crisis.

"The time is now," she said, setting the tone for the two-day summit.

While America's reliance on mineral imports has long been on the radar of Washington, D.C. policymakers, the rapid transition to low-carbon energy and the heating up of geopolitical tensions related to the Ukraine War and tensions between China and Taiwan have elevated the criticality of securing reliable sources of the mined commodities that go into manufacturing electric vehicles, solar panels, military equipment, and other goods vital to economic and national security.

Over the past five decades, the U.S. has become increasingly reliant on China and other nations for its supply of minerals and metals. According to the U.S. Geological Survey, America is more than 50% import reliant on 47 minerals, including 100% for 17 of them.

This heavy reliance on imports, primarily from China, comes at a time when global governments and automakers are racing to ensure they have the materials to build hundreds of millions of EVs in the coming years.

Critical minerals frontier

How richly endowed in critical minerals is Alaska?

From zinc and germanium already being produced at the Red Dog Mine in Northwest Alaska to cobalt-enriched copper deposits in the Ambler Mining District, the largest graphite deposit in the U.S. found on the Seward Peninsula, rare earths at the Bokan Mountain project on the Southeast Alaska Panhandle, and thousands of deposits and prospects found between, America's 49th State hosts 49 of the 50 minerals and metals deemed critical to the U.S.

Interestingly, aluminum is the only commodity on the U.S. critical minerals list that has not been found in any appreciable quantities in Alaska.

Sen. Lisa Murkowski says that many of her colleagues in Washington, D.C., believe that the talk of Alaska's enormous critical minerals potential is hyperbole.

"Because Alaska is always the biggest, we always have more, we always have the tallest or the deepest, the widest or the bluest, and the fact of the matter is that we do," she said during the opening day of the Alaska's Minerals summit.

Federal geologists, however, agree with the senator's superlatives when it comes to Alaska's mineral endowment, which is why they recently announced a $6.75 million investment into an expanded critical minerals exploration program there.

"All the way back to the days of the Gold Rush, Alaska has been famous for its mineral wealth. These new projects represent the next steps in understanding the mineral potential for commodities that are critical to our national economy and defense," said U.S. Geological Survey Director David Applegate.

The USGS director told delegates gathered for the Alaska's Minerals summit that the new programs being carried out under the USGS Earth Mapping Resources Initiative, or Earth MRI, will provide information vital to narrowing the search for critical minerals across the vast, mineral-rich, and underexplored landscape that is Alaska.

"The Last Frontier remains a frontier for critical mineral resource development," he said.

The new Earth MRI programs are investigating three Alaska frontier regions – Kuskokwim River, Seward Peninsula, and Yukon-Tanana Upland – known to host intriguing quantities of antimony, bismuth, graphite, platinum group metals, rare earth elements, tin, tungsten, and other critical minerals.

More information on the USGS Alaska critical minerals program can be read at Earth MRI for Alaska critical minerals in the August 26, 2022 edition of North of 60 Mining News.

BC's critical minerals role

Northern BC is enormously enriched with critical minerals, especially the copper needed to wire an electric-centric world and the nickel vital to the lithium-ion batteries for EVs and clean energy storage.

This rich endowment of minerals positions BC and its First People to benefit from the rocketing demand for minerals to build a low-carbon future, according to the "Explore our Economy" report published a year ago by the Association for Mineral Exploration BC and iTOTEM Analytics.

"With demand for the minerals and metals we discover soaring to meet the needs of a low-carbon economy, we understand the acute importance of the critical role we play in achieving net-zero goals," said AME President and CEO Kendra Johnston.

During the opening day of AME's Roundup 2022, BC Minister of Energy, Mines and Low Carbon Innovation Bruce Ralston announced that mineral exploration expenditures in BC are near all-time highs, which is good for the province, its people, and the clean energy future.

"Mineral exploration and mine development are fundamental and essential industries in BC and will continue to play a critical role in the growth of our province and the transition to a low-carbon economy," Ralston said during the AME Roundup 2022 opening ceremonies.

According to the Explore our Economy report, roughly 21% of the mineral exploration investments in BC during 2021 went to First Nations-affiliated vendors.

"This report demonstrates how vital Indigenous-affiliated business and collaborative partnerships are to mineral exploration, and how these relationships can advance reconciliation and economic advancement for Indigenous communities," said Johnston.

With the growing demand for the minerals and metals needed for a low-carbon economy, it is expected that new records for mineral exploration and the consequential investments with First Nations vendors will continue to grow in the coming years.

"Huge volumes of metals including copper, gold and nickel, together with critical minerals, are required for electric vehicles, renewable energy generation, energy storage and transmission, medical technology and more," AME and iTOTEM inked in a summary of the Explore our Economy report. "These metals occur naturally in BC where we are already exploring for these critical minerals using the highest environmental, social and governance (ESG) standards."

From communities in the remotest corners of the province to the more than 1,100 mineral exploration companies headquartered in the bustling city of Vancouver, the enormous demand for minerals to build a clean energy future is providing an enormous boost for the BC economy.

"Explore our Economy demonstrates how the mineral exploration industry is essential to thousands of businesses and people in all corners of the province, helping to ensure a strong and vibrant provincial economy for generations to come," said Johnston.

BC copper and nickel

While Northern BC is enriched in many of the metals needed for EVs, renewable energy, and new technologies, this mineral-rich region stands to benefit most from the nearly unfathomable volumes of copper that are going to be needed in the coming decades.

The World Bank estimates that roughly 1.1 trillion pounds of copper will be needed for the EVs, charging stations, transmission, and generations of low-carbon electricity to replace the fossil fuel-based energy that powered the 20th century.

Copper is so vital to low-carbon energy and transportation that Goldman Sachs has declared this conductor metal to be the new oil.

In September, Goldman Sachs said the price for a pound of copper needs to be at least US$6.50 to incentivize the development of enough mines to wire the low-carbon electric future.

This could be a boon for Northern BC, a region with multiple world-class deposits of the red metal.

Five of the largest and most advanced copper-gold projects in Northern BC – Galore Creek, KSM, Red Chris, Schaft Creek, and Tatogga – host nearly 100 billion lb of copper in the inferred and indicated resource categories.

Only Red Chris, which is owned by Newcrest Mining Ltd. (70%) and Imperial Metals Corp. (30%), is currently in production. The other four are near development.

Numerous other earlier staged copper projects are being explored across Northern BC.

While BC's Golden Triangle region is famed for its copper and gold, this area hosts many other metals critical to the energy transition, including nickel and cobalt at Giga Metals Corp.'s Turnagain project.

Aside from the massive demand for both battery metals, one of the intriguing aspects of Turnagain is recent studies that indicate that the tailings of a future mine there would capture and sequester nearly as much CO2 as the operation would emit, which could make the nickel and cobalt produced attractive to automakers seeking to lower the carbon footprint of the batteries going into their EVs.

The advantages have drawn the interest of Mitsubishi Corp., which has agreed to pay Giga roughly US$6.2 million (C$8 million) to acquire a 15% interest in Hard Creek.

"We are very pleased to welcome Mitsubishi Corporation, a global trading and investment company, as a strategic partner for the development of Turnagain project," said Giga Metals President Martin Vydra.

A new era for NWT

The mining of gold, zinc, and diamonds has provided a foundation for Northwest Territories' economy for more than a century. Now, the northern Canada territory is looking to build upon this legacy by feeding critical minerals and metals into North American supply chains.

"From our beginnings in base metals like zinc, lead, and gold, we progressed to becoming the birthplace of ethically sourced diamonds in the 1990s," Northwest Territories Minister of Industry, Tourism and Investment Caroline Wawzonek said. "The breadth of our mineral potential is expanding even further, thanks to the presence of green economy metals like rare earth minerals, lithium, nickel, and cobalt needed to meet the demand of clean technologies along with many other resources recognized as critical or strategic minerals and metals."

NWT hosts known deposits and occurrences with 23 of 31 minerals that have been deemed critical by the Canadian government, and this northern territory that is about twice the size of Texas is as underexplored as it is vast.

Above and beyond being enriched with rare earths and other critical minerals often imported from places like China, the Democratic Republic of Congo (DRC), and Russia, the permitting system in NWT ensures that the mined commodities produced in the territory meet high environmental, social, governance, and indigenous participation standards.

"We are world leaders in these measures, well known for our environmental oversight, Indigenous representation in regulatory processes, and the recognition of traditional knowledge," Wawzonek said. "In fact, the NWT model; the ESG-I, with its unique approach to collaborative and consensus-based legislative development, resource royalty sharing, and socio-economic and benefit agreements, is anchored by the critical leadership of NWT Indigenous Governments in resource exploration and development in Canada."

The newly developed Nechalacho rare earths mine is an operating example of the advantages NWT has to offer, both in terms of rich critical minerals potential and the strength of the ESG-I model in the territory.

In addition to being the first rare earths mine in all of Canada, Nechalacho boasts environmental advantages and a relationship with local indigenous companies that bolster the ESG-I score of this producer of a group of elements critical to EVs, wind turbines, and a broad array of other modern industrial and consumer products.

Australia-based Vital Metals Ltd., which operates Nechalacho Mine through its Canadian subsidiary Cheetah Resources Corp., is working hard to ensure that as many benefits as possible from mining rare earths at Nechalacho are realized by NWT businesses and people.

This includes Canada First People making up roughly 70% of the workforce at Nechalacho.

The ability to achieve such a high First Nation hire rate has a lot to do with contracting Det'on Cho Nahanni Construction Ltd., a Northwest Territories-based First Nations company, to carry out the mining and earthworks at Nechalacho.

"The Yellowknives Dene First Nation is pleased to be the first Indigenous group in Canada to be responsible for mineral extraction on their traditional territory," said Yellowknives Dene First Nations Chief Ernest Betsina. "When indigenous people conduct the mining operations, they are better able to control the process, resulting in better safeguarding of the environment."

NWT seeks federal funds

Like the rest of Canada's North and Alaska, NWT is a vast and remote land with limited transportation and energy infrastructure. This often makes the economics of mining even high-grade deposits, especially those that produce a concentrate that must be shipped elsewhere for processing, out of reach.

The territory, which has been working to bridge this gap between its rich mineral resources and the markets that need them, hopes the federal government's C$3.8 billion (US$3 billion) budget to support Canada's critical minerals strategy includes funds to continue this effort.

The recently completed 97-kilometer (60 miles) Tlicho Highway to the community of Whati is an example of recent efforts to extend infrastructure closer to the territory's critical mineral potential.

Funded by a partnership between the federal, territorial, and Tlicho First Nations governments, this recently completed project extends road access to within 50 kilometers (30 miles) of Fortune Minerals Ltd.'s NICO cobalt-gold-bismuth-copper project, which will need road access to deliver concentrates to market.

Located about 150 kilometers (95 miles) north of northern NWT rail system terminus at Hay River, NICO is a near-development stage project that includes an intriguing mix of critical and precious metals that makes it an intriguing prospect.

NWT hopes that Ottawa will support further infrastructure development to critical minerals-enriched areas of the territory.

"To transition into the next chapter of our storied mining history with our rich critical mineral potential, we need strong partners at the federal level and continue to make the case for significant infrastructure investment. By doing this, we will be able to capitalize on our true economic potential," said Northwest Territories Premier Caroline Cochrane.

The C$3.8 billion (US$3 billion) federal budget to support the development of critical minerals across Canada includes C$1.5 billion (US$1.2 billion) specifically designated for infrastructure investments to unlock new mineral projects in critical regions.

"The NWT is a vibrant jurisdiction with opportunities in abundance. We are looking for new partnerships across a variety of ventures and areas of development," said Wawzonek. "We continue to build on our best practices and our strengths, and we are looking to welcome like-minded investors and partners. We are ready to raise our bar once again and are likely one of the best positioned jurisdictions to do that at this moment in time."

Miners have to make move into higher risk jurisdictions, ERG CEO says

Originally posted on Fastmarkets.com

The mining sector will need to get over its reticence to operate in jurisdictions with high-risk profiles in order to achieve the growth required for the move to a new generation of energy markets

Speaking in an interview with Fastmarkets on Thursday January 11, Benedikt Sobotka, chief executive officer of Eurasian Resources Group (ERG) said that while large, listed miners have historically turned to perceived lower-risk environments such as Canada and Australia, this will need to change because there are vast resources outside those countries.

“It forces companies to go into jurisdictions they have historically shied away from and makes it – particularly because of today’s ESG requirements – more difficult to get access and operate,” he said on the sidelines of the Future Minerals Forum in Riyadh, Saudi Arabia.

“But those riskier jurisdictions are where the growth has to happen, because it is now harder to quickly develop large deposits in Canada, Australia and so on. We have to be able to work in jurisdictions that are more complicated,” he added.

ERG, which is 40% owned by the government of Kazakhstan, is the world’s largest high-carbon ferro-chrome producer by chrome content and among the major cobalt producers. It is also a large producer of copper, the only producer of high-grade aluminium in Kazakhstan and one of the largest suppliers of alumina and iron ore in Europe and Asia.

In addition to Kazakhstan, the company has operations in the Democratic Republic of Congo (DRC), Zambia, South Africa, Zimbabwe, Mali and Mozambique, as well as in Brazil.

Securing permits a lengthy process

Sobotka said that securing permits to develop projects is a protracted and lengthy process, even more so in established regions, which is a key reason why the industry cannot get the required volumes from those jurisdictions.

It comes down to political will, he noted. He cited the example of Germany, which realized it needed to diversify its gas supply away from Russia, taking 250 days to build a regasification terminal instead of the traditional six to seven years.

“It’s a question of political will as to whether you are able to accelerate — country, jurisdictional and geopolitical risks impact the type and size of projects you can build, because the cost of capital goes up. Plus, the riskier the country, the more likely the metal stays in the ground because the grade has to be much higher to justify the investment to balance the risk,” he said.

Copper and cobalt ‘top picks’ for 2023

Copper and cobalt are among Sobotka’s top picks for 2023. Meanwhile, the incremental demand for cobalt and lithium relative to the contemporary supply base will likely create a deficit, he told Fastmarkets.

According to Sobotka, copper is increasingly shifting away from an outlook of surplus in 2023 to one of deficit as demand for the material used in construction as well as electric vehicles (EVs) and renewables increases. This shift is already well reflected in the annual benchmark premiums for 2023 copper cathode supply, which have risen markedly, indicating a tightening of cathode supply.

“I think we’re going to see $10,000 per tonne copper easily this year. There are also other markets that are in a great material deficit, but there’s more financial speculation falling into [copper] in anticipation of the price increase, which in a way preempts that price increase too,” he said.

Sobotka forecast a surge in demand for cobalt, used in batteries for EVs, while its supply faces huge downside risks, a situation he said could quickly transition from a moderate surplus to a deficit in 2023. Total demand for cobalt in the next five years will be higher than all cobalt consumed in the first two decades of this century, he estimated.

“Over the next 10 years, the world will need at least 20 more cobalt production facilities of a similar size to Metalkol RTR, to meet growing demand for critical minerals,” he said, referring to the company’s operation in the DRC.

“As part of this effort, ERG is doubling its cobalt production over the next four years,” he told Fastmarkets, noting that ERG has three development projects that will deliver an additional 20,000 tonnes of cobalt.

“There is the same supply gap in lithium and other metals,” he added.

Sobotka said the company will look at opportunities in nickel when the time is right.

“Everything in the market today is too expensive – it’s the worst time to buy, particularly exploration projects – and it’s the time to do exploration. We’ve been very active, taking large exploration lands in multiple jurisdictions, and we’ll be exploring very actively,” he told Fastmarkets.

“When the market cools down a little bit, there will be opportunities for acquisitions, and then we’ll look at the whole suite of battery raw materials including nickel, but also commodities like zinc and lead,” he said.

Macro outlook appears stronger for the year ahead

Despite the uncertainty over the outlook for the global economy, Sobotka said he remains optimistic that the metals markets are going to enter a phase of fundamentally higher prices.

“The short-term volatility that you’ve seen in some battery materials prices is happening in relatively small markets that depend very much on China,” he added, noting that the lockdowns in China due to the country’s “zero-Covid” policy had dramatic and challenging impacts on the buying patterns of Chinese customers and their access to capital.

“The question is, how quickly is the Chinese [growth] machine going to run again? If it does resume rapidly, it’s going to be a big supply shock,” he told Fastmarkets.

“We’re not seeing much restocking – maybe a little bit in copper – but once the Chinese have the confidence the opening is for the long term, you’ll see a lot of restocking that will drive prices up, and that could go very high, very quickly,” he added.

A weakening of the United States, meanwhile, would help commodity prices, since it would put pressure on the exchange rate, allowing for a slower increase in interest rates, he said.

“You will see more of a rebalancing plus the strengthening of the yen, yuan and euro, which is good for commodities,” he added.

The wild card is the situation in Ukraine, where military operations by Russia began last year. According to Sobotka, the fact that the war was a totally unexpected event means that it would be just as difficult to forecast the next so-called “black swan” incident.

Visit our dedicated battery materials page to discover more insights on the factors at play in the industry in 2023 and beyond.

The Future of Clean Energy: Why Critical Minerals are Vital to Achieving the Global Energy Transition

Orginally posted on Medium.com

Introduction

The world is witnessing a rapid shift towards a cleaner and more sustainable energy future. As governments, corporations, and individuals recognize the urgent need to address the impacts of climate change, there is a growing demand for energy sources that are less carbon-intensive.

However, the transition to clean energy is not as simple as replacing fossil fuels with renewable sources such as wind, solar, and hydro. In order to power the clean energy revolution, we need a range of critical minerals that are essential for the generation, transmission, and storage of energy.

Photo by Pixabay

What are Critical Minerals?

Critical minerals are natural minerals that are essential to the generation (uranium, silver, rare earth), transmission (copper) and storage of clean energy (lithium, nickel, manganese, cobalt, graphite).

Critical minerals are used in various applications such as electronics, renewable energy technologies, aerospace, and defence. They are in limited supply and have a high economic value.

Photo by Olia Danilevich

Why are Critical Minerals Important for the Clean Energy Transition?

Let’s take a look at critical minerals; what is driving the global clean energy transition and their significance in this energy revolution.

Generation of Clean Energy

Uranium — It is a critical mineral used in the generation of clean energy. Uranium is used as fuel in nuclear power plants to produce electricity, which is a low-carbon source of energy. The energy released from the nuclear reaction is harnessed and converted into electricity, which can then be transmitted to homes and businesses.

Silver — It is a critical mineral used in the generation of clean energy. Silver is a key component in photovoltaic cells, which are used to convert sunlight into electricity. Solar panels made with silver are more efficient and durable, which makes silver an essential component of clean energy generation.

Rare Earth Elements (REE) — These are critical minerals that are used in the production of wind turbines, electric motors, and other clean energy technologies. Rare earth elements provide the materials needed to produce high-performance, energy-efficient devices that are essential to the clean energy transition.

Transmission of Clean Energy

Copper — It is a critical mineral used in the transmission of clean energy. Copper is used in power cables, electrical transformers, and other electrical components that make it possible to transmit clean energy from its source to consumers. Copper is an excellent conductor of electricity and is resistant to corrosion, making it ideal for use in the energy sector.

Storage of Clean Energy

Lithium — It is a critical mineral used in the storage of clean energy. It is used in the production of lithium-ion batteries, which are widely used to store energy in electric vehicles, renewable energy systems, and stationary energy storage systems. Lithium-ion batteries are highly efficient and have a long life span, which makes them ideal for energy storage.

Nickel — It is a critical mineral used in the storage of clean energy. It is used in the production of nickel-manganese-cobalt (NMC) batteries, which are widely used in electric vehicles. NMC batteries provide a long driving range for electric vehicles and are highly efficient, making nickel an essential component of the clean energy transition.

Manganese — It is a critical mineral used in the storage of clean energy. It is used in the production of NMC batteries, which provide a long driving range for electric vehicles. Manganese is also used in other applications, such as the production of steel, making it a valuable mineral in the clean energy transition.

Cobalt — It is a critical mineral used in the storage of clean energy. It is used in the production of NMC batteries, providing stability and durability to the battery. Cobalt is also used in the production of superalloys and magnetic materials, which are essential components in the renewable energy and clean energy storage industries.

Graphite — It is a critical mineral used in the storage of clean energy. It is used in the production of anode materials for lithium-ion batteries. Graphite provides a stable and efficient anode material, which is essential for the performance of lithium-ion batteries. It is a critical component in the clean energy transition, helping to store energy from renewable sources so it can be used when needed.

The Investment Thesis for Critical Minerals

There are several reasons why investing in critical minerals is a smart move for investors who are interested in the clean energy transition.

Firstly, demand for these minerals is only going to increase as we move towards a cleaner energy future. International Energy Agency (IEA) predicts that the demand for critical minerals is set to soar as the world transitions to a low-carbon economy, with a projected growth rate of 5% per year for the next two decades.

In addition, the global shift towards electric mobility is driving the demand for critical minerals, as electric vehicles (EVs) require up to 10 times more minerals than conventional cars. A typical EV battery pack contains around 15 kg of lithium, 10 kg of cobalt, and 5 kg of nickel, all of which are critical minerals. The global EV market is projected to grow at an annual rate of 25% between 2020 and 2030, which will result in a massive demand for critical minerals.

The transition to clean energy will require a massive supply of critical minerals, but the current supply chain is not adequate to meet the demand. China currently dominates the global supply of critical minerals, accounting for around 80% of the world’s rare earth elements (REE) production. This puts the global supply chain at risk of disruption, as China has demonstrated its willingness to use its dominant position to gain geopolitical leverage. For example, during a dispute with Japan in 2010, China imposed an embargo on REE exports, causing a surge in prices and a scramble for alternative sources.

To mitigate this risk, many countries are now seeking to develop their own domestic sources of critical minerals. This includes the US, which has identified critical minerals as a strategic priority and has launched an initiative to develop a domestic supply chain. The European Union (EU) has also identified critical minerals as a key priority, with a focus on developing a sustainable and responsible supply chain.

Investing in the critical minerals market can provide significant returns for investors. As the world transitions to a low-carbon economy, the demand for critical minerals will continue to grow, which will result in higher prices and increased investment in exploration and development.

Companies that are involved in the extraction, processing, and manufacturing of critical minerals are well-positioned to benefit from this trend.

3 Ways to Invest in Critical Minerals

There are many ways that investors can take advantage of this investment opportunity presented by critical minerals:

Investing in Mining Companies — One of the most straightforward ways to invest in critical minerals is to invest in mining companies that specialize in the extraction and production of these minerals. These companies are well-positioned to benefit from the growing demand for critical minerals as the world shifts towards cleaner energy sources. There are several mining companies that produce these minerals, including BHP Group, Rio Tinto, and Vale.

Investing in Energy Technology Companies — Another way to invest in critical minerals is to invest in energy technology companies that use these minerals in their products. For instance, investing in companies that produce solar panels, wind turbines, or EVs would provide exposure to the demand for critical minerals such as silver, rare earth elements, and cobalt. There are several companies that produce clean energy technologies, including Tesla, First Solar, and Vestas Wind Systems.

Investing in Energy Transition Funds — A third way to invest in critical minerals is to invest in energy transition funds such as the Sprott Energy Transition Exchange-Traded Funds (ETFs). These ETFs provide exposure to a diverse range of energy transition companies, including those that produce critical minerals, as well as companies involved in the production of clean energy technologies.

The transition to clean energy is a critical step toward mitigating the effects of climate change, and critical minerals play a vital role in making this transition possible.

From the generation of nuclear energy to the storage of clean energy in batteries, critical minerals are essential to the future of clean energy.

As the world moves towards a more sustainable energy future, it is crucial that we understand the importance of critical minerals and ensure that we have a secure supply of these essential materials.

References:

U.S. Department of Energy. (2017). Critical Materials Strategy. https://energy.gov/sites/prod/files/2017/06/f34/CriticalMaterialsStrategy2017.pdf

World Nuclear Association. (2021). Nuclear Power in the World Today. https://world-nuclear.org/information-library/current-and-future-generation/nuclear-power-in-the-world-today.html

The International Energy Agency. (2020). Key World Energy Statistics. https://www.iea.org/reports/key-world-energy-statistics-2020

The National Renewable Energy Laboratory. (2021). Renewable Electricity Futures Study. https://www.nrel.gov/analysis/re_fut

Vanadium Market Update: VRFB Strengthening Assets

Originally posted on capital10x.com

Capital 10X highlights vanadium often, we think this a very undervalued commodity tying into the theme of the energy transition. In January, we’ve seen a continued increase in vanadium prices globally. Vanadium prices increased by approximately 6%, and 29% since September last year.

The rise in vanadium prices came on strong news from the vanadium energy storage industry, with a spotlight on China. Several battery and electrolyte projects greater than 100MWh were announced over the past few months; the commissioning of Dalian-based 100MW / 400MWh vanadium redox flow battery (VRFB) system was the major highlight. This is the largest project and the world, and reveals China’s keen interest in the roll out of VRFB technology.

Each 200MWh of battery capacity is approximately 2,000 mt of V2O5 equivalent or 1% of production. 2023 estimates are as high as 2 GWh of total new VRFB projects, representing approximately 10% of global vanadium production and more than double the total installed capacity since the 1980s. These projections have the potential to transform the vanadium industry.

We’ve made a report about the increasing market potential for vanadium and VRFBs see our video summary:

Read the full report here

Demand from other vanadium markets (e.g., aerospace, steel and chemical) have been stronger than expected, buoyed by China reopening in the aftermath of COVID-19 lockdowns and a returning construction industry. Producers like Largo Inc. and Bushveld Minerals Ltd. Announced lower than 2022 guidance production, while large producers in China are reducing output in the early months of the year.

Let’s take a look at the only ETF-structured asset for vanadium, Largo Physical Vanadium Corp (LPV) (TSX: VAND), for an idea of the leverage investors can receive from dipping the toe in the industry.

LPV net assets are over 90% held in physical vanadium product and near-term delivery commitments. LPV launched in September 2022, which was a bright point for the company – coinciding with a period of lower vanadium prices, which enabled LPV to purchase vanadium units at favorable market conditions. Their NAV is at C$2.47/share, or 24% above their public transaction price of C$2.00/share, and 40% above the closing share price of C$1.76 per share on January 31st.

So, the NAV to share price discount offers investors a solid investment case. If LPV focuses on closing this disconnect, this would prove to be a boon to the share price, as they are highly leveraged to vanadium spot price.

The world's biggest miner is ready to plant more flags in 'highly desirable' Canada

Originally posted on ca.finance.yahoo

A little over a year ago, Melbourne-based BHP Group Ltd., the world’s largest miner, bowed out of the highly publicized bidding war with Australian billionaire Andrew Forrest’s Wyloo Metals Pty. Ltd. for a nickel project in Ontario’s Ring of Fire region.

The tug of war between the two Australian miners over a Canadian asset included multiple bids over almost half a year before Wyloo’s $616.9-million bid in December 2021 led to the takeover of Noront Resources Ltd. — and with it the much talked about Eagle’s Nest project in northern Ontario.

Losing out to Wyloo, however, didn’t discourage BHP on planting more flags in Canada. The company has made a series of alternative investments since bowing out of the Noront auction that haven’t received as much attention, but suggests that BHP may be open to building a battery metals empire in Canada.

“Mergers and acquisition is one lever for growth but not the only lever for growth for us at all,” Rag Udd, BHP’s president of minerals for the Americas, said after the company reported its latest quarterly financials on Feb. 21. “We see Canada as a highly prospective and desirable location to actually making investments,” he added.

BHP is coming off a down year. The company said this week that revenue fell 16 per cent over the final six months of 2022 from the same period in 2021, while profit tumbled 27 per cent. Udd attributed the decline to lower prices of iron ore and copper last year and rising costs. The company’s stock dropped sharply on the news, but recovered, and is now about four per cent higher than year ago.

Still, BHP, like most miners these days, is optimistic. The demand for metals that are crucial in powering batteries and driving the transition to greener energy — primarily lithium, nickel and copper — is on the rise as more countries look to meet their climate goals. Major mining companies such as Teck Resources Ltd., Barrick Gold Corp. and Rio Tinto Ltd. have been involved in building, exploring and buying projects containing these minerals to take advantage of the boom.

Governments also want a piece of the action. Canada, for its part, is attempting to lure miners and automakers to the region through tax credits and funds in order to build its own electric vehicle industry.

We see Canada as a highly prospective and desirable location to actually making investments

Rag Udd, BHP's president of minerals for the Americas

BHP, which already produces a vast amount of nickel and copper at mines around the world, set up an office for minerals exploration in Toronto about a year-and-half ago. The group has a special focus on metals such as copper and nickel, and the objective is to find Canadian miners with good assets and invest in them.

Over the past year, the Australian miner invested $13.6 million in a copper project run by Vancouver-based Brixton Metals Corp., renewed its exploration alliance with Montreal-based Midland Exploration Inc. and invested $100 million in Vancouver-based Filo Mining Corp., which is developing a copper-gold project on the Argentinean-Chilean border.

These investments aren’t significant, especially for a company the size of BHP, which earned a revenue of about US$65 billion in 2022, Udd acknowledged. One of the reasons BHP has taken a cautious approach to investing in green metals in Canada is because it already runs the Nickel West operations in Australia, which it says is the world’s leading nickel supplier to the battery metals market.

A tonne of nickel powder made by BHP Group sits in a warehouse at its Nickel West division, south of Perth, Australia.

However, Udd said that Canada’s recently announced critical minerals strategy makes it a “very very attractive jurisdiction” for BHP and aligns it with the “company’s priorities moving forward.”

Released in December, Canada’s first significant critical minerals strategy aims to expand exploration, speed up mining projects, tackle labour shortages, and build secure supply chains with allied nations in a bid to build its on electric vehicle industry.

While the strategy comes with a list of 31 minerals that the government has deemed as “critical,” the country will initially prioritize six: lithium, graphite, nickel, cobalt, copper and rare earth elements.

If one of the goals was to attract international investment, then the strategy could be working because Prime Minister Justin Trudeau’s government got BHP’s attention.

“As we are looking to bring new supply to the market quickly, we hope that Canada actually continues to not only focus on the critical minerals strategy but also the efficiency of the regulatory processes associated with that,” said Udd.

Ottawa knows regulation is getting in the way of investment. Jonathan Wilkinson, the natural resources minister, said repeatedly last year that he’s working on making the system more efficient. When he released the critical minerals strategy in December, he acknowledged that permits need to be granted faster, and suggested the federal and provincial governments could conduct reviews concurrently instead of consecutively.

BHP to start recruiting hundreds to operate potash mine in Saskatchewan

Rio Tinto invests in early stage copper project amidst next ‘M&A cycle’

Ottawa to give BHP up to $100 million to cut emissions at Jansen potash project

Of course, BHP’s main focus in Canada currently isn’t on battery metals, but potash, a vital crop nutrient that is also deemed as a critical mineral by the federal government. BHP is currently pressing forward with Jansen, a $7.5-billion project 140 kilometres east of Saskatoon that will be the world’s largest potash mine once completed.

However, judging by BHP’s activities in the last year and Udd’s statements on BHP’s future in Canada, few would be surprised to see the world’s largest miner expand its interests in Canada.

“We are looking to build up on in terms of thematics around decarbonization, electrification and population growth,” Udd said. “We see these as the mega-trends that are going to play out in the next 50 years globally, and we think Canada is well positioned.”

US seeks critical mineral pacts with Japan, UK to curb China

Originally posted on Mining.com

The US government is exploring narrowly focused trade pacts on critical minerals with Japan and the UK, in addition to talks with the European Union, the latest salvo in its push to counter Chinese influence in key sectors, officials familiar with the matter said.

The US is looking to create a “critical minerals buyers club” with allies like the EU and Group of Seven, the US officials said, speaking on condition of anonymity. The move would ensure the bloc is not reliant on China for critical minerals, particularly as the countries look to build out renewable energy pacts, the officials said.

So-called rare Earth elements and minerals including lithium and cobalt have assumed huge strategic importance because of their role in electric-vehicle technology, defense electronics and other uses. Especially worrisome to the US and its allies is China’s geological fortune in having supplies within its borders and its moves to lock up agreements with other producers — potentially cutting off US access in the event of a crisis with Beijing.

The deals, while aimed at China, could also make the countries eligible for benefits from the Inflation Reduction Act, soothing a key irritant over industrial incentives.

The White House did not immediately respond to a request for comment. The Treasury declined a request to comment.

The development adds Japan and the UK to the list of countries where the US is seeking critical mineral pacts. The US had already been in talks with the EU over such a deal.

The US has long been pushing to secure supply chains of critical minerals, including through a Minerals Security Partnership that includes the EU, UK and Japan, as well as other countries such as Australia and South Korea. That group held a meeting earlier this week to discuss mining, processing, and recycling of critical minerals with representatives of several African nations, according to the State Department.

The push is part of President Joe Biden’s effort to shift global supply chains away from China, blunting Beijing’s clout in key sectors and hedging against disruptions — like the Covid-19 pandemic — that would upend supply chains or create scarcities that may starve US or other friendly producers.

Part of the joint push is driven by a desire to make sure the US is not reliant on China for critical minerals, the officials said.

It will also mean the US and its allies have access to the inputs needed to meet emission-reductions goals, according to the officials.

Participating countries would be eligible under Section 30D of the Inflation Reduction Act, an incentive aimed at promoting new electric vehicles, officials said.

A pact that clears the way for benefits under the IRA would help sooth tensions with Europe, which has complained that the provision freezes out American partners. Biden’s administration has responded by pledging cooperation and encouraging European allies to pass their own domestic subsidies.

“This is one of the most promising ways to go forward,” German Economy Minister Robert Habeck told Bloomberg TV in an interview Monday, referring to a possible agreement on organizing a market for critical minerals.

(By Josh Wingrove)

Electric vehicle sales top $1 trillion in wake-up call for carmakers

Originally posted on Mining.com

Ford EV at charging station. Stock image.

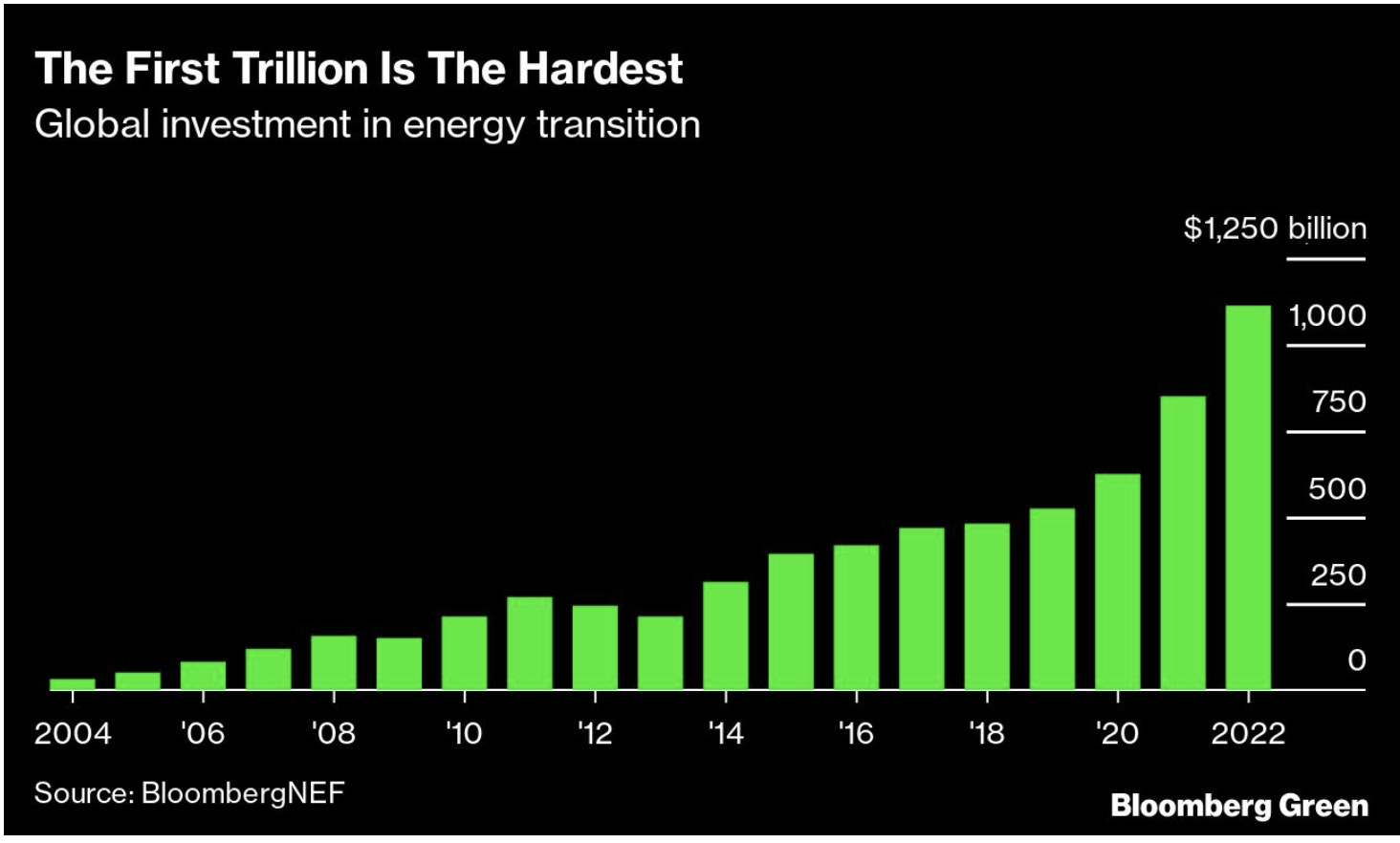

Global spending on electric vehicles is surging. According a new report published by BloombergNEF on investment in the energy transition, annual spending on passenger EVs hit $388 billion in 2022, up 53% from the year before.

With the 2022 tally included, the total value of electric vehicles sold to date in the passenger vehicle segment has now crossed $1 trillion. There are a few ways to look at that figure. At the most basic level, if an automaker didn’t have a decent EV strategy, they missed out on their share of a trillion-dollar revenue opportunity over the last decade.

That sounds like a big number, but global auto sales are worth around $2.5 trillion a year. So, over the last 10 years since EVs first showed up in the modern era, the value of total car sales has been roughly $25 trillion. In that context, the cumulative value of EV sales is relatively modest. Total profits from EVs also are much lower.

Still, growth rates matter, and almost 60% of total EV spending occurred in just the last 18 months. This year will break records again, with passenger EV sales likely to comfortably exceed $500 billion. This is now a very material, very fast-moving part of global auto sales.

The auto industry operates on long product cycles. While it feels like there’s a constant stream of new products, many are just cosmetic updates to existing models — facelifts, in industry parlance. To understand product cycles and what happens next, it’s important to look at vehicle platforms.

High-volume automakers develop new platforms that underpin vehicles over what is usually a six- to 10-year period. The platforms take years to develop, cost billions of dollars and ideally are versatile, allowing automakers to use different body structures catering to a wider variety of consumer preferences. These platforms also allow for component sharing across many models, which is a necessary part of the cutthroat economics of building vehicles at scale around the world.

Long development cycles also mean that if an automaker has been caught wrongfooted, it can take quite a while to realize the full impact of mistakes. The trillion-dollar EV sales mark is probably the point where it becomes clear that some automakers made the wrong bets.

Japanese automakers illustrate this well. All of the Japanese brands combined sold less than 5% of the EVs purchased globally last year, and none were among the top 10 EV brands by volume. This wasn’t a problem in 2019, when plug-in vehicles were just 2.6% of global auto sales, but it’s worrisome when they’ll likely be closer to 18% of sales in 2023.

It’s even more extreme in China, where EVs will likely be over 30% of sales this year, up from just 5% in 2019. That’s a huge change in a timeframe well within the normal life cycle of a vehicle platform. Japanese automakers’ market share in China is now starting to slip, to 21% of new-vehicle sales last year from 25% in 2020.

Alarm bells are ringing at the Japanese automakers now, with Honda revamping its EV strategy and Toyota installing new management preaching an EV-first strategy.

Changing course will take a while. Toyota has said it won’t have a new dedicated EV platform ready for launch until 2027. While that might get accelerated, it reflects the timescales traditional automakers operate on.

Toyota may well still succeed. The company has shown impressive adaptability over its 85-year history, but the point here is that the next vehicle cycle is absolutely critical to turning the ship around. If it misses the mark, the consequences will be dire.

Many other automakers face a similar situation, with their platforms for models due to arrive from 2026 to 2028 largely set. It will take a few years to find out if they’ve made the right bets.

There are still many challenges ahead as EV sales take off. Even after the phenomenal growth of late, only about 3% of the 1.3 billion passenger cars on the road globally will be electric at the end of this year. Soaring demand is also placing real strains on the battery supply chain and public charging infrastructure.

Still, the first trillion dollars highlighted in BNEF’s report marks the beginning of real materiality in the auto sector. EVs have captured mind share and excitement from industry watchers for years. They’re now capturing real market share, too.

(By Colin McKerracher)

LG Chem prepares to lock in mineral supplies

Originally posted on Mining.com

LG Chem Ltd. is prioritizing efforts to secure raw materials used in electric-vehicle batteries and establishing a self-sufficient global supply chain, including via potential partnerships and investments in mining companies.

“We are preparing ourselves first of all to secure supply of raw material, which is more important than the price,” LG Chem Chief Executive Officer Shin Hak-cheol said in an interview with Bloomberg Television in Seoul. “Our first and foremost priority is to secure enough raw material for the future.”

LG Chem makes cathode-active materials, a key ingredient for EV batteries. It is the parent of LG Energy Solution, the world’s second-largest battery cell maker and supplier for automakers including Tesla Inc., General Motors Co., Ford Motor Co. and Stellantis NV.

The South Korean company is doing “a lot of projects” to ensure it has a stable source of supply, according to Shin. “I don’t think we’ll ever be a mining company. However, if there’s a project that makes sense, maybe we can invest.”